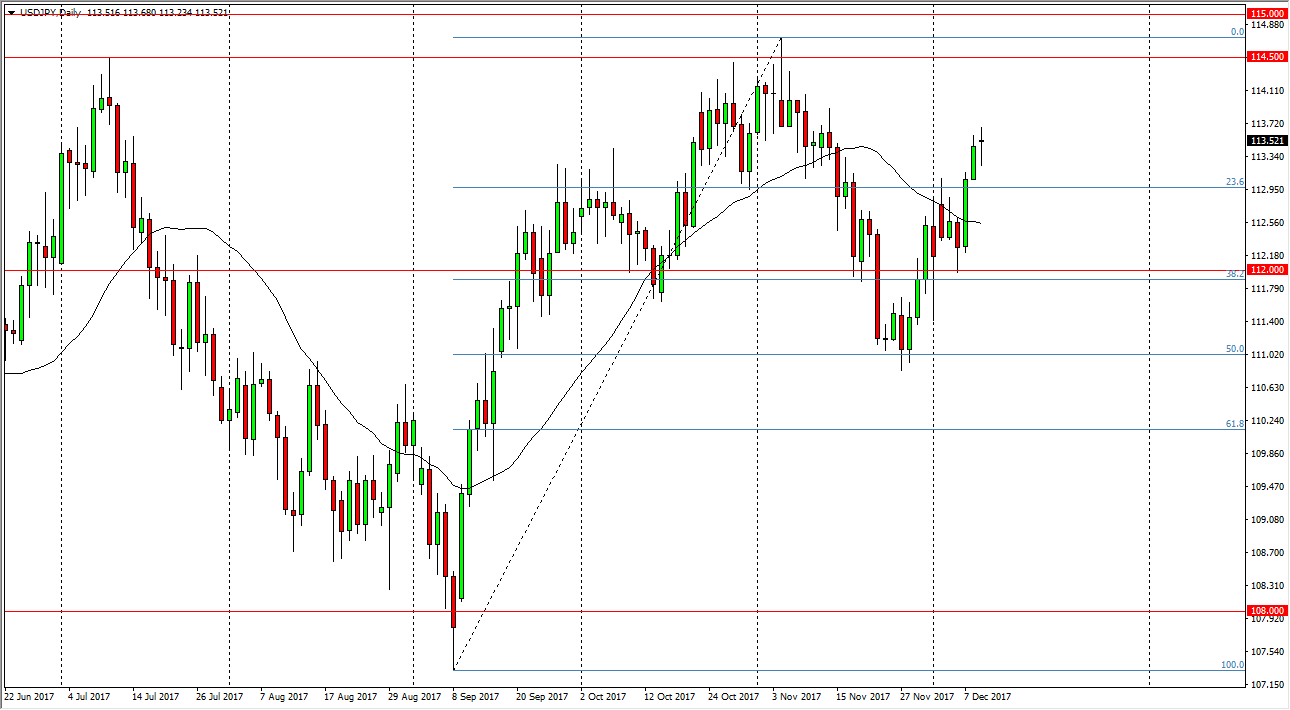

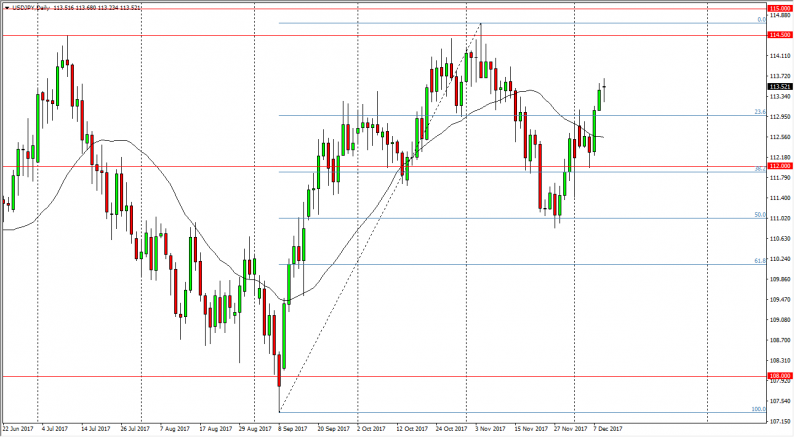

USD/JPY

The US dollar went back and forth during the course of the session here on Monday, ultimately forming a hammer. The hammers suggesting that we are going to continue to go higher, perhaps towards the 114.50 level above. That area should continue to offer resistance, extending to the 115 handle. If we break down below the hammer, that could send the market back down to the 112 level. If we break above the 115 handle, that is a very bullish sign, and I think at that point it becomes a “buy-and-hold” situation. With the Federal Reserve having an interest rate hike and statement on Wednesday, it’s very likely that this market is waiting to find out whether the Federal Reserve is going to be hawkish or dovish.

