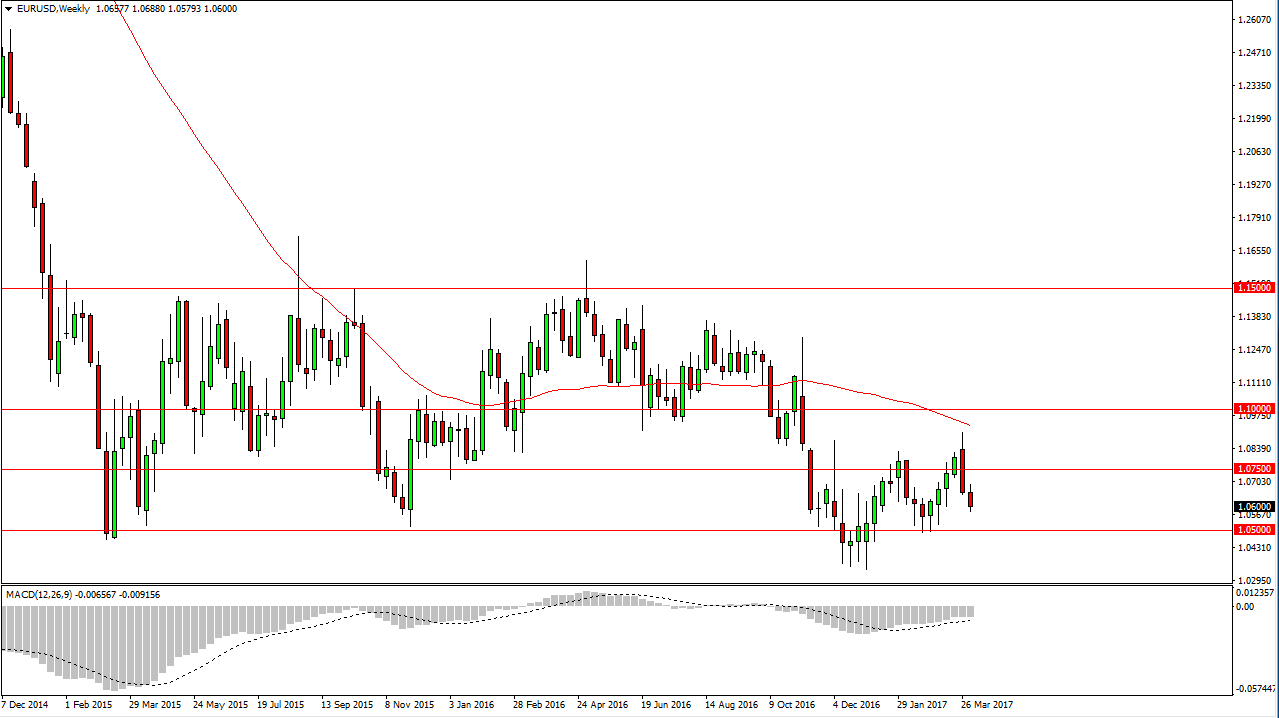

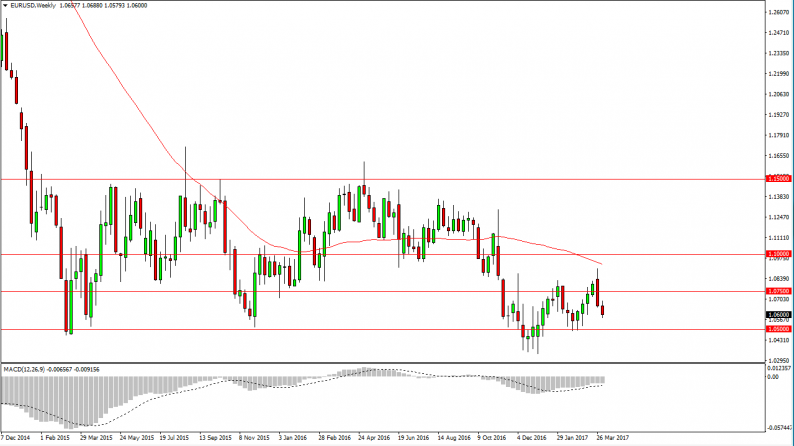

EUR/USD

The EUR/USD pair fell again during the week, breaking below the 1.06 handle. Because of this, I believe that the market is going to continue to go lower, and that short-term rally should offer short-term selling opportunities. The 1.05 level should be the next target, as it is a large, round, major level. On top of that, it has been supportive in the past.

