Written by Mark Melin

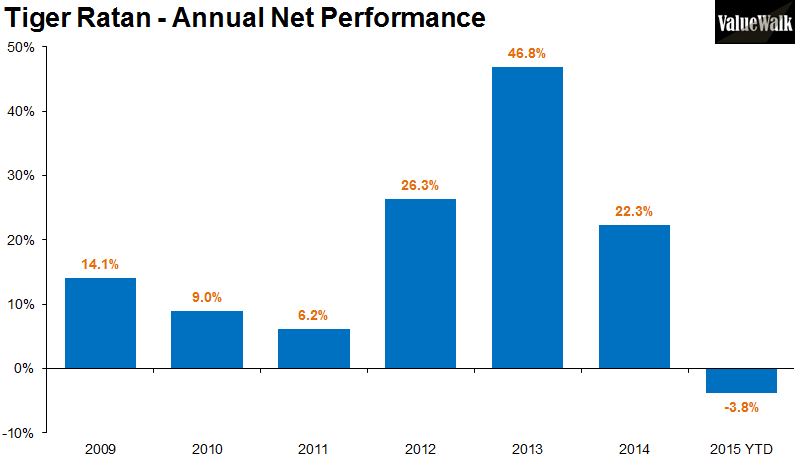

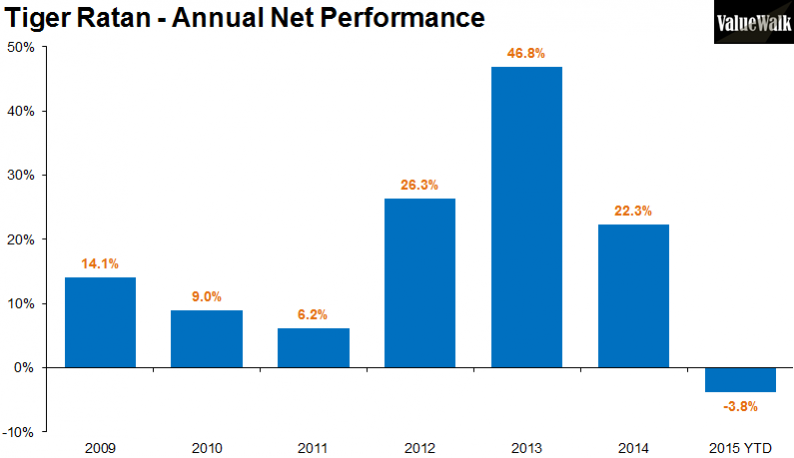

One of the shining female stars of Wall Street is carefully watching her hedge fund’s exposure to healthcare after experiencing the worst quarterly performance in the fund’s history. With the Tiger Ratan hedge fund down a whopping 20.9 percent in September, according to a letter to investors reviewed by ValueWalk, the fund founded by Nehal Chopra is repositioning for the future. While the healthcare bet didn’t work out as planned, Chopra’s short exposure to Walmart did benefit the portfolio, which was down 3.8 percent year to date as of the end of September. The negative performance is rare for Chopra, who was up 22.3 percent, 46.8 percent and 26.3 percent in the previous three years respectively and has not had a losing year since the fund’s founding in 2009.

Source – Q3 2015 letter to investors

Chopra’s shorts in Walmart and Pier One cushion tough quarterly results

It was the shorts in Tiger Ratan’s $1 billion portfolio that benefited investors the most, as betting the stocks would go lower “acted according to plan.” Shorts in the portfolio added 4.9 percent in value during the third quarter, with bets against Pier One and Walmart leading the way.

Walmart, which traded near $87 per share the first week of 2015, saw its stock plummet on fears that Amazon.com was going to eat the discount retailer’s customers, trading down near $57 as recently as yesterday. But just today the $3.3 billion retailer reported that existing U.S. store sales rose by 1.5 percent in the third quarter, the fifth straight quarter of growth after long periods of declines. The stock bounced today on the news, closing in on $60 per share in mid-afternoon trading. Certain technical indicators on the stock turned higher in early November and remained a buy signal even as the stock price broke into new lows last Friday.

The short thesis on Walmart – that online shopping would hamper performance – was also behind the hedge fund’s short logic behind Pier One. The stock reached a high of $17.31 towards the end of January and is now trading near $6.53 per share, a dramatic plunge and a benefit to the Tiger Ratan portfolio. Chopra wrote that the retailer is increasingly facing secular pressures from consumers shifting their home furnishing shopping online.

Leave A Comment