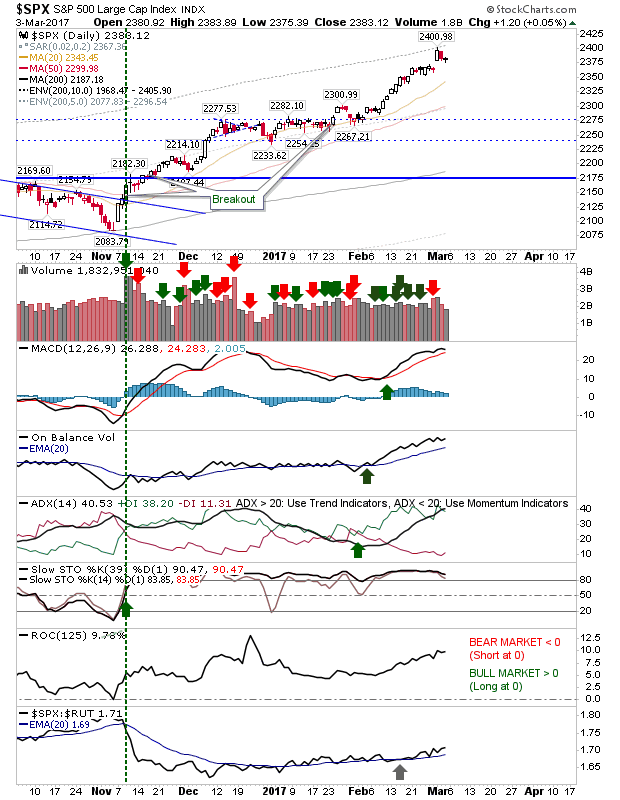

Friday’s action stemmed whatever profit taking was in play from Thursday. It kept bulls well placed to attack again Monday, barring some early morning Trump Tweet Disaster.

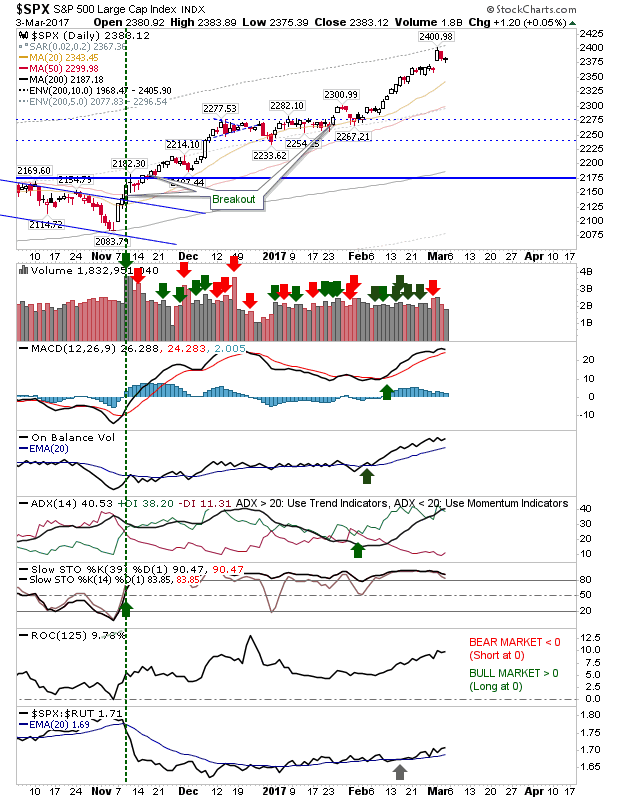

After the Winter lull, the S&P kicked off the spring in style with solid gains. All lead technicals are on firm ‘buy’ signal. If bears are to gain a foothold it will likely require a retest of highs to confirm a switch – so bulls should have a second chance to get out if there is any concerted profit taking here.

The Nasdaq still has a MACD ‘sell’ and a ‘sell’ trigger in relative performance against the S&P to contend with, and Friday’s buying volume wasn’t exactly stellar, but the overall trend from November remains healthy (no blowout top here – just steady gains all the way).

