I have to send them a check every month, and sometimes it gets a little expensive. But I couldn’t imagine life without them.

In fact, life would be unbearable if they weren’t around.

But, to be completely honest, they have returned to me much more than I have ever given to them. Not in the same way, but you know what I mean.

No, it isn’t my family members. They’re a money pit of another kind.

It’s my electric utility.

Can you imagine life without electricity? It is unthinkable!

No one (well, virtually no one) lives without it. Not in this country, anyway.

And that is exactly why, for decades, utility companies were some of the most popular holdings in income portfolios.

But since the ‘90s, despite being as close to a “guaranteed market” as you can get, utilities have fallen off many income radar screens. In fact, they aren’t the gods of the income world they once were.

Back then, every income portfolio was heavily into electric utilities. And why not? Even the lowest dividends were in the 6% to 8% range.

And they returned a little growth, too – 6% to 7% back then was very common. (In fact, those figures were considered small and substandard for stocks.)

But when Washington “fixed” yet another part of our world that wasn’t broken, new regulations drove utility companies’ dividends down and the growth stalled, causing utilities to lose a lot of their shine.

But then came the zero interest rate market, and their 3% and 4% dividend yields started looking pretty good.

And during the recent rout in January, they lived up to their decade-old reputation of being rock solid and reliable.

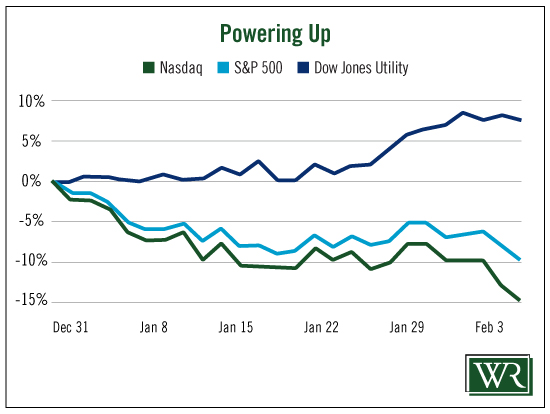

The year-to-date chart below for the Nasdaq, the S&P 500 and the Dow Jones Utility index shows just how resilient and reliable these power generators can be.

They not only sent out their quarterly dividend payments, which they have been doing forever, but they also were the best-performing and the most stable sector of the whole market.

Leave A Comment