If you were expecting today’s retail sales report for October to deliver a blowout gain in line with the surprisingly strong rise in payrolls for last month, today’s release on consumer spending is a disappointment. It’s not terrible, but the monthly 0.1% advance in retail consumption is below expectations and a sign that it’s still reasonable to keep expectations in check for anticipating a sharp turnaround for the economy overall in the fourth quarter.

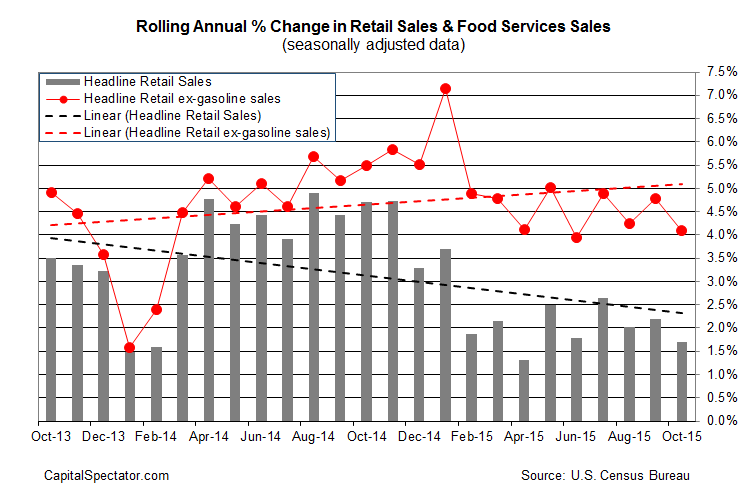

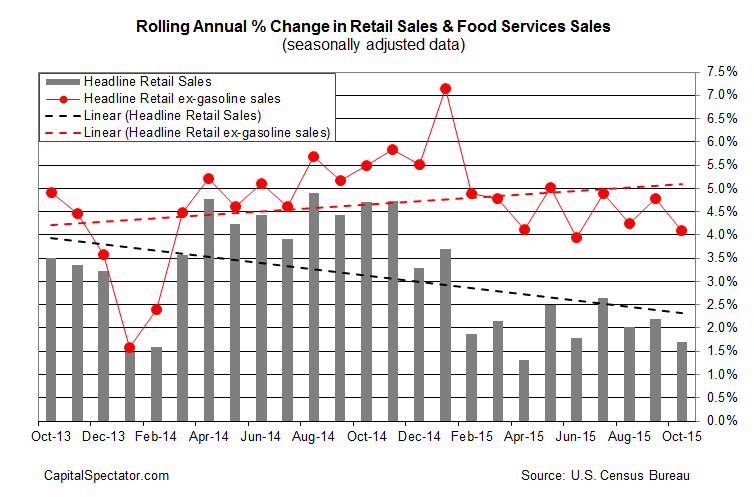

The monthly data is noisy, of course, and there’s the added glitch that the Census Bureau has tweaked its methodology for estimating retail sales. In any case, today’s numbers don’t look particularly strong for the year-over-year trend either. Spending increased a soft 1.7% in October vs. the year-ago level—the slowest rise in six months.

Stripping out gasoline sales paints a brighter profile, which provides some cover for arguing that the bear market in energy is distorting the trend to the downside for tracking retail spending. That’s partly true, although sales ex-gas decelerated to a 4.1% year-over-year gain last month. That’s a healthy pace, but it’s the slowest rise since June, providing more ammunition for arguing that consumer spending isn’t going to impress policymakers on the upside any time soon.

“Admittedly, this is a not a great start to the fourth quarter, which is important as we head toward the holiday shopping season,” notes Jennifer Lee, a senior economist at BMO Capital Markets.

The US macro trend is still likely to stay positive for the near term, but for the moment it’s not obvious that last month’s robust gain in payrolls is a prelude to a bull run of economic reports.

Leave A Comment