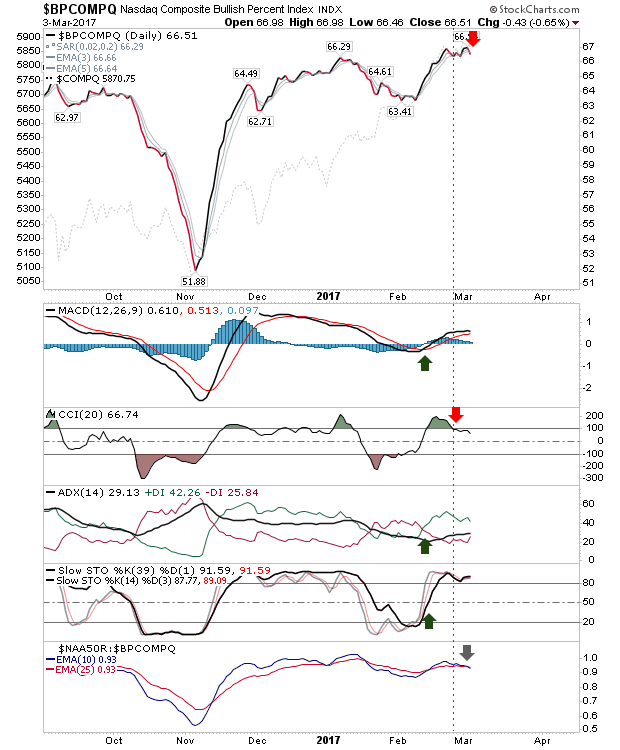

Where things are looking a little more concerning for the Nasdaq is in Breadth Metrics. The Percentage of Nasdaq Stocks above the 50-day MA is now confirmed bearish. This tends to be the most sensitive breadth metric to change in market conditions, but also the most prone to whipsaw.

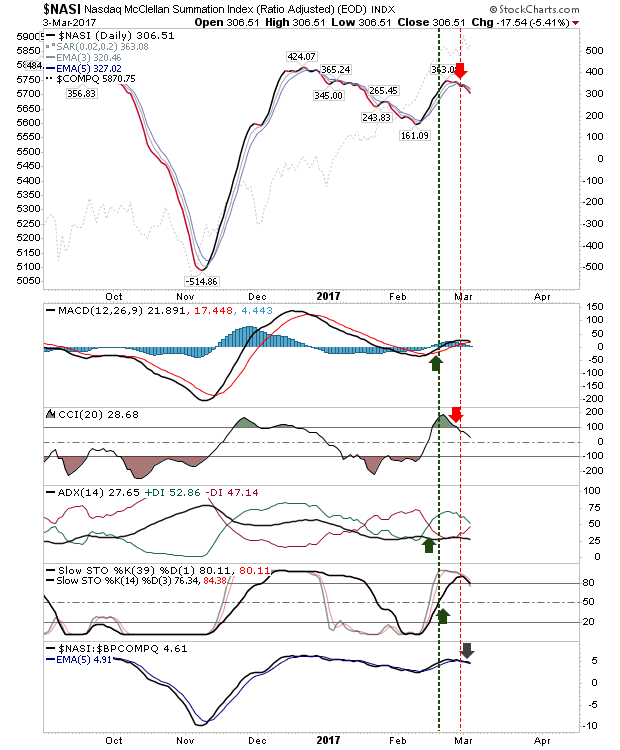

The Nasdaq Summation Index is more reliable, although it was pointing to weakness from December through February as the parent Nasdaq kept on rising higher. It’s on the decline again, but nothing confirmed. Note, when Stochastics [39,1] dipped below the bullish 50 midline in January, this would have marked a confirmed bearish trend – which itself proved to be a big bear trap. So skepticism should be the watchword here.

The Bullish Percents have struggled to get past the mid-60th percentile, so while Friday left this metric near its high, supporting technicals are not suggesting any major bearish divergence to worry about.

Finally, the Russell 2000 continues to toy with former resistance turned support. Monday could be yet another buying opportunity for bulls. There is a MACD trigger ‘sell’ trigger to overcome along with two months of continued relative underperformance against the Nasdaq.

Leave A Comment