Real Estate Investment Trusts, or REITs, are a simple way for regular investors to gain exposure to the real estate sector.

While there are many different types of REITs to choose from, healthcare in particular has strong long-term potential growth due to highly favorable demographic trends.

Let’s take a look at Welltower (HCN), America’s largest medical REIT, to see why this industry blue chip may be a great fit for conservative high-yield investors, especially those looking for the best high dividend stocks.

Business Overview

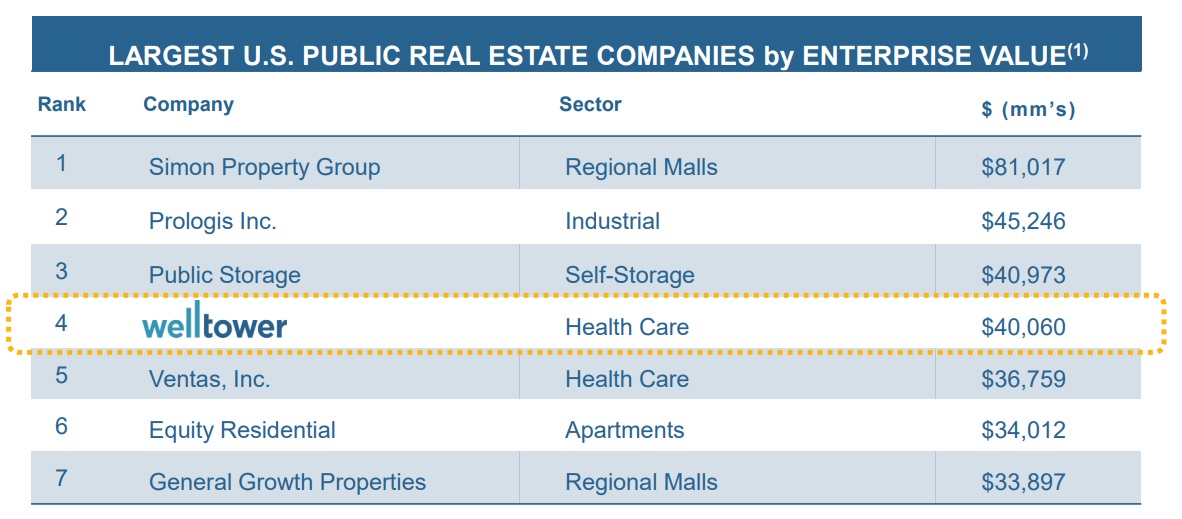

Founded in 1970 in Toledo, Ohio, Welltower has grown into America’s largest medical REIT and is the fourth largest REIT by enterprise value (market cap + net debt).

