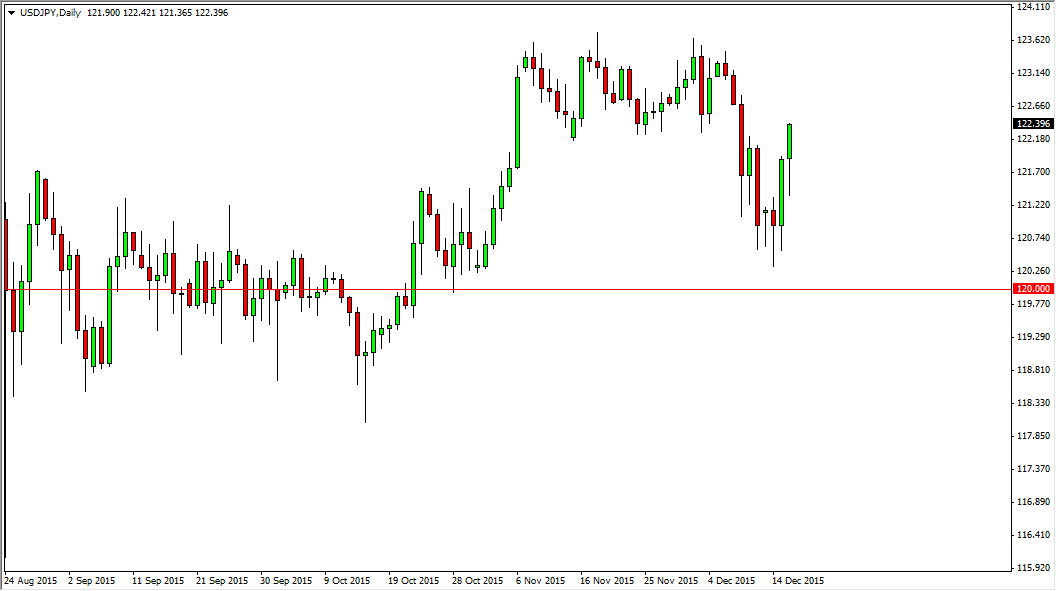

The USD/JPY pair initially fell during the course of the day on Wednesday, but found enough support near the 121.25 level to turn things around and bounce much higher. This isn’t much of a surprise though, because the FOMC Statement came out during the day, and the USD/JPY pair is highly sensitive to the employment and interest-rate situations in the United States. Ultimately, this is a market that looks as if it is ready to continue going higher, and with that being the case I am a buyer every time we pull back on short-term charts. I recognize that the area above is resistive, but ultimately we should reach the top of that previous consolidation area, which means we should go to the 123.50 handle.

Bank of Japan

We also have the Japanese Monetary Policy Statement coming out, and that of course could mention potential liquidity measures being taken by the Japanese, which could work against the value of the Japanese yen as well. Ultimately, the Bank of Japan wants this pair to go higher, and it will do so given enough time. We did have an interest-rate hike in the United States during the session, but the real question is whether or not we can continue to raise interest rates? Right now, it doesn’t look as if the Federal Reserve is ready to do right away, but they are most certainly going to do it much quicker than the Japanese will. In the end, that could be the determining factor in this pair.

I believe that the 120 level is still the floor in this market, and that as a result we should continue to see plenty of buying opportunities as long as we can stay above that area. Ultimately, I think that every time this market pulls back you have to start thinking about value in the US dollar. At this point in time, interest-rate differential should continue to expand in the favor of the US dollar.

Leave A Comment