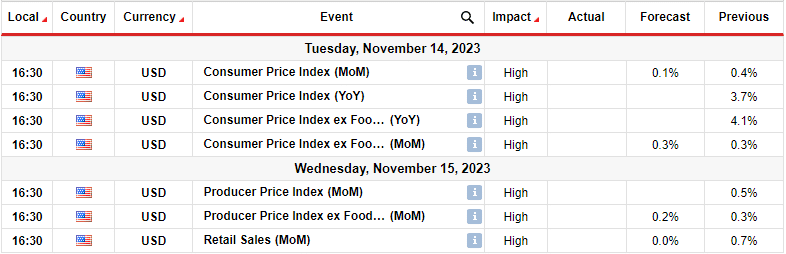

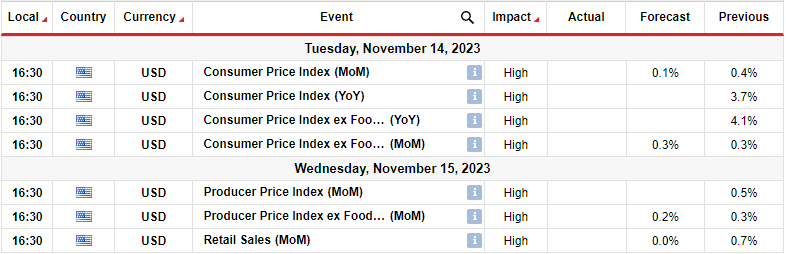

The anticipated return of dollar strength is shaping a bullish USD/CAD weekly forecast, propelled by assertive remarks from Federal Reserve officials.–Are you interested to learn more about MT5 brokers? Check our detailed guide-Ups and downs of USD/CADUSD/CAD had a bullish week, with the dollar gaining on hawkish comments from Fed policymakers. Fed Chair Powell and several other Fed policymakers got a chance to restate their commitment to lowering inflation. All these speeches came out hawkish, boosting the dollar.Meanwhile, according to a Reuters poll, the Canadian dollar will gain less strength than earlier projections in the next year. Moreover, a slowdown in the domestic economy creates an opportunity for interest rate cuts by the Bank of Canada. Money markets predict that the Canadian Central Bank will likely start reducing its benchmark interest rate in April. Next week’s key events for USD/CAD  Investors eagerly anticipate US inflation data next week to assess the Fed’s efforts in lowering last year’s record-high inflation. Notably, a drop in prices beyond expectations could support the case for the Fed to start cutting rates.Additionally, a report on US retail sales will offer insights into the country’s current state of consumer spending. USD/CAD weekly technical forecast: Strong bullish bias points to looming new high.

Investors eagerly anticipate US inflation data next week to assess the Fed’s efforts in lowering last year’s record-high inflation. Notably, a drop in prices beyond expectations could support the case for the Fed to start cutting rates.Additionally, a report on US retail sales will offer insights into the country’s current state of consumer spending. USD/CAD weekly technical forecast: Strong bullish bias points to looming new high.  The USD/CAD price is on an uptrend on the daily chart, with the price trading above and respecting the 22-SMA support. Moreover, there is an indication of solid bullish momentum on the RSI, which trades above 50. Since the bullish trend began, bulls have consistently made higher highs and lows. However, the price broke below the SMA at one point as bears attempted to take control. Bulls later reversed this move, making it a false breakout. Since then, they have pushed the price higher between the 1.3602 support and the 1.3902 resistance. Initially, the 1.3902 resistance stopped the uptrend, driving the price back to the 22-SMA support. However, bulls regained strength near the SMA and are currently heading to retest the 1.3902 resistance. Given the solid bullish bias, the price might make a new high above this level. It would confirm a continuation of the bullish trend.More By This Author:EUR/USD Weekly Forecast: Fed Officials Voice Inflation ConcernsGBP/USD Price Analysis: Rebounds As UK Avoids RecessionUSD/JPY Outlook: Bulls Gaining Amid Hawkish Fed

The USD/CAD price is on an uptrend on the daily chart, with the price trading above and respecting the 22-SMA support. Moreover, there is an indication of solid bullish momentum on the RSI, which trades above 50. Since the bullish trend began, bulls have consistently made higher highs and lows. However, the price broke below the SMA at one point as bears attempted to take control. Bulls later reversed this move, making it a false breakout. Since then, they have pushed the price higher between the 1.3602 support and the 1.3902 resistance. Initially, the 1.3902 resistance stopped the uptrend, driving the price back to the 22-SMA support. However, bulls regained strength near the SMA and are currently heading to retest the 1.3902 resistance. Given the solid bullish bias, the price might make a new high above this level. It would confirm a continuation of the bullish trend.More By This Author:EUR/USD Weekly Forecast: Fed Officials Voice Inflation ConcernsGBP/USD Price Analysis: Rebounds As UK Avoids RecessionUSD/JPY Outlook: Bulls Gaining Amid Hawkish Fed

Leave A Comment