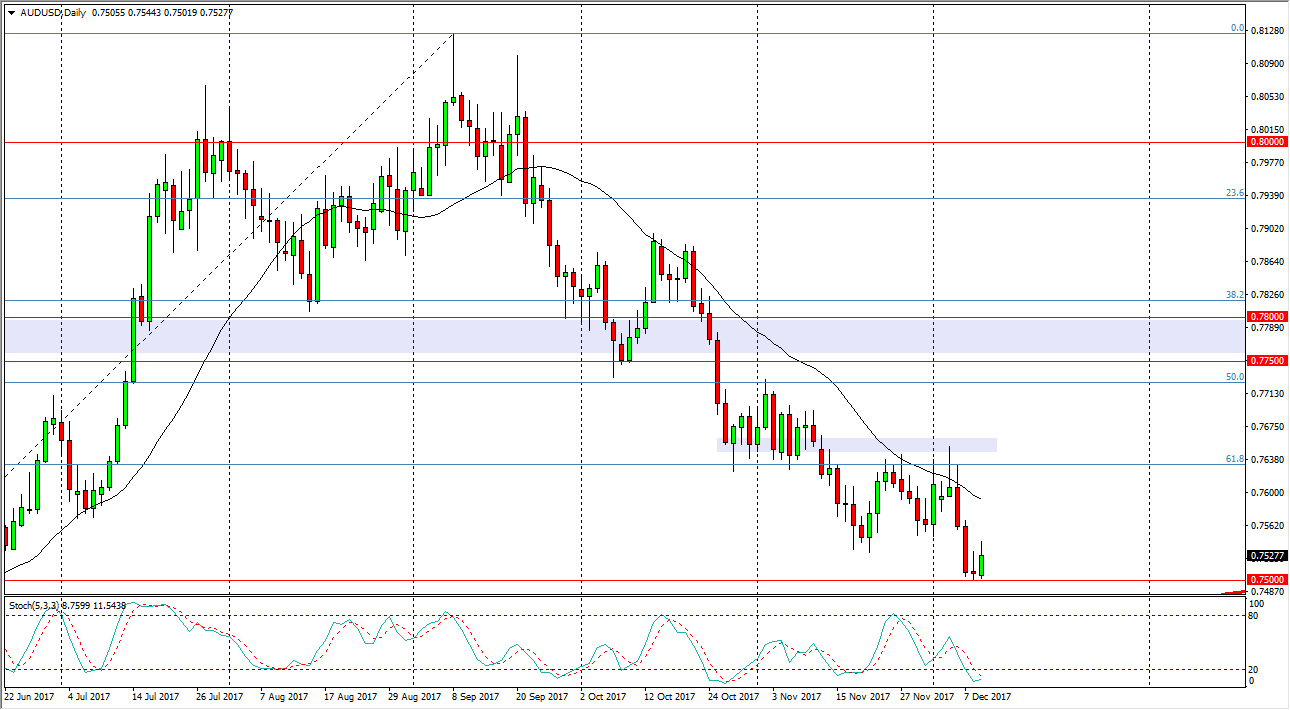

AUD/USD

The Australian dollar rallied during the day on Monday, breaking above the top of the shooting star from Friday. That’s a bullish sign, but I think a lot of this comes down to people positioning themselves ahead of the Federal Reserve meeting, as it should have a significant amount of influence on where this market goes next. I think the 0.75 level underneath continues to be massively supportive, and is not until after we get the announcement coming out of the Federal Reserve that the market may or may not be able to break through that support of level. A breakdown below the 0.75 level sends this market down to the 0.7350 level. In general, this is a market that should continue to be very noisy, and even though I think that we may drift a little higher in the short term, I’m waiting until we get that announcement coming out of Federal Reserve, and more importantly the statement, to put money to work in this pair.

Leave A Comment