Is Brexit bad, bearable or brilliant we asked in our recent podcast. It seems that the team at Bank of America Merrill Lynch is becoming more optimistic:

Here is their view, courtesy of eFXnews:

The UK looks like it will avoid recession.

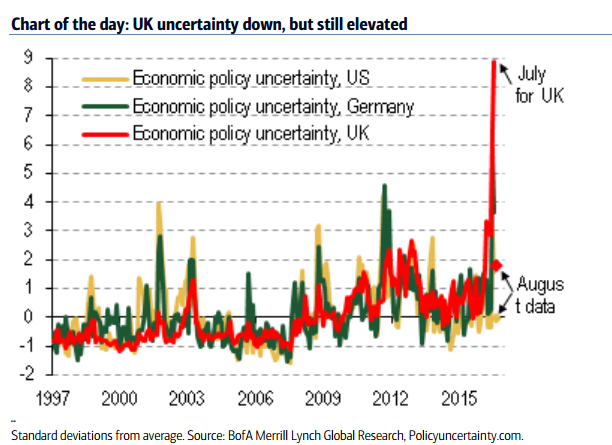

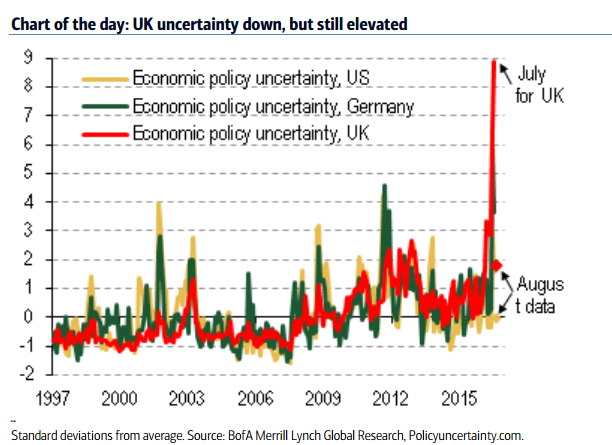

After a miserable July, UK data have rebounded to a degree in August, probably responding to lower economic uncertainty (Chart of the day). Whether that lasts remains an open question, with politicians back to work discussing Brexit but offering little guidance. Still, it now seems the UK will avoid recession. A simple GDP tracker – a weighted average of the major surveys of output and expenditure shown in Exhibit 2 below – points to 0.2% growth. The National Institute of Economic and Social Research estimated 3m/3m GDP growth of 0.3% in August. There seems a good chance that estimate will drop in September, but remain positive, as strong monthly growth in April drops out of the comparison.

In response to the better than expected data, we raised our forecasts. We no longer expect a mild UK recession in the near term: we now look for 0.2% QoQ growth in 3Q and 4Q 2016, slowing to 0.1% in 1Q 2017, then remaining at 0.2% through the remainder of 2017. That takes our calendar year growth forecasts to 1.8% GDP growth for 2016E and 0.7% for 2017E, from 1.7% and 0.2%.

…And remember, it’s still early days.

We would be cautious about drawing firm conclusions. In reality, we still know very little about how the post-Brexit economy has and will perform in the short-term. Sentiment data probably exaggerated the July weakness and may have over-egged the bounce in August. Even supposedly ‘hard data’ will likely face years of revisions. And we believe a significant chunk of the Brexit shock has not even begun feeding through yet: when sterling’s decline pushes up inflation next year, consumers will find their real incomes squeezed again, which is likely to weigh considerably on consumption.

Leave A Comment