USD/JPY

The USD/JPY pair fell initially during the week but found enough support at the 50% Fibonacci retracement level to turn around and form a hammer. The hammer of course is a bullish sign and therefore I think that the buyers are starting return. If we can break above the 112.50 level the market then goes to the 115 level. Longer-term, I expect bullish pressure but this is more of an investment than a short-term trade.

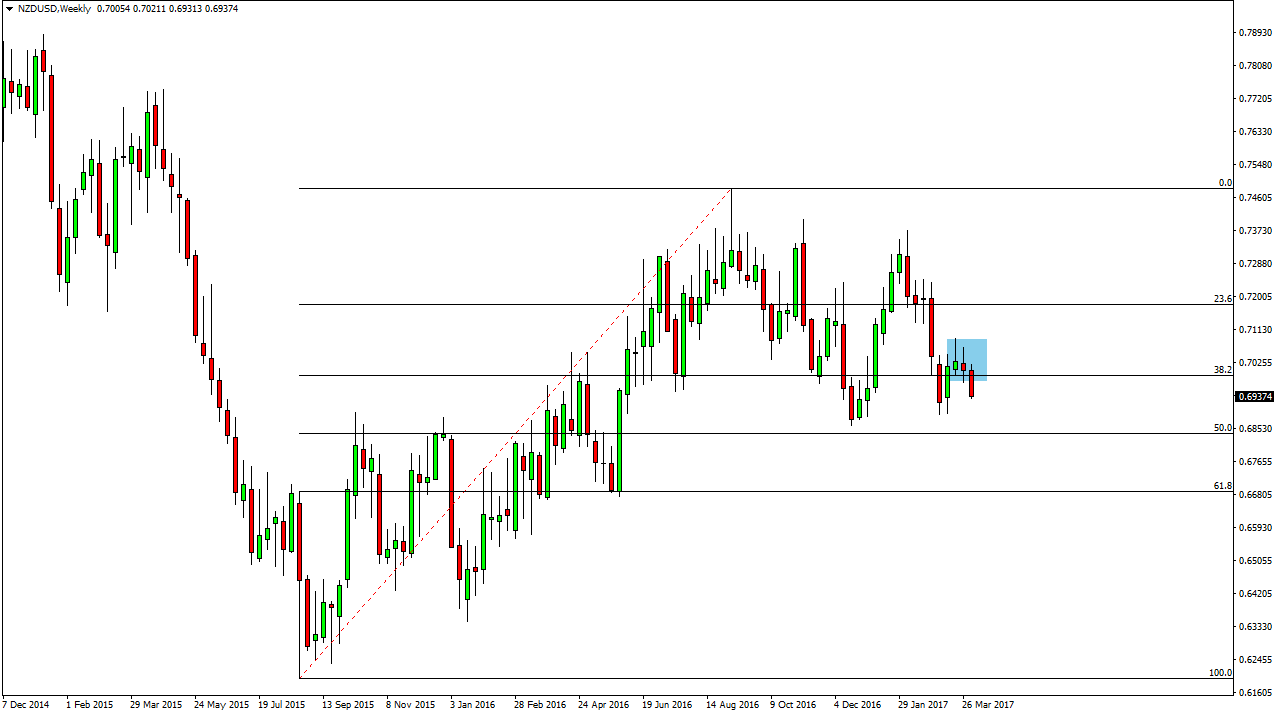

NZD/USD

The New Zealand dollar trying to rally initially, but found enough selling pressure to turn things around and break below the 0.70 level. On the chart, you can see that the 0.69 level has offered support in the past, as well as the 50% Fibonacci retracement level. So, because of this, I think that the markets probably going to reach lower, but it is going to be choppy between now and then.

EUR/GBP

The EUR/GBP pair bounced from the 0.85 level below, turning around a bearish move from the previous week. Because of this, the market looks as if it is going to try to rally from here, reaching towards the top of the symmetrical triangle. On the other hand, if we break down below the uptrend line, I feel the market will fall rather significantly. Either way, expect choppiness, this is “Ground Zero” for “Brexit.”

Leave A Comment