JAPANESE YEN TALKING POINTS

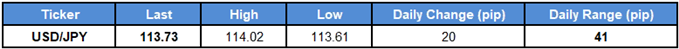

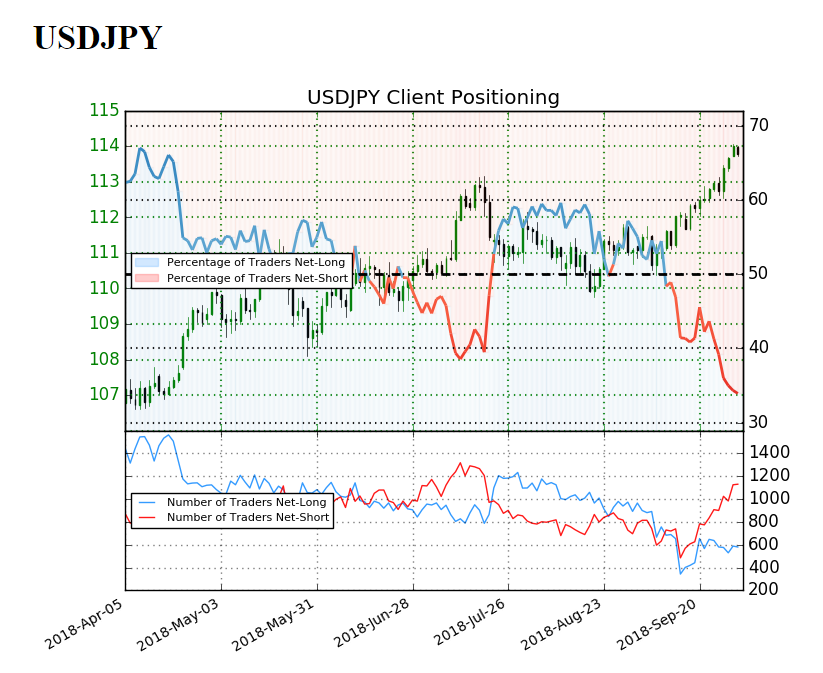

The recent rally in USD/JPY appears to have stalled ahead of the November 2017-high (114.74) as the exchange rate snaps the recent series of higher highs & lows, but there appears to be a broader shift in market behavior amid a jump in retail short interest.

USD/JPY RATE SNAPS BULLISH SEQUENCE, SHORT INTEREST JUMPS

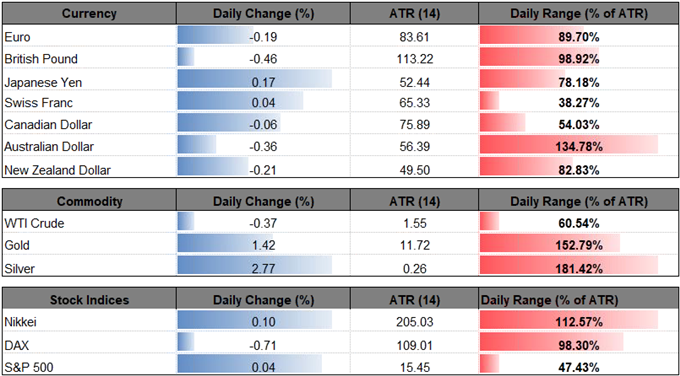

USD/JPY pulls back from the 2018-high (114.06) as Fed officials strike a cautious tone, with Boston Fed President Eric Rosengren warning that the U.S. economy flashing ‘a bunch of yellow lights,’ and another batch of lackluster data prints may keep the dollar-yen exchange rate under pressure as the ISM Non-Manufacturing survey is anticipated to show the index narrowing to 58.0 from 58.5 in August.

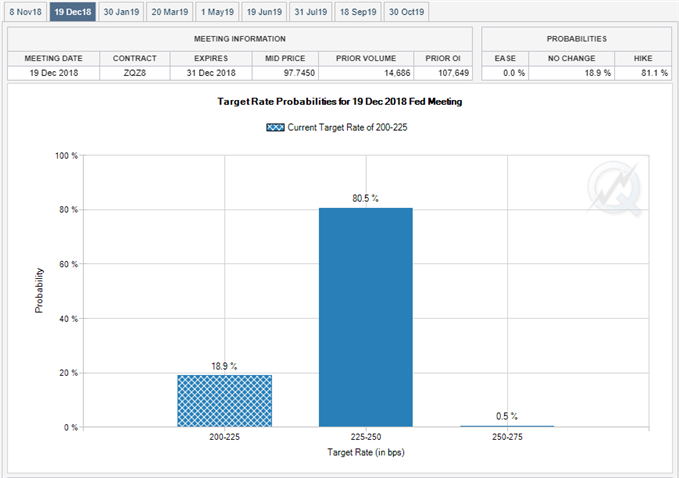

Signs of waning business confidence may encourage the Federal Open Market Committee (FOMC) to keep the benchmark interest rate on hold at the next meeting in November as the trade war with China dampens the outlook for growth, but the data prints may do little to derail the central bank from its hiking-cycle as Chairman Jerome Powell & Co. reiterate that ‘the Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective over the medium term’.

With that said, expectations for a less accommodative stance should keep USD/JPY bid as Fed Fund Futures continue to highlight bets for another 25bp rate-hike at the next quarterly meeting in December, and the exchange rate may exhibit a bullish behavior over the remainder of the year especially as the Bank of Japan (BoJ) remains in no rush to move away from its Quantitative/Qualitative Easing (QQE) Program with Yield-Curve Control.

Nevertheless, the IG Client Sentiment Report now shows33.9% of traders are now net-long USD/JPY, with the ratio of traders short to long at 1.95 to 1. In fact, traders have remained net-short since September 13 when USD/JPY traded near the 111.20 region even though price has moved 2.3% higher since then. The number of traders net-long is 4.7% higher than yesterday and 9.8% lower from last week, while the number of traders net-short is 13.7% higher than yesterday and 37.5% higher from last week.

Leave A Comment