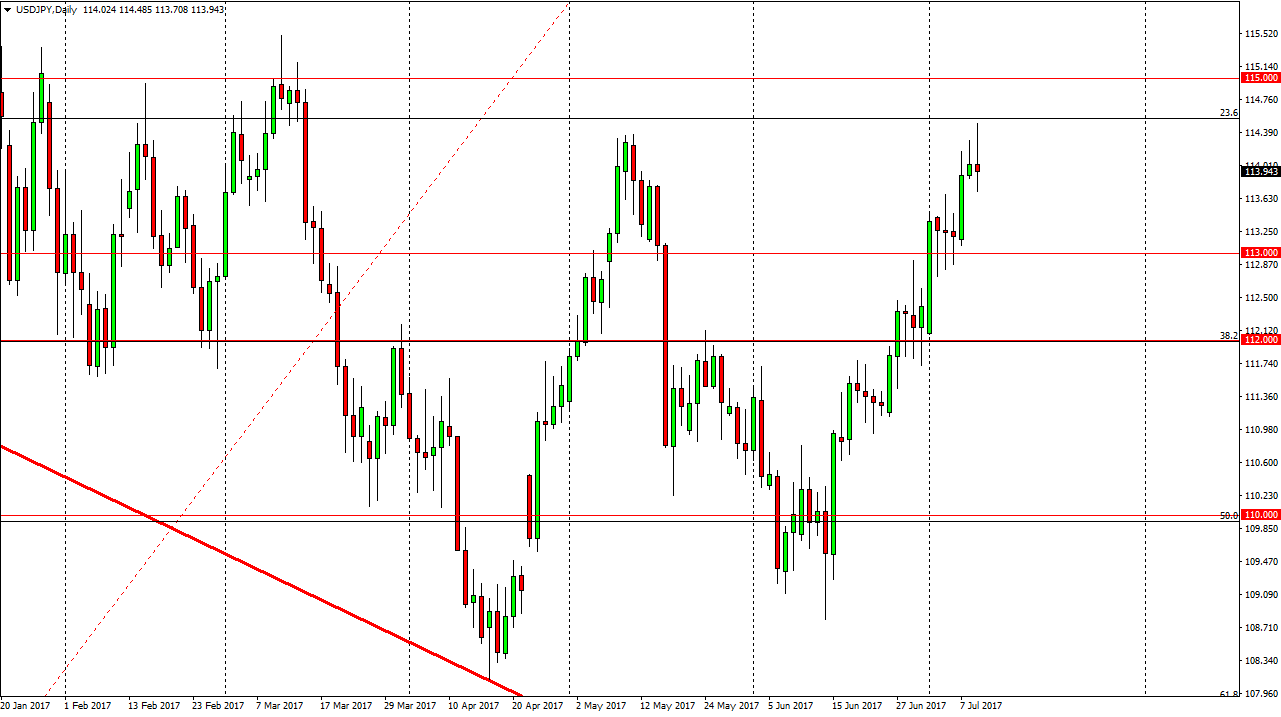

USD/JPY

The US dollar rallied against the Japanese yen during most of the session on Tuesday but turned around to form a bit of shooting star. That is a negative sign, and it’s possible that we could turn around, but we have Janet Yellen speaking during the day in front of Congress should continue to keep a lot of volatility in the market. I think it’s probably best to stand on the sidelines because of the potential explosiveness of a move in this market, as 115 is an area of significant resistance, but if we can break above that, the market should continue to go much higher, as the market will have cleared massive resistance. A pullback from here makes quite a bit of sense though because we are bit overextended. Because of this, I think that participants will look for support at lower levels, as the market has been bullish for so long.

AUD/USD

The Australian dollar rallied during the day on Tuesday, breaking above the 0.7625 level, which is an area where we have seen a lot of resistance. Because of this, the market looks like it is ready to continue going higher, and given enough time I think we will. The market will more than likely go looking towards the 0.7750 level where the resistance was found last time. Pay attention to gold, if we get some type of rally in the gold markets, it’s likely that the AUD/USD pair will follow suit. I have no interest in shorting this market, I think there is more than enough pressure underneath to keep the market going higher. I think it will also be very choppy, and the fact that Janet Yellen is speaking today will have a massive amount of influence on the gold market, and by extension this market.

Leave A Comment