With 15% gains in the major stock indices (Nasdaq 28%) stocks are on pace for their 4th best year since 1999. Precursors of accelerating economic growth abound in 2017, reflective of the rebounding earnings and future expectations. The stubbornly sluggish US GDP continues to hover near its 2.1% post mortgage bubble 7 year expansion cycle. Underlying proxies of manufacturing and service sectors are approaching historic rates of expansion with record demand for job seekers. Factories are struggling to find capacity as New Orders and Shipments are outpacing depleted customer inventories. Today’s 3.0% GDP report for the 3rd quarter, following the 2nd quarter pace of 3%, is a strong sign that real growth is finally percolating to the economy’s bottom line GDP.

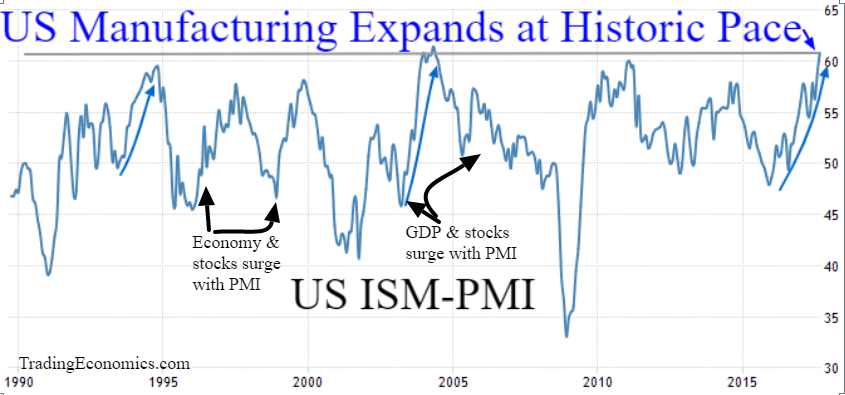

US Manufacturing as measured by ISM’s Purchasing Managers Index (PMI) hit a 13 year high in September, one of the most comprehensive rates of expansion ever recorded.Should legislative winds provide corporate tax cuts and an estimated $3 Trillion repatriation of foreign earnings in 2018, then there may yet be hope for GDP growth rates above 3% despite the impedance of a tight labor pool. Lower business taxes here would boost global growth as other countries follow suit.

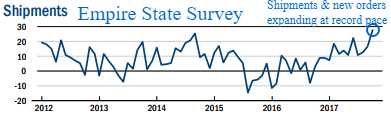

The pace of shipments is at a new high is causing a strain in logistics and slower delivery times. Inventory accumulation gave a boost to 3rd quarter GDP, but New Order expansion and heavy backlogs hint that inventory building may continue.

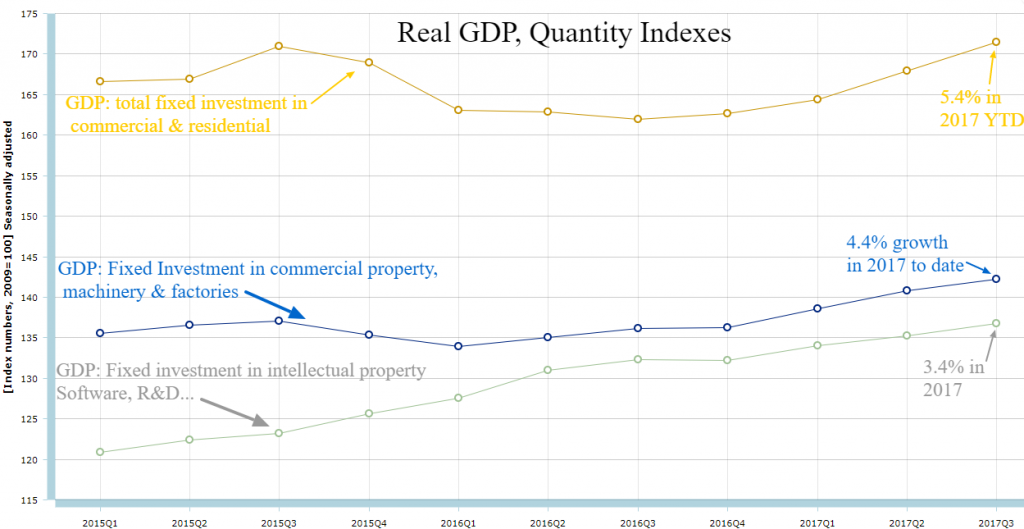

The personal consumption and the service sector has accounted for the lions share of GDP growth since 2009, but lately the missing ingredients of fixed investment and goods producing sectors have contributed to a more robust total GDP number.

More rapid pace of new orders, shipments and production leads to increased capital spending (CapEx) to increase capacity.

Leave A Comment