Dramatic events reset agendas. People re-evaluate probabilities about what is possible as well as the personal implications. Because the recent market story is so big and so fresh the week will start with the punditry asking:

What are the lessons from the market turmoil?

Prior Theme Recap

In my last WTWA I predicted that everyone would be asking whether the recent market decline was the start of something big. Monday’s 1000 point opening decline in the Dow underscored the theme. The next day the story continued with a failed rally. At that point, few would have guessed that the market would finish in the plus column for the week.

As he does each week, Doug Short’s recap explains this dramatic story and his great weekly snapshot lets you see it at a glance. With the ever-increasing effects from foreign markets, you should also add Doug’s Doug Short’s recap to your reading list.

As Doug notes, the rebound stalled at the end of the week. CNBC quit running the “Markets in Turmoil” special report and went back to reruns of American Greed. Attention then turned to my secondary theme – the early reports from the Fed conclave at Jackson Hole.

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can try it at home.

Last week some advance planning was especially important. There was little time to react intelligently.

This Week’s Theme

Big events refocus attention and redefine the public agenda. They change our minds about what is possible, what is likely, and what to worry about. This week will start with more discussion about the meaning of the market turmoil and what, if anything, individual investors should do about it. The question for each producer or editor in financial media will be:

What are the lessons from the market turmoil?

It is a fertile topic and worth exploring. It should keep interest piqued until late in the week when the jobs report and Fed implications regain center stage.

So what were the lessons?

The Viewpoints

What you “learned” from the market turmoil seems to vary based upon your starting viewpoint. See Josh Brown’s recap of editorial cartoonist’s take on the market, including this one:

The conclusions once again cover a wide spectrum, with authorities lining up on all sides. Here are contrasting takes on several different topics.

On the Overall Economic and Market Health

On China

On the Fed

On Personal Finance

As always, I have my own ideas in today’s conclusion. But first, let us do our regular update of the last week’s news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasion something really good. My working definition of “good” has two components:

The Good

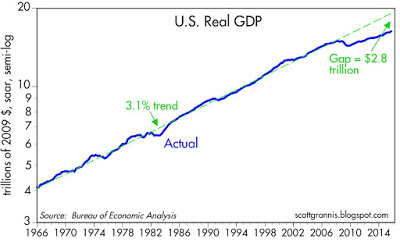

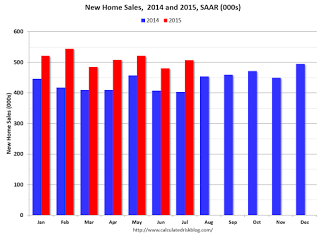

There was some good economic news, especially GDP revisions.

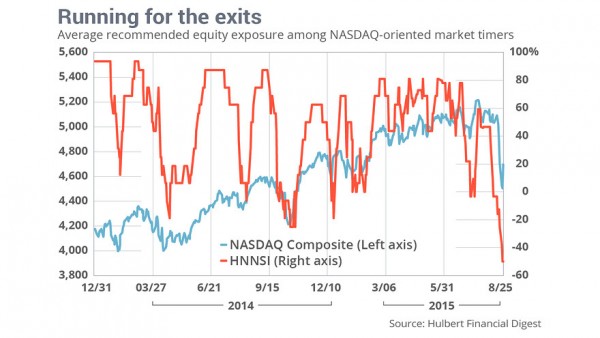

Sentiment on many fronts

- Negative among short-term market timers (Mark Hulbert highlights this contrarian indicator)

The Bad

There was also some negative data last week.

Leave A Comment