With $7.7 billion in debt at about 5.4x EBITDA Weatherford WFT is one of the most-highly indebted oilfield services companies. Oil & gas E&P is in the doldrums. Worse, Weatherford generates over 30% of its revenue from North America land drillers — one of the industry’s hardest hit sectors. However, the stock has held up pretty well. WFT is off about 30% over the past 12 months, which is not bad considering it was recently downgraded to junk status.

The stock has held up too well, in my opinion. Management is attempting to wring costs out of the business and pare its debt load. I remain skeptical. Q3 revenue was off over 6% while EBITDA was flat. Debt built up for acquisitions when oil prices were above $100 will remain an albatross around the company’s neck. With an enterprise value of $15.3 billion, Weatherford trades at nearly 11x run-rate EBITDA. At $10.41 WFT is overvalued by at least 60%.

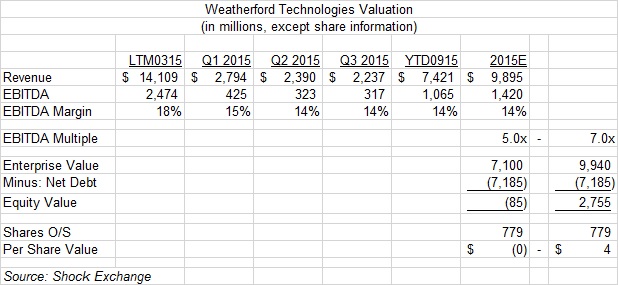

Weatherford Is Worth $0 – $4

Based on a bottoms up analysis, WFT is worth from $0 – $4 per share. The following chart outlines my analysis:

2015E Revenue

2015E revenue is revenue through the first nine months of 2015 annualized. This is optimistic given that revenue has declined each quarter since the beginning of the year.

2015E EBITDA

2015E EBITDA is first half 2015 actual EBITDA annualized. This equates to a 14% EBITDA margin which is the blended margin for the first three months of the year.

EBITDA Multiple

The EBITDA multiple of 5.0x to 7.0x is appropriate for companies in cyclical industries.

Enterprise Value

The company’s enterprise value (equity and debt) is $7.1 to $9.9 billion.

Equity Value

After subtracting net debt (debt less cash and equivalents) of $7.2 billion, I derived an equity value of $0 million to $2.8 billion. This equates to about $0 to $4 per share.

Per Share Price

I assumed 779 million shares outstanding which was sourced from Yahoo!.

Leave A Comment