Video Length: 00:06:08

USD/JPY

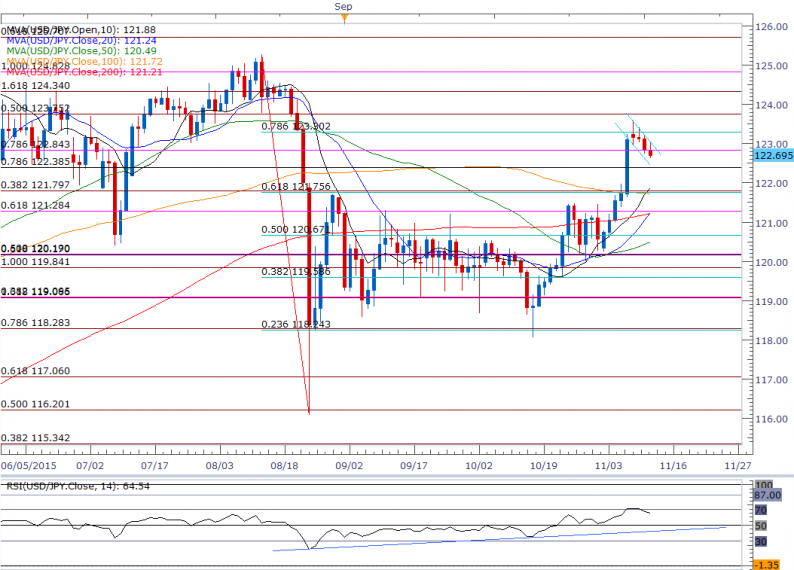

Chart – Created Using FXCM Marketscope 2.0

Despite the weakness in the global benchmark equity indices, USD/JPY may mount a larger topside assault in the days ahead as a bull-flag formation appears to be taking shape, while the Relative Strength Index (RSI) preserves the bullish formation from August.

However, the dollar-yen may continue to consolidate ahead of the remaining interest rate decisions for 2015 as the Bank of Japan (BoJ) remains in no rush to further expand its asset-purchase program despite the weakening outlook for global growth.

The DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long USD/JPY since June 8, but the ratio appears to be working its way back towards recent extremes as it climbs to +1.41, with 58% of traders long.

EUR/USD

Even though EUR/USD fails to hold the post-NFP low (1.0704), the pair may face a larger rebound over the next 24-hours of trade as the Euro-Zone’s 3Q Gross Domestic Product (GDP) report is expected to show the monetary union expanding an annualized 1.7% after growing 1.5% during the three-months through June.

Long-term outlook remains tilted to the downside especially as the RSI retains the bearish formation from August, but EUR/USD stands at risk for a bigger correction as the oscillator comes off of oversold territory.

Close above former support around 1.0790 (50% expansion) to 1.0800 (23.6% expansion) may open up the door for a run up to 1.0940 (61.8% retracement) to 1.0960 (23.6% retracement)

Leave A Comment