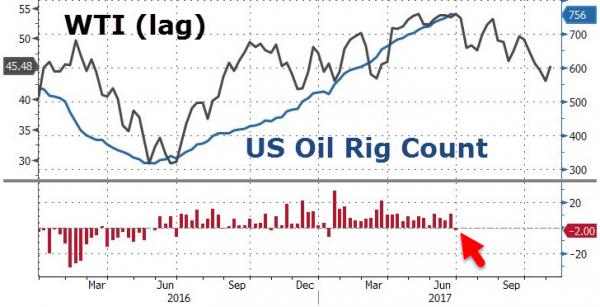

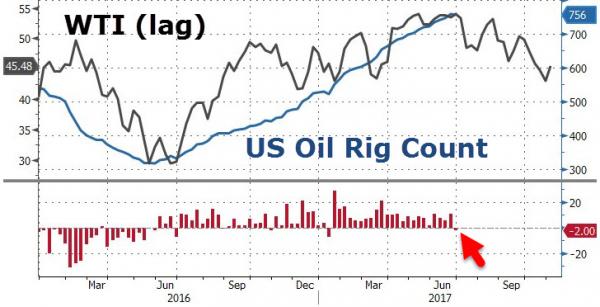

Last week saw US crude production decline by the most since Aug 2016 (perhaps affected by ‘Cindy’) and given the lagged response to WTI prices, many expected the oil rig count to drop this week. As WTI heads for its 7th up-day in a row – the longest streak in 6 months – it is supported as the US oil rig count dropped 2 to 756, the first drop in almost 6 months.

“Is it possible we’d have our first negative number in 24 reports? Unlikely but it’s possible” when you see production down 3 of the past 7 weeks, Bob Yawger, director of the futures division at Mizuho Securities USA in New York, says by telephone

WTI lifted modestly on the print holding earlier gains…

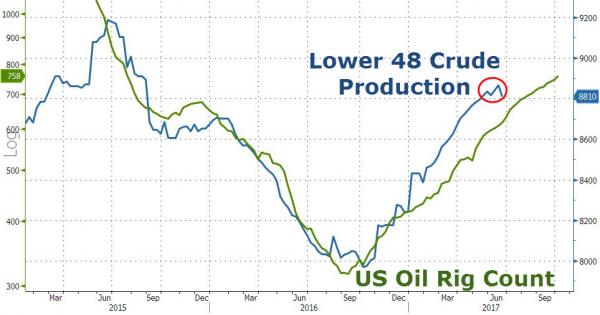

Lower 48 Production fell 55k b/d last week – the biggest drop since Aug 2016…

Total U.S. crude output dropped 100k b/d to 9.25m b/d last week, the biggest drop in almost a year and 3rd decrease in the last 7 weeks, according to EIA report Wednesday.

We suspect the drop is related to shut-ins from tropical depression Cindy and will recover quickly. It appears President Trump is confident that the Lower 48 will keep pumping as OilPrice.com’s Tsvetana Paraskova reports, to boost American energy exports, the administration of U.S. President Donald Trump has approved the construction of a new petroleum pipeline from the U.S. to Mexico that “will go right under the wall,” President Trump said on Thursday.

As part of the ‘energy week’, which promotes U.S. global leadership and dominance in energy, President Trump announced six initiatives “to propel this new era of American energy dominance,” he said.

The first initiative is the U.S. to start reviving and expanding its nuclear energy sector. Next, the Department of the Treasury will address barriers to the financing of highly efficient, overseas coal energy plants, President Trump said, mentioning Ukraine as one of the countries that need coal. The third initiative is the petroleum pipeline to Mexico. The fourth step to growing American relevance in global energy is U.S. Sempra Energy signing a deal to start negotiating sales of more American natural gas to South Korea.

Leave A Comment