by Dirk Ehnts, Econoblog101

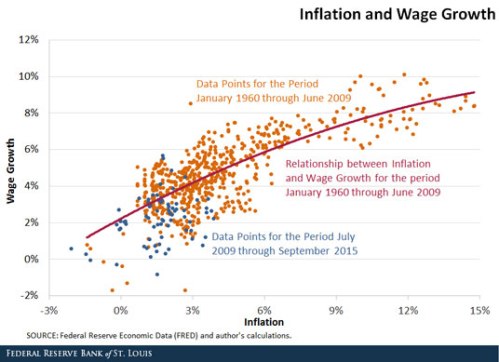

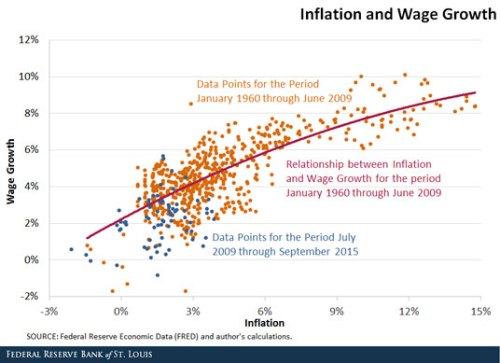

The St Louis FED has a blog which has recently presented this figure:

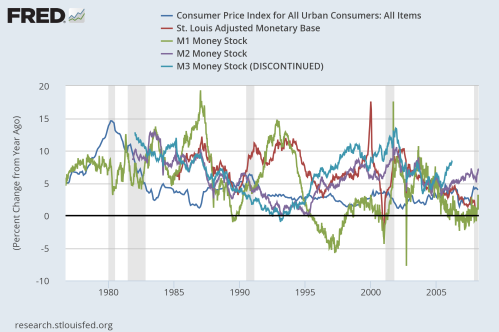

This is very interesting since most economists still think that it is monetary aggregate(s) that are driving the inflation rate. I have done a quick&dirty job and assembled changes in monetary base, M1, M2 and M3 in the figure below:

The time span has been chosen to increase readability. When the Great Financial Crisis broke out, the monetary base was increased at times by 100%, which ruins my graphic. Anyway, it seems quite clear that the data says that change in the price level (=inflation) seems to depend more on the development of wages than the development of some monetary aggregate.

What is also influencing inflation should be the exchange rate, with depreciations potentially increasing the inflation rate and appreciations decreasing it. However, since a cheaper USD means more exports, that should also translate into inflation through changes in wages via the labor market.

Forecasting inflation is much more difficult if it is depending to a large extent on developments on the labour market because these are not independent from development of credit, fiscal stance (G-T) and trade stance (EX-IM).

Leave A Comment