Despite the wobbly start last week, the bulls took control again on Thursday and Friday to push the week back into the black. The move has yet to clear all the major hurdles that could prove to be technical problems, but at least things are pointed in a bullish direction.

On the flipside, stocks may have already walked back into a valuation headwind.

We’ll weight it all below after taking a close look at last week’s and the coming week’s economic news.

Economic Data

Last week was pretty well packed with data, not the last of which was a snapshot of inflation (or lack thereof) picture. Low oil prices (USO) have kept inflation practically nonexistent for producers as well as consumers, but even taking food and energy out of the equation, inflation remains rather tame.

Inflation Rate Chart

Source: Thomas Reuters

Retail sales (XRT) were better or worse than anticipated in September, depending on your perspective. Overall they grew 0.1% last month, versus flat expectations. But, taking automobiles out of the equation, they fell a hefty 0.3% versus expectations of only a 0.1% decline. Broadly speaking, retail sales growth has been tapering off for a few months.

Retail Sales Chart

Source: Thomas Reuters

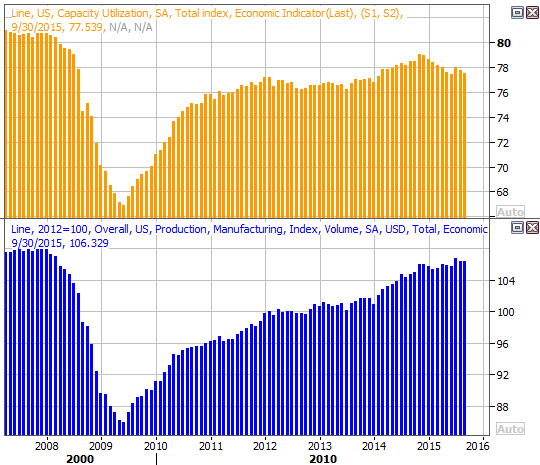

Last but not least, although capacity utilization is still deteriorating, actual production hasn’t yet. Historically, both need to be in a decline to be of significant concern.

Capacity Utilization and Productivity Chart

Source: Thomas Reuters

Everything else is on the following grid:

Economic Calendar

Source: Briefing.com

This week will be less busy. In fact, there’s only one item of any real interest… Tuesday’s housing starts and building permits (XHB). Both have been in bigger-picture uptrends, and economists expect sustained – even if not heroic – strength through September.

Housing Starts and Building Permits Chart

Source: Thomas Reuters

Stock Market Index Analysis

Leave A Comment