Next week the Janet Yellen and her minions are expected, with 100% certainty, to lift the Fed funds rate by another 0.25% to 1.00%.

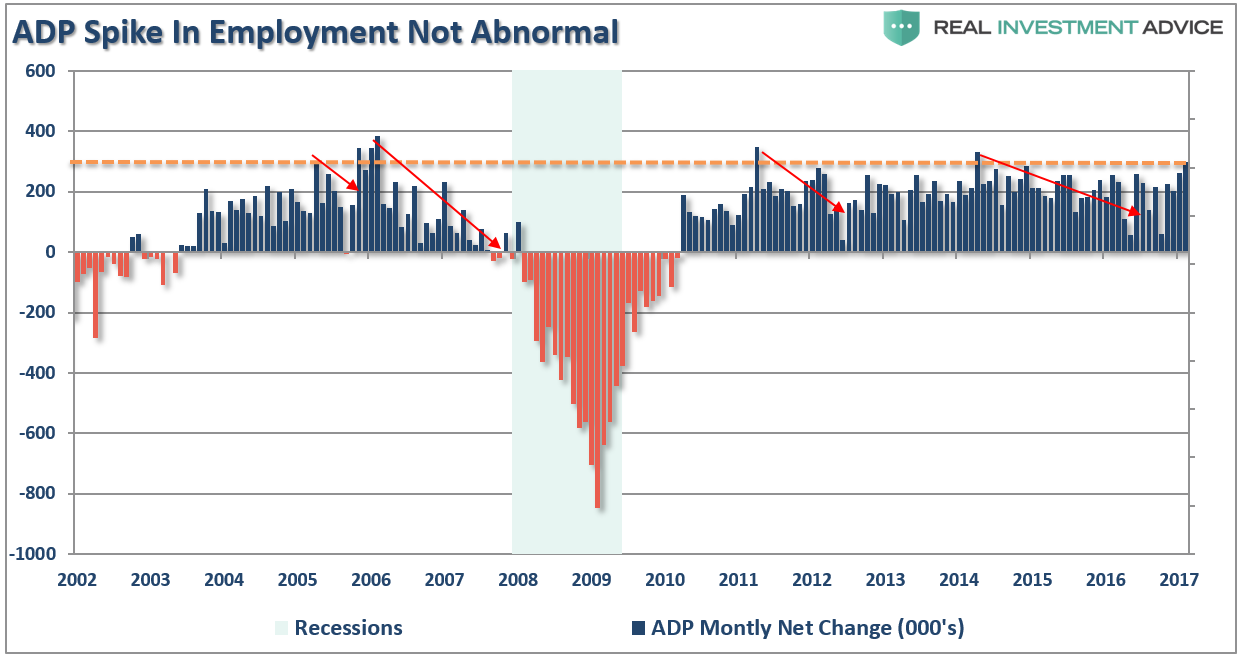

This certainty has been building as of late given the rise in inflation pressures from higher commodity, particularly oil prices, and still rising health care costs as well as a strong market, dollar, and employment data. Speaking of employment data, ADP reported on Wednesday a 298,000 person increase in employment. What is interesting is this was the highest monthly employment rate seen since 2014, 2011, and 2006. In all three previous cases, it was the peak of employment before weakness begin to set in.

Of course, given the “exuberance” following the election of “the guy that was supposed to crash everything,” it is not surprising that we have seen a pick up in some activity more closely aligned with a boost in sentiment.

