Last weekend, in my Market Forecast, I wrote:

“For the new week, the market will start out with a neutral stance, albeit leaning a bit more towards bullish. I think there is a chance that SPX will re-test 1980, or perhaps even 2000.”

Well, things pretty much happened as predicted. On Monday, things struggled to find a real direction. But, buyers came in in full force on Tuesday and continued all the way until just before the Fed’s rate announcement on Thursday. By that time, SPX was hovering right around 2000.

On Thursday, before the Fed announcement, I said in our Chatroom:

“…we might see a flat market today… a lot of people are expecting big movements… so, what might happen today is “nothing”… real movement may come tomorrow or next week…” [8:55 am] PST

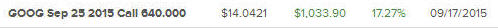

That was what exactly happened as well! Right after the Fed announced “no rate change”, markets were volatile. But, when Yellen came on TV to further detail Fed’s decision, stocks rallied. SPX went up another 20 points to test 2020. During that time we picked up GOOG calls and made a quick, nice trade:

We locked in the quick profit because I did not expect the gains to hold. Sure enough, before the market close on Wednesday, SPX came back to flatline, and went slightly negative for the close.

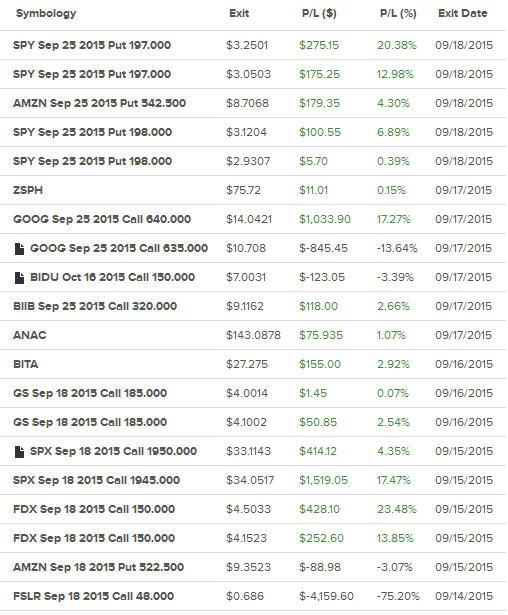

Friday was the “real” move after the Fed, as the markets dropped, with SPX losing 1.62% to trade below 1960! We captured the downside with some puts. Here are the closed trades for the week:

For the week, the Dow was down 48.51 points; SPX fell 3.02 points; Nasdaq added +4.89 points. Oil (WTI) fell to trade at around $45/barrel. Gold got a good pop to trade just below $1140/ounce. At the time of this writing, Asian markets were mostly down. Here are how the US markets closed on Friday:

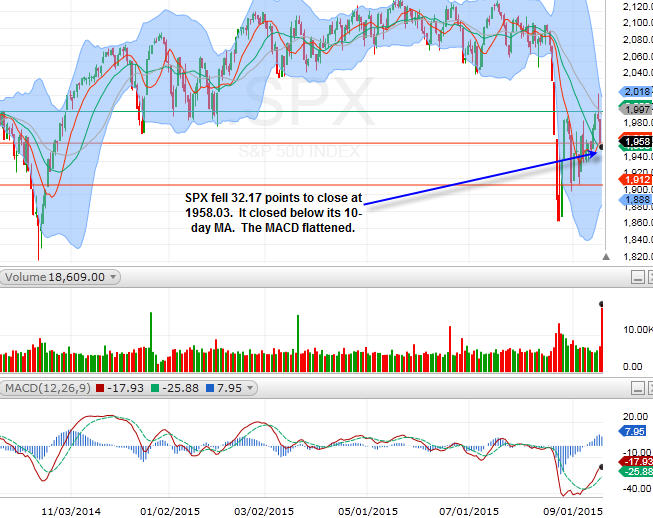

SPX

On Friday, SPX fell 32.17 points to close at 1958.03. It closed below its 10-day MA. The MACD flattened.

Leave A Comment