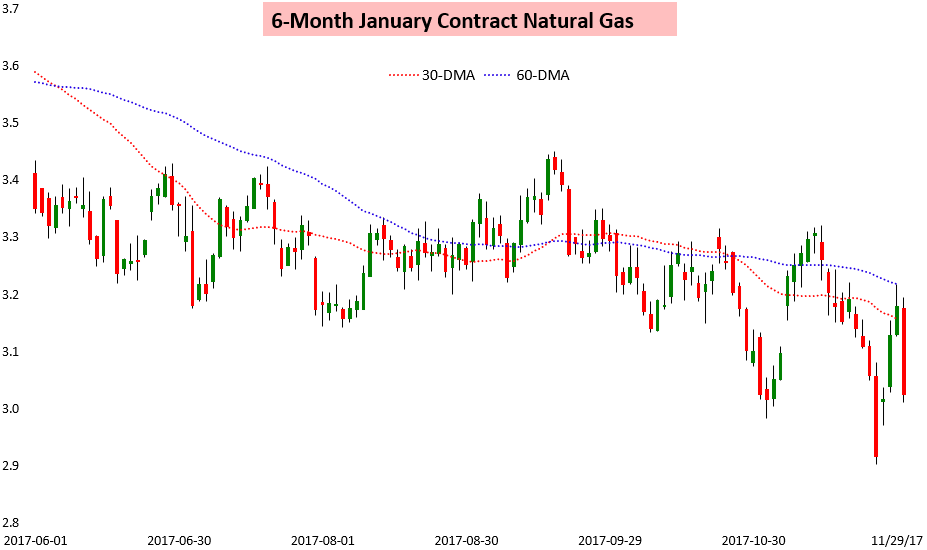

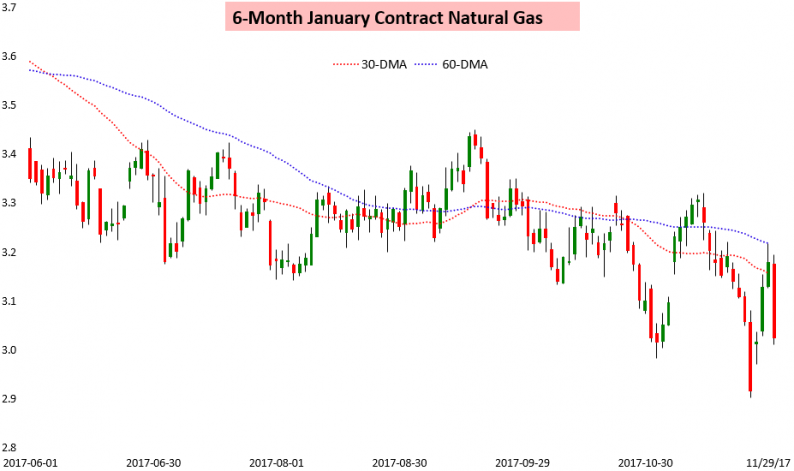

Natural gas volatility has returned as traders attempt to price in variable heating demand expectations into the middle of December. After three straight days of rallying, today prices declined, and the decline was not small. The January natural gas contract pulled back almost 5% after reversing off the 60-DMA yesterday.

As would be expected with such heavy selling, losses were worst at the front of the strip, but even the Spring 2018 strip saw decent losses on the day too.

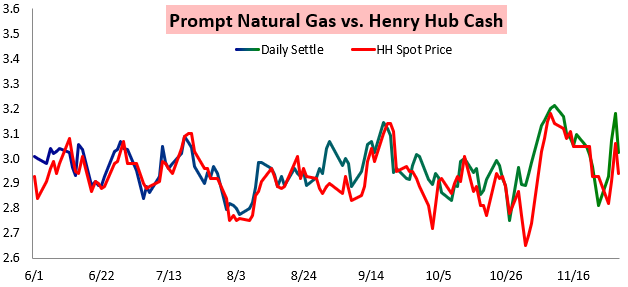

Cash prices were of no help either.