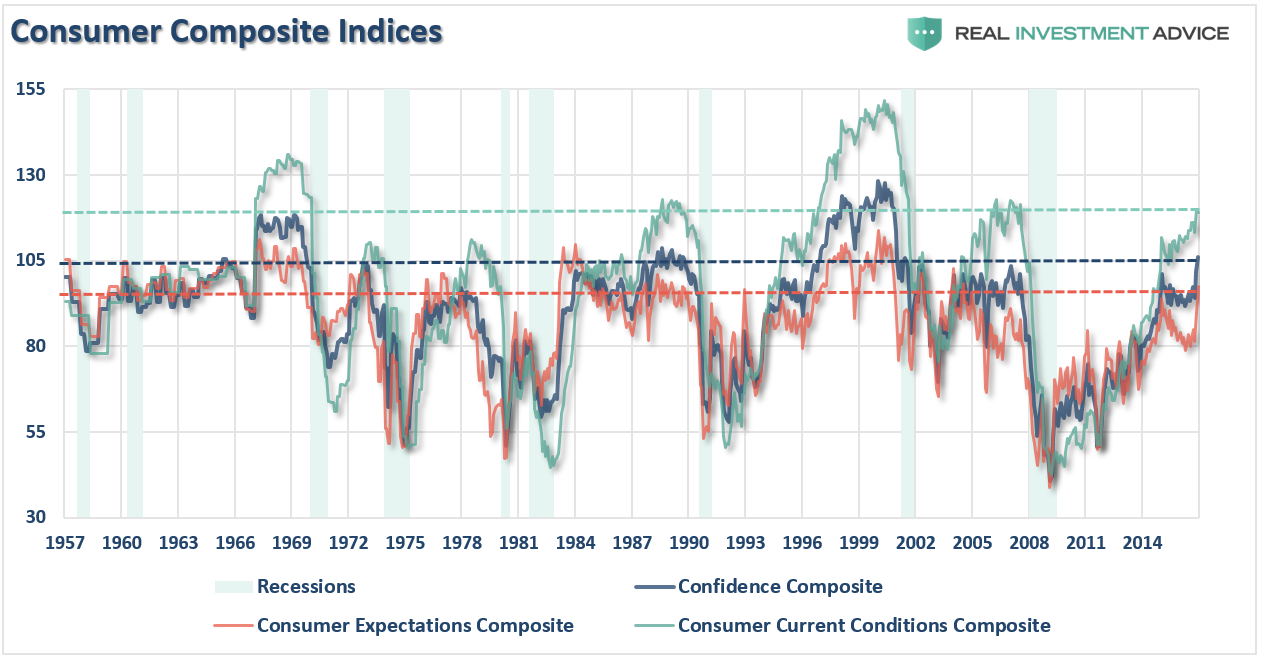

The chart below is a composite index of the average of the UofM and CB survey readings for consumer confidence, consumer expectations, and current conditions. The horizontal dashed lines show the current readings of each composite back to 1957.

Importantly, as noted above, high readings of the index are not unusual. It is also worth noting that high readings are historically more coincident with a late stage expansion, and a leading indicator of an upcoming recession, rather than a start of an economic expansion.

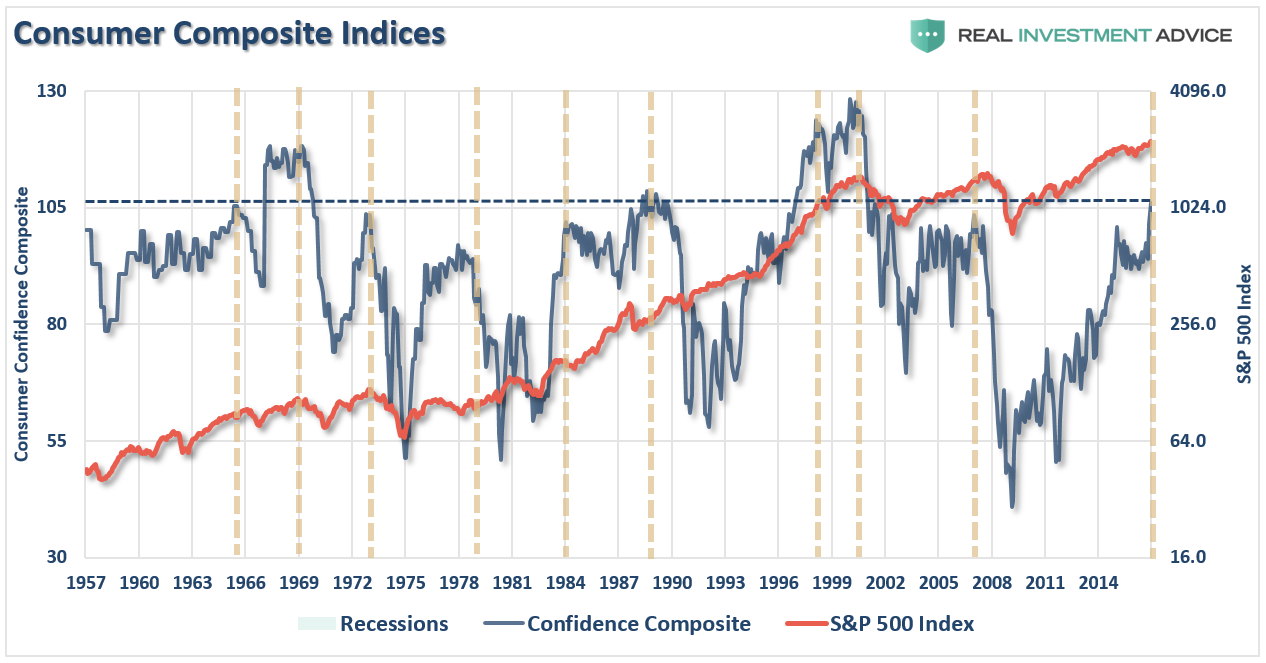

The next chart shows the same analysis as compared to the S&P 500 index. The dashed vertical lines denote peaks in the consumer composite index.

Again, not surprisingly, when consumer confidence has previously reached such lofty levels, it was towards the end of an expansion and preceded either a notable correction or a bear market.

But therein lies the other issue. The strength in the recent employment reports will most assuredly push Yellen to hike rates next week. It is worth noting that historically there was a significant gap between the Labor Market Condition Index and the ZERO line when the Fed started a rate hiking campaign (vertical black lines) which provided a buffer until the next recession. That is not the case currently.

Leave A Comment