US Session Bullet Report

Eurozone trading has been almost non-existant so far today as a lack of news has made for very light movement. Despite opening upwards with a gap of more 100 points the German DAX has again failed to deliver and is currently trading around the 10060 mark.

Oil remains almost flatlined following yesterdays losses, currently trading around $44.50 with investors anxiously waiting for crude oil inventories for further direction. An increase in inventory numbers could see oil testing its support so definately one to watch.Gold is trading lower today as a mild selloff see’s it trading around the 1138 mark following yesterdays high of almost 1148.Currencies have been subdued with slight USD strength so no clear opportunities today so far.

ADP employment data just released from the US revealed just 190k jobs were added in August verses 201k expected. With news and sentiment changing it seems by the day, traders seem reluctant to move on this poor data as the market remains static. For now at least!

Durable goods at 14:00GMT and crude oil inventories at 14:30GMT could however, represent a good opportunity for traders.

Trading quote of the day:

“A great trader is like a great athlete . You have to have natural skills, but you have to train yourself how to use them.”

– Marty Schwartz, Pit Bull

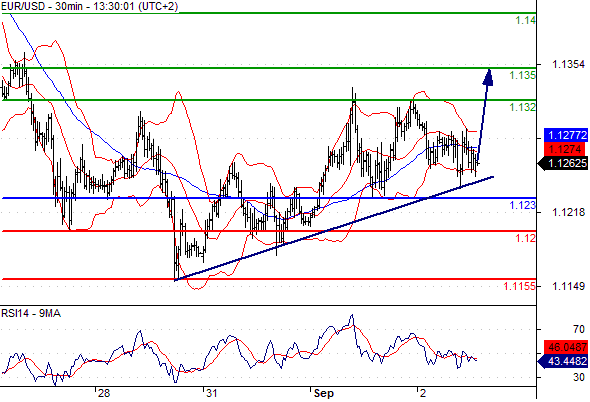

EURUSD

Pivot: 1.123

Likely scenario: Long positions above 1.123 with targets @ 1.132 & 1.135 in extension.

Alternative scenario: Below 1.123 look for further downside with 1.12 & 1.1155 as targets.

Comment: The pair is supported by a rising trend line.

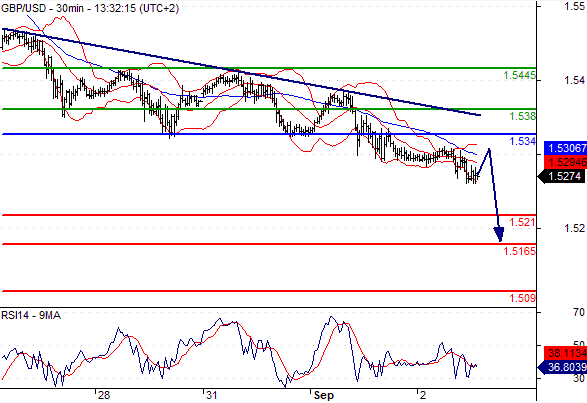

GBPUSD

Pivot: 1.534

Likely scenario: Short positions below 1.534 with targets @ 1.521 & 1.5165 in extension.

Alternative scenario: Above 1.534 look for further upside with 1.538 & 1.5445 as targets.

Comment: The RSI is badly directed.

AUDUSD

Pivot: 0.7065

Likely scenario: Short positions below 0.7065 with targets @ 0.698 & 0.695 in extension.

Alternative scenario: Above 0.7065 look for further upside with 0.7095 & 0.712 as targets.

Comment: The RSI is mixed to bearish.

Leave A Comment