The “tax bill cometh.” According to the press, this is going to be the single biggest factor to jump-starting economic growth since the invention of the wheel.

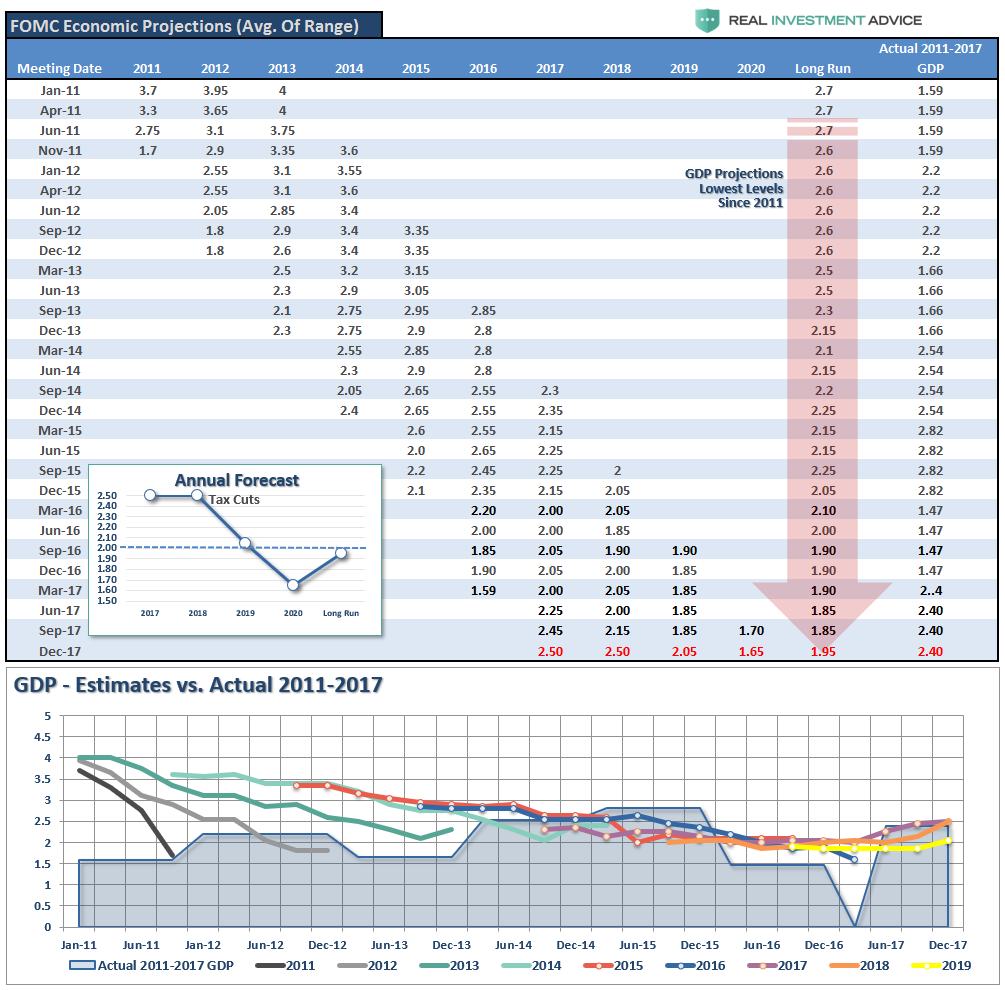

Interestingly, even the Fed’s economic projections are suggesting that economic growth will pick up over the next two years from the impact of tax cuts. (Chart is the average of the range of the Fed’s estimates.)

Of course, you should note the Federal Reserve has NEVER accurately forecasted future economic growth. In fact, it has become an annual tradition of over-estimating growth and then slowly ratcheting down estimates as reality failed to achieve overly optimistic assumptions.

However, despite the Administrations hopes of long-term economic growth rates of 3% or more, in order to pay for the deficits created by cutting revenue, even the Fed has maintained their long-run outlook of less that 2% annualized growth. (Down from 2.7% in 2011) Hardly the supportive stamp of endorsement for the “greatest tax cut”of all-time.

But for economic growth to blossom, the consumer will have to pull their weight given consumption makes up roughly 70% of GDP. The problem, as witnessed by the latest retail sales report, is that consumptive spending is far weaker than headlines suggest.

On Thursday, the retail sales report for November clicked up 0.8%. Good news, right?

Not so fast.

First, sales of gasoline, which directly impacts consumers ability to spend money on other stuff, rose sharply due to higher oil prices and comprised 1/3rd of the increase. Secondly, building products also rose sharply from the ongoing impact of rebuilding from recent hurricanes and fires. Again, this isn’t healthy longer-term either as replacing lost possessions drags forward future consumptive capacity.

But what the headlines miss is the growth in the population. The chart below shows retails sales divided by those actually counted as part of the labor force. (You’ve got to have a job to buy stuff, right?)

Leave A Comment