Weekly Market Outlook

Despite ending the first week of December on a bullish foot, the bears started – and finished – last week in charge of things… to say the least. Last week’s -3.8% pullback was the biggest weekly loss for the S&P 500 (SPX) (SPY) since the heart of the August meltdown. Perhaps worse, the pullback broke some key support levels, and there isn’t much other support until we get back to the August lows.

On the flipside, between the time of year a Santa Claus rally usually takes shape and the possibility that traders are preemptively getting any rate-hike selling out of the way (leaving only the would-be buyers behind), there’s still a good chance stocks could reverse this bearish course with little to no warning. It is, after all, the way things have been for the reversal-prone market all year long.

We’ll look at the details after a quick run-down of last week’s and this week’s economic news.

Economic Data

It was a fairly busy week last week, on the economic front, though nothing heavy-hitting came until Friday when we got a double-dose of big news… last month’s retail sales, and last month’s producer price inflation rate (which in many regards is a preview of next week’s consumer inflation rate). Both showed decent economic strength.

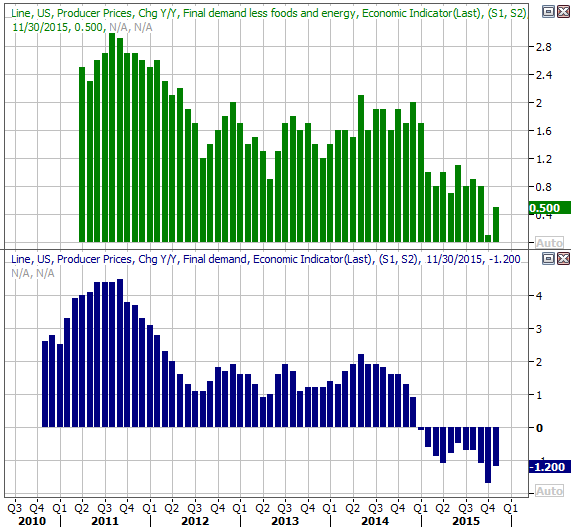

Producer price inflation edged 0.3% higher, with and without the costs of food and energy factored in. Both were notably better than the figures predicted by economists. On an annualized basis, PPI stands at -1.2%, though on a core basis is stands at a healthier 0.5%.

Annualized Producer Price Inflation Chart

Source: Thomas Reuters

As for retail sales, they were up too, roughly as expected. Overall consumer spending was up 0.2% last month (versus an expectation of 0.3% growth), and were up 0.4% when not counting automobile sales (again, versus an expectation for 0.3% growth). On a year-over-year basis, we’re still mostly seeing growth, though the extent of that growth is waning… and not just because of slowing auto sales.

Leave A Comment