So far so good.

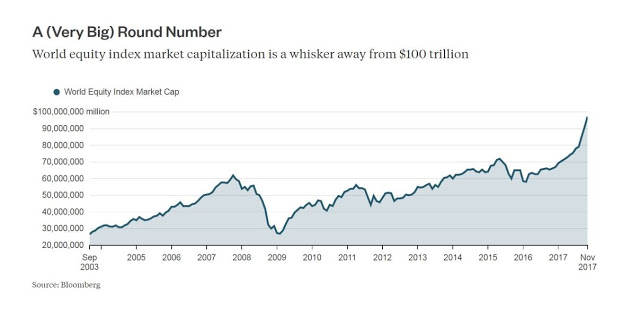

We have no regrets on Monday’s call to get to CASH!!! Now, it is possible that it’s a self-fulfilling prophesy as I went on TV, live at the Nasdaq on Monday Morning and told their viewers why I thought the market was drastically overbought – using very simple math that simply demonstrates that it’s not likely that, after taking 200 years to get to $65Tn, the global markets were going to be able to justify a $35TN (53.8%) gain in 12 months.

What’s most amusing to me is the number of people on Social Media who feel that they need to defend the bubble and come up with dozens of reasons why I am wrong and why “this time is different” because of Trump’s Tax Plan, the Global Recovery, Emerging Markets, Easy Money Policies, the Sharing Economy, Robot Automation… All good reasons we should be having a rally – but not this INSANE, RIDICULOUS, UNSUSTAINABLE rally and, frankly, the whole time they are talking I just keep thinking “Wow, people just don’t understand the basic concept of math, do they?”

It’s the same math I used in 2010 when I wrote: “The Worst-Case Scenario: Getting Real With Global GDP!” when I used the same MATH to show that the markets should be much higher than they were. 7 years later, the math hasn’t changed, the markets have. I’m not your enemy just because I’m trying to tell you the markets are overbought any more than your doctor is when he tells you your cholesterol is too high. I’ve been warning you for a long time and I’ve prescribed hedges to make sure our portfolios didn’t suffer any major damage but now, unfortunately, the untreated condition has gotten worse and we need to operate/liquidate – IMMEDIATELY – to prevent serious damage to your finances.

Like a doctor, we don’t know for sure that staying in the market will kill you, we have to rely on our observations and the risk/reward of cashing in vs. staying bullish into 2018. Is the global market more likely to add $5Tn (5%) in the next month or two or is it more likely to realize it couldn’t possibly have grown 58% in a year and, therefore, stock prices have probably gotten ahead of themselves, to some extent, between 58% and the actual growth of 3.4%.

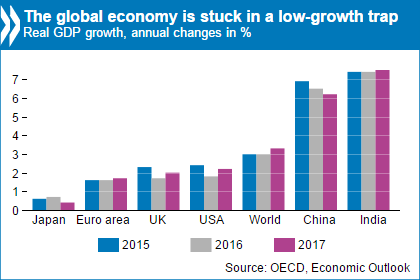

As you can see from the Chart, China has been a huge part of the Global growth story and they are slowing down (because of pollution and debt, which we also predicted) and India is still doing well but it’s only a $2.2Tn economy, 20% of China’s size so, unless India is going to pop 5% more – it’s not going to make up for China’s 1% drop. Again, math…

I’m not trying to be a downer, I’m very long-term bullish on the global economy but that doesn’t mean the markets can’t get ahead of themselves and, clearly, they are way ahead of themselves now. Not only have they priced in ALL the possible good news and then added a huge bonus but we’re completely ignoring all the bad news (see Monday’s list) and not even considering some of the good news, like Tax Cuts, may not be good news at all because it increases the National Debt by 50% over 10 years and it throws 36M people off health care and it cuts benefits to the 250M (78%) people lucky enough to still have health coverage and it cuts funding for basic education, R&D, environmental protection, infrastructure spending and college loans – you know – the future.

Leave A Comment