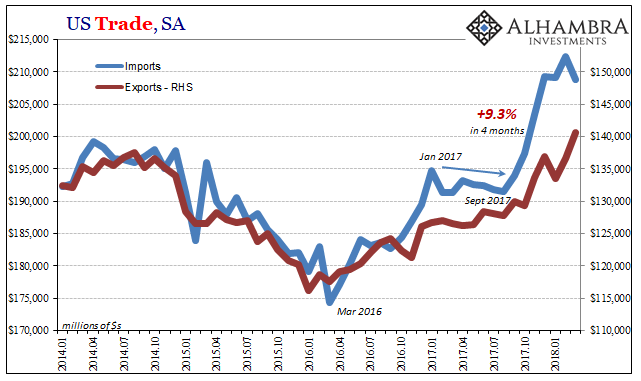

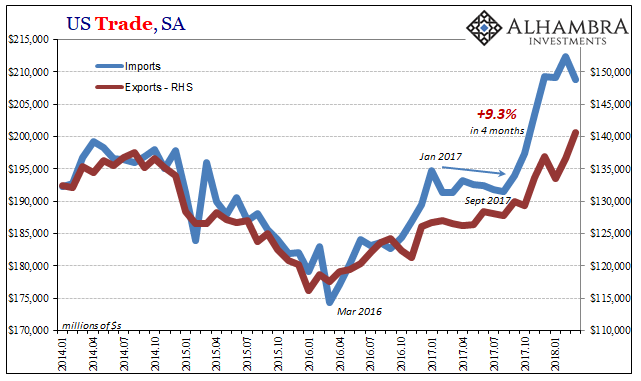

The US trade deficit, a sensitive political topic these days, declined sharply in March. It had expanded significantly (more deficit) in January and February, reaching nearly -$76 billion (seasonally adjusted) in the latter month, before posting -$68 billion in the latest figures. Exports rose while imports fell in March, making for the largest single month change in the trade condition in many years.

That may mean something in Washington or Beijing, but it largely suggests the erosion of a couple temporary factors. The first is Harvey and Irma receding farther into the past. The aftermath of the storms saw a tremendous increase in import activity, particularly in consumer goods.

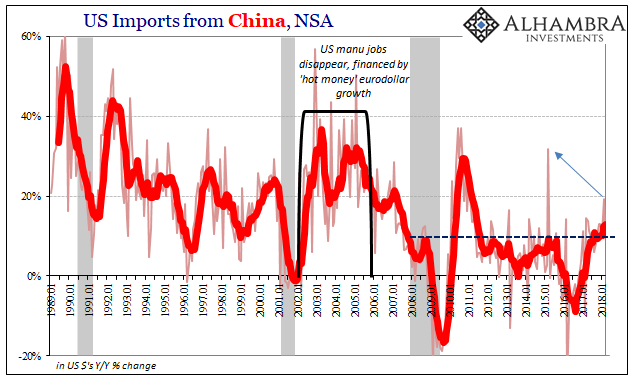

The second is the trade issue itself. According to Chinese export estimates, there was indicated a massive rush to move product outside the country in February. In all likelihood, a lot of it had to do with trying to beat whatever tariffs or restrictions might have been, or still might be, imposed in the ongoing, unresolved dispute. On the US side, imports from China demonstrated that pattern but to a much lesser degree (continuing to raise questions about where all those Chinese goods actually went in February, or whether there were fake goods mixed within serving to channel nothing more than funding into the country from Hong Kong or elsewhere).

Chinese imports rose 11.8% year-over-year in March following a 19.2% rise in February. Taking into account holiday factors, as well, the 11.8% is among the weaker gains recently. Whatever the cause, it still doesn’t suggest a determined uptick in US demand for Chinese products.

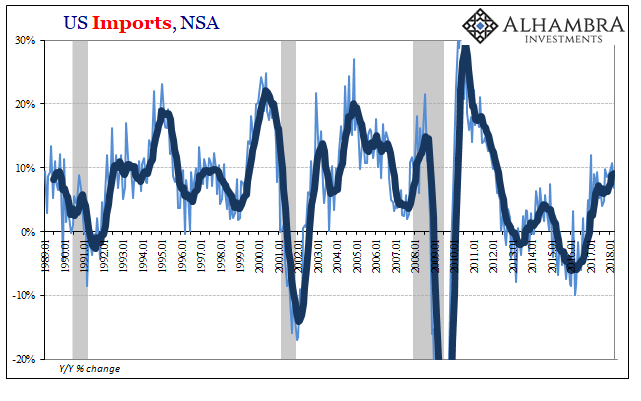

Overall, US imports increased 6.9% in March 2018 from March 2017 (unadjusted). That’s also the weakest gain in several months, the lowest since last September before all the storm effects converged.

Leave A Comment