Upbeat news from one of the regions largest mining and commodity trading companies provided a mild boost to eurozone indices. Swiss20, German DAX and the FTSE100 benefiting most in what is otherwise a quiet day.

Elsewhere, in FX, the GBP is trading higher today. At one stage the Cable was almost 100 points up and another 50 points against the EUR. With no economic data, we may possibly see a further correction in GBP crosses following 9 days of declines.

Gold is currently trading just below 1121 at time or writing and seems to have leveled out as it looks to claw back its losses of the last 2 weeks.

Oil, as on Friday remains static, currently trading around the $45.50 mark.

Despite the recent turmoil in the markets, its interesting to note that despite the selloff, major indices in the US in particular, are trading at levels much higher than 2007 highs pre crash. In Asia on the other hand, major indices are trading below 2007 levels so, are we seeing nothing more than a huge correction or is there more to the story?

Trading quote of the day:

“Have no fear of perfection – you’ll never reach it.”

– Salvador Dalí

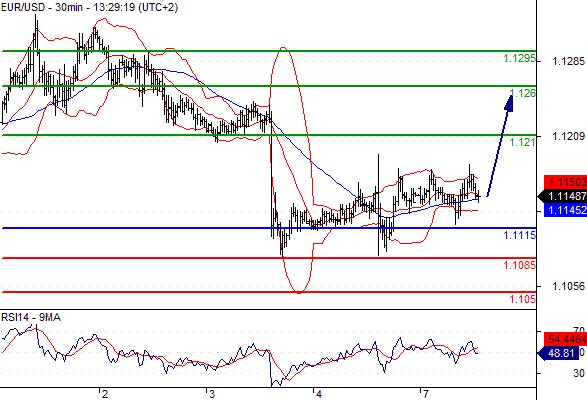

EURUSD

Pivot: 1.1115

Likely scenario: Long positions above 1.1115 with targets @ 1.121 & 1.126 in extension.

Alternative scenario: Below 1.1115 look for further downside with 1.1085 & 1.105 as targets.

Comment: The RSI is mixed to bullish.

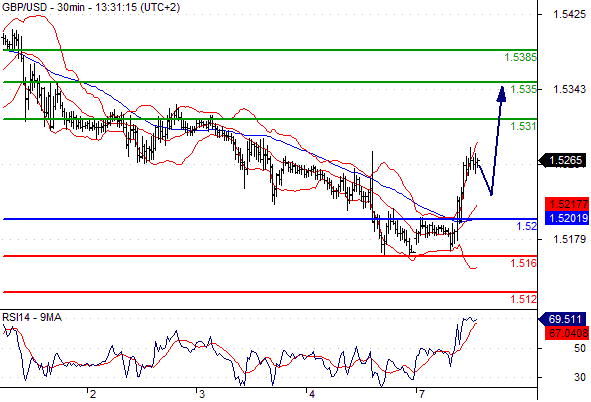

GBPUSD

Pivot: 1.52

Likely scenario: Long positions above 1.52 with targets @ 1.531 & 1.535 in extension.

Alternative scenario: Below 1.52 look for further downside with 1.516 & 1.512 as targets.

Comment: The RSI is well directed.

AUDUSD

Pivot: 0.699

Likely scenario: Short positions below 0.699 with targets @ 0.69 & 0.685 in extension.

Alternative scenario: Above 0.699 look for further upside with 0.702 & 0.7065 as targets.

Comment: As long as 0.699 is resistance, look for choppy price action with a bearish bias.

Leave A Comment