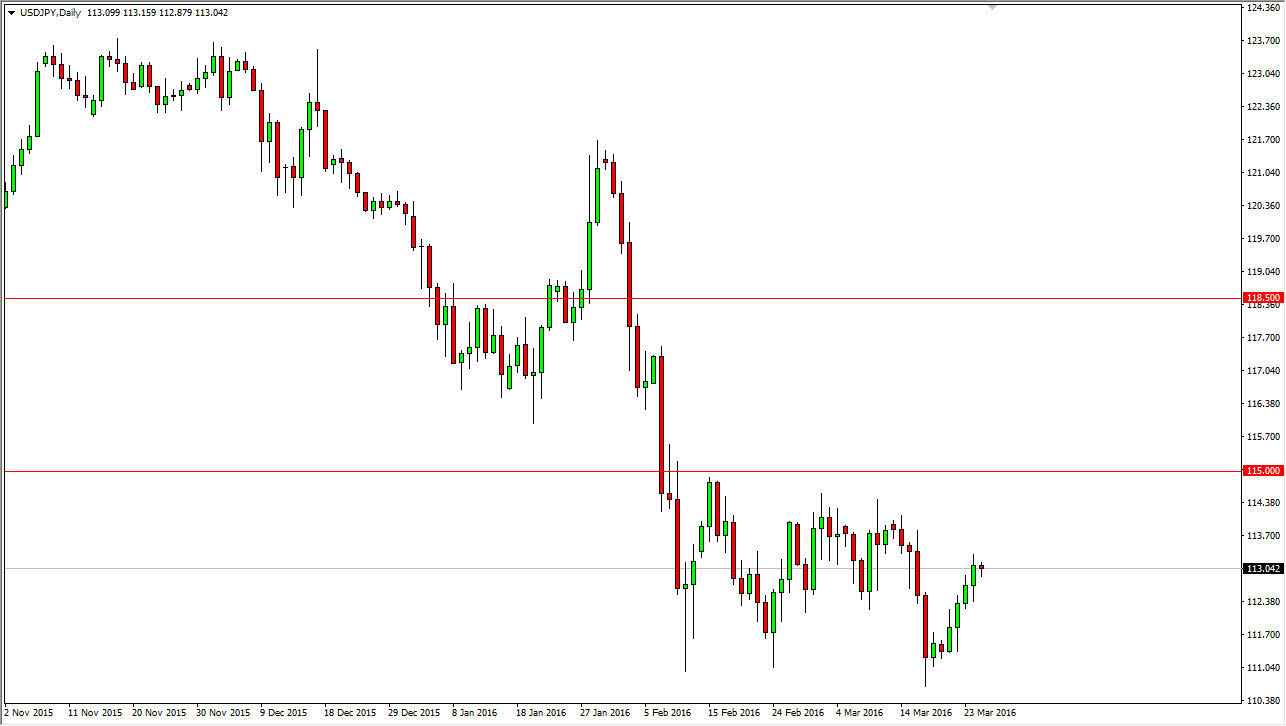

USD/JPY

The USD/JPY pair initially fell during the course of the day on Friday, but bounced enough to form a hammer. Keep in mind that it was Good Friday, so the liquidity would have been as strong as it typically could be. Having said that, it looks as if we are going to try to continue to go higher and perhaps grind to the top of the consolidation range. That should send the market racing towards the 114.50 level. Above there, we have quite a bit of resistance at the 115 level. With this, it’s probably short-term buying opportunity but whether or not we can break out might be something that we have to wait and see. Selling isn’t something that I’m interested in doing, because quite frankly look like we have quite a bit of buying pressure just underneath.

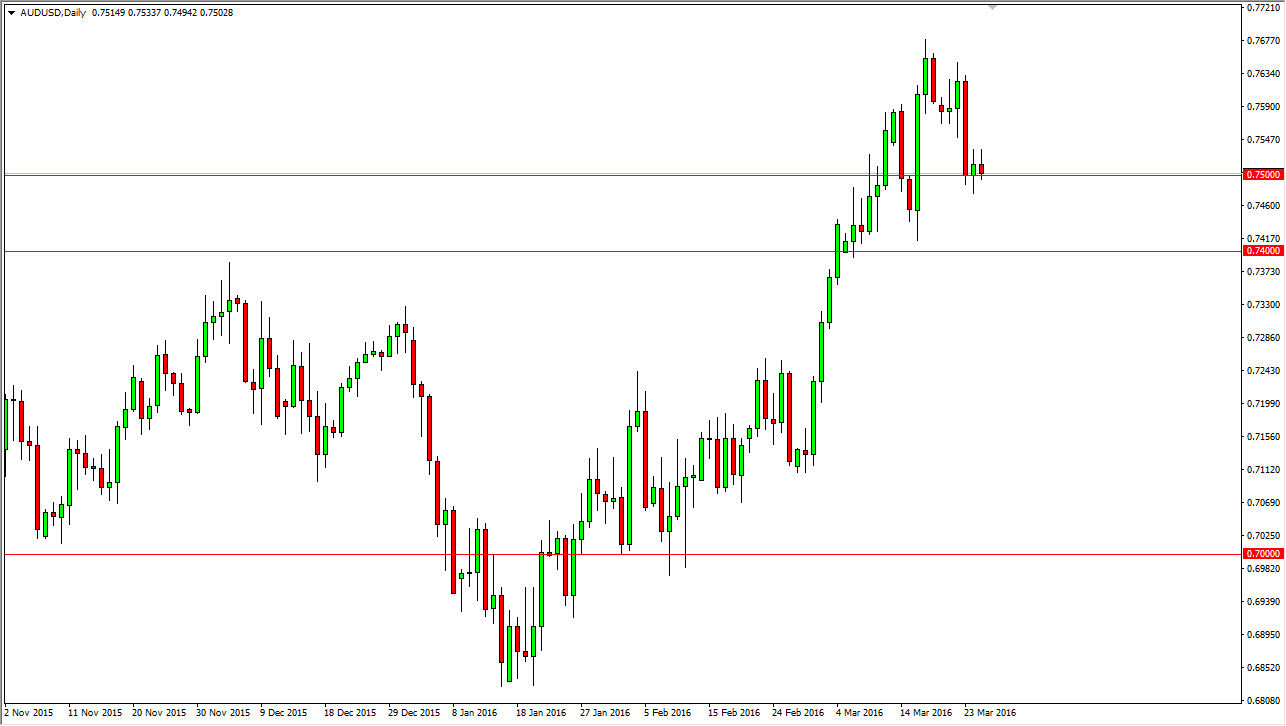

AUD/USD

The AUD/USD pair initially rose during the day on Friday, but turned around to form a shooting star. The shooting star is sitting right on top of the 0.75 handle, which of course is a large, round, psychologically significant number. I believe that there is a significant amount of support all the way down to the 0.74 level, so having said that if we get a supportive candle I am more than willing to start buying the Aussie as well. On top of that, if we can break above the top of the shooting star, that would be a very good place to start buying as well.

Pay attention to the gold markets, because they look as if they may be ready to rally. That would be a great signal to start buying the Australian dollar as well. I believe that we will target the 0.77 level above, as it recently offered quite a bit of resistance and it now seems as if the market is going to continue to go higher given enough time, I’m just waiting on a signal to start going slow.

Leave A Comment