The impact of the Federal Reserve’s dovish hike (see 5 dollar downers) continues to hurt the US dollar, especially against the majors. More specifically for USD/JPY, often a bellwether for the wider US dollar trend, the risk-off sentiment has its impact as well.

The S&P 500 is extending its losses, which exceed 1% at the time of writing. The index has been edging up very gradually, skipping nasty corrections so far.

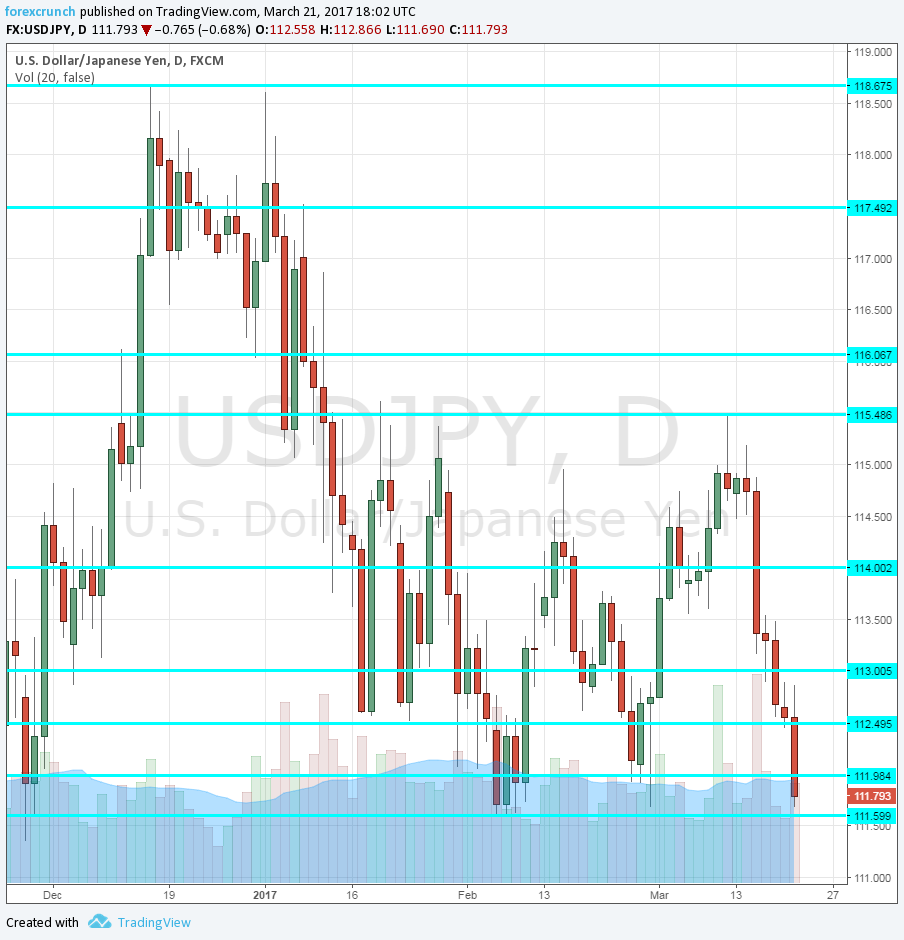

At current levels, USD/JPY is hitting edging closer to a triple low around 111.60. The previous touches of the line were seen during mid-February and previously in late 2016, November 29th to be precise.

Further support awaits at 111.40, which served as resistance when the pair traded at lower levels. The round number of 110 is much lower support. On the upside, 112.50 serves as resistance.

If we see further drops in the pair, we can expect some complaints from the Bank of Japan. Voicing concern about excessive volatility in foreign exchange markets is a not uncommon in Tokyo.

The daily chart below shows the previous hits of the line.

Leave A Comment