I often talk about watching market internals during a rally out of a dip for signs that confirm the run. Indicators that are derived from price are mostly showing confirmation, but many other market internals are lagging price. This lag is causing negative divergences that often accompany intermediate to long term market tops. With those divergences in place it’s now time to watch internals during the next dip. Here are a few things I’m watching.

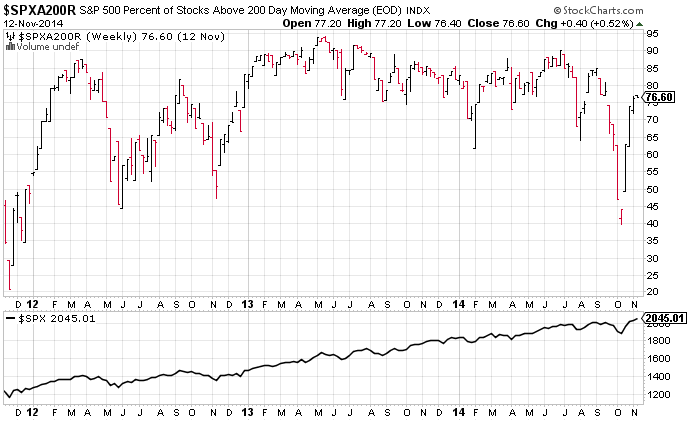

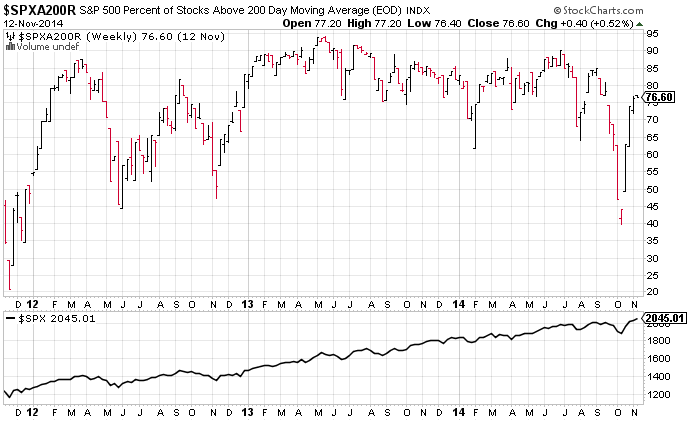

First is the percent of stocks in the S&P 500 Index (SPX) that are above their 200 day moving average. Currently about 77% are above their 200 dma. This is a healthy number, but below the readings of the last two years due to the damage done on the last dip. About 10% of the stocks in SPX did not recover their 200 dma after being pushed below in October. If this trend continues on subsequent dips it will provide warning of a longer term top being put in place. If it can hold above the 60% level it will suggest the market has room to run to new highs again.

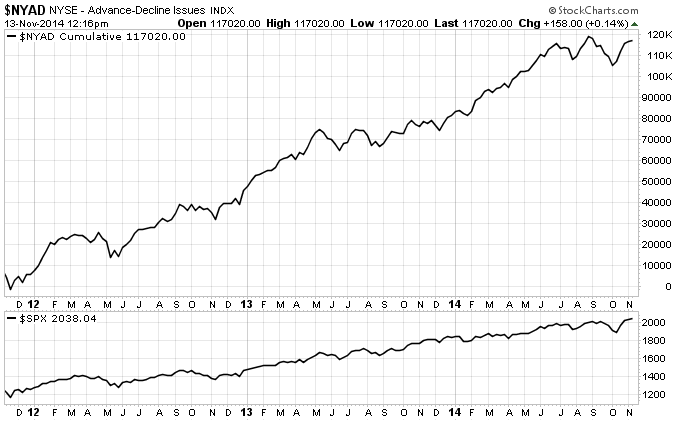

Second is the NYSE Advance / Decline line (NYAD). It shows that not as many stocks advancing as the market moves to new highs. I would view a lower low in this indicator as confirmation that a longer term top is in place. If it can move to new highs it will be a healthy sign.

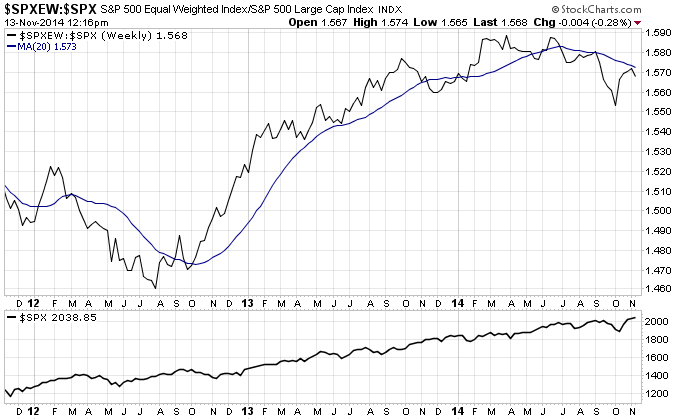

The ratio between Equal Weighted SPX (SPXEW) and (SPX) is turning back down just beneath its 20 week moving average. After a strong rally where the smaller cap stocks in the index were being bought, we’re now seeing money shifting back to mega caps. This could be a rotation to safety or simply profit taking, but the rotation often causes a dip in the market. So we should be close to a short term top and some choppy action…giving us a chance to watch internals to see how committed people are to the current rally.

Another indication of a short term top comes from Trade Followers. All sectors were positive last week which has preceded almost every short term top in the past two years. In addition, 7 day Twitter momentum has just turned down from a “normal” over bought condition which usually marks short term tops as well.

Leave A Comment