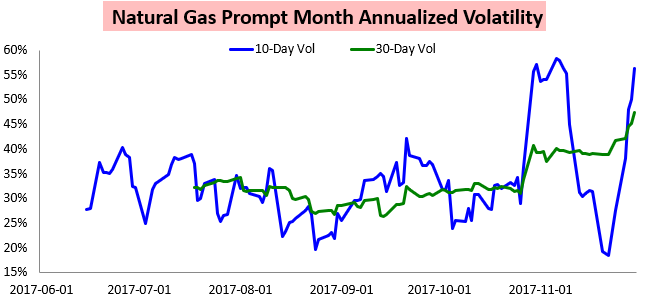

The result is that 30-day natural gas annualized volatility is now far higher than it was at any point this past summer or fall.

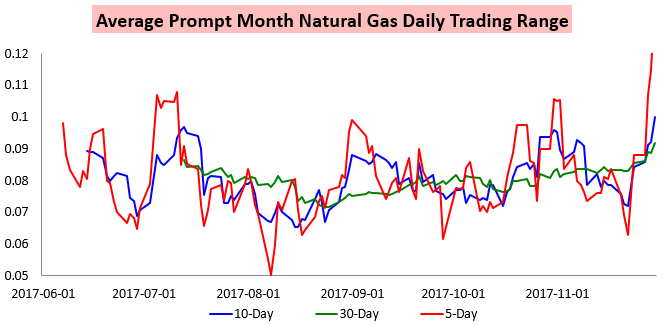

The 5, 10, and 30-day trading ranges all set new highs as well, with large intraday moves becoming the norm again.

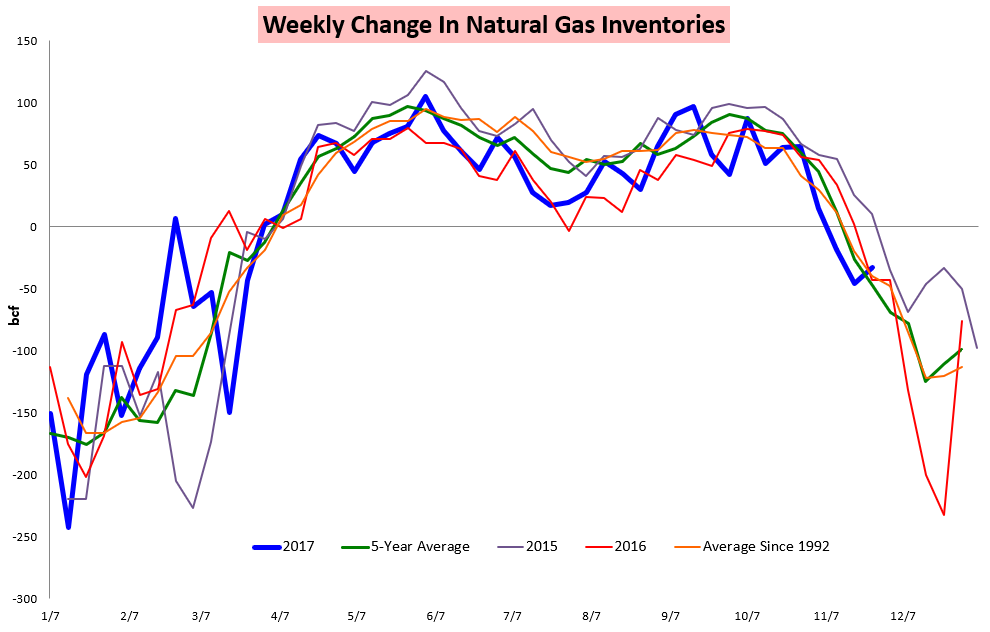

Prices initially attempted to stabilize following the morning EIA print, but the slightly bearish nature of the print (it came in as a -33 bcf net implied flow for last week, vs. our estimate of -37 bcf) appeared to help push prices lower through the day.

Our EIA Data Rapid Release, sent out to clients within 10 minutes of the data release, picked up on the bearish nature of the print. We saw this print as confirming the loosening balance that has resulted from recent production increases, which are expected to absorb some additional weather-driven demand.

Still, prices continued selling off through the afternoon as well, settling near the lows of the day. The market did not find afternoon weather model guidance particularly impressive, and CPC forecasts stopped trending colder in the 8-14 Day time frame, instead trending a bit warmer across the center of the country.

Now, attention turns back to expected forecast trends, as each of the past four weekends have featured rather significant gaps into the Sunday evening open off shifting weather expectations.

Leave A Comment