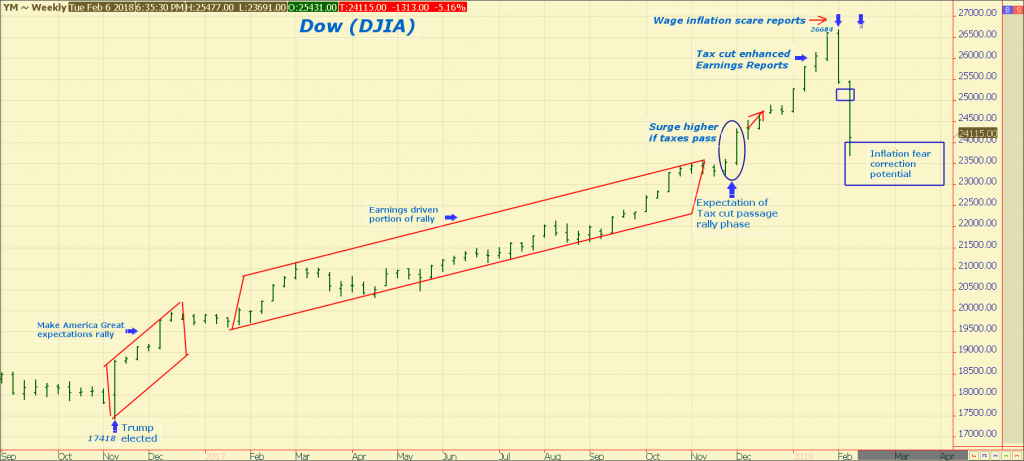

In recent months we have been warning that the first deep dive in stocks since Trump’s 2016 election would be in the 1st quarter 2018. Once Trump passed the Tax cuts last December we opined that the trigger for this market decline would be Wage inflation and fear of higher interest rates. The strong economy was already adding inflationary pressure to material prices and labor costs. Then huge Corporate Tax cuts in December escalated these pressures as evidenced by the surprising early announcements that hundreds of larger companies have already promised bonuses, pension contributions and wage hikes. We suspect a temporary spike closer to 3.5% growth in hourly earnings is coming over the next few months. The labor cost infused inflation (CPI) report due on the 14th this month may be another reminder of higher interest rate worries.

While a strong economy and earnings growth are critical to any Bull market in stocks, the key psychology of market behavior is to fool most investors most of the time. When stocks exploded higher after Trump’s victory in 2016 we had almost 15 months of rapid appreciation that left too many investors on the sidelines awaiting a 5 to 10% pullback. With so much pent up demand, we expected that the only way to keep investors from finding an easy entry to catch this market required a decline of well over 10%. With more inflation coming there could be still lower prices this quarter.

The Dow and SP 500 Indices have now fallen 13 and 12% on an intraday basis in just over 6 days, qualifying for a fairly common but exceptionally fast correction that will scare investors. Here is what ExecSpec stock market forecasts have been saying in recent months:

10-24-17: in 1995 stocks ran higher for 15 months without exceeding a 3% correction before scaring traders with a 3 week plunge of over 11% intraday. A similar replay of 1995 would keep the buying frenzy going until about January 2018 before a “real” correction begins. http://execspec.net/correction-volatility-stocks-sp/

Leave A Comment