Source: HCN Investor Presentation

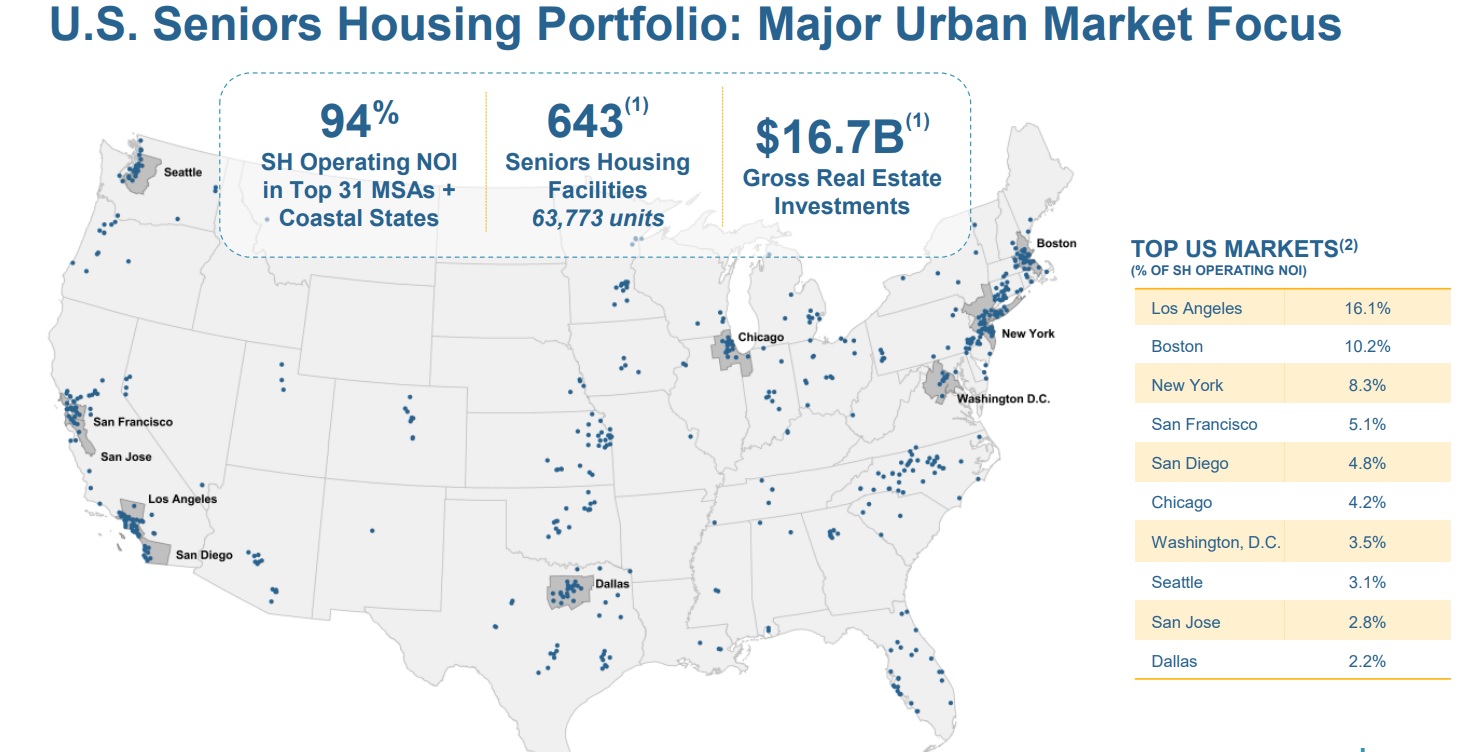

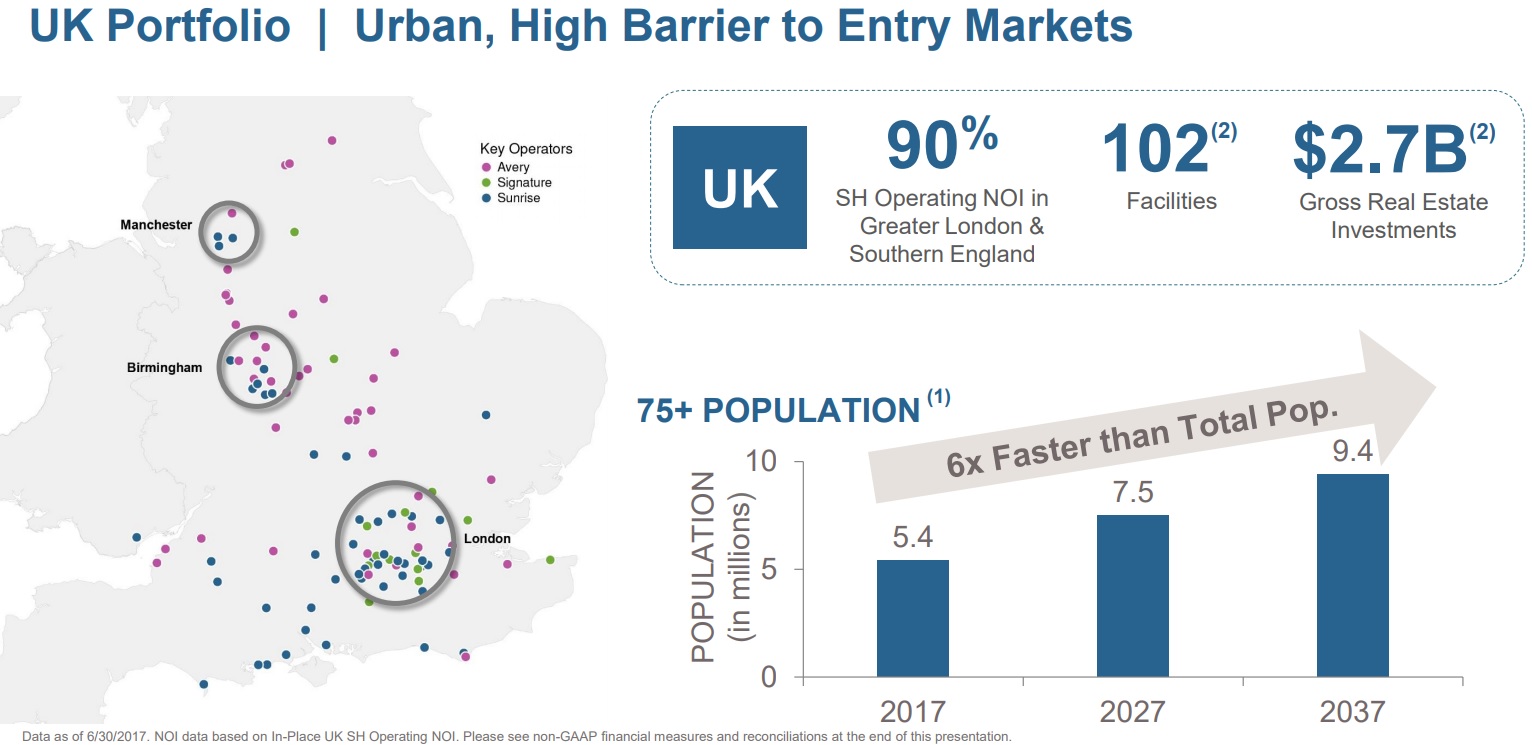

The REIT owns a total of 1,384 properties across the U.S., Canada, and the U.K., but the majority of its real estate investments are in the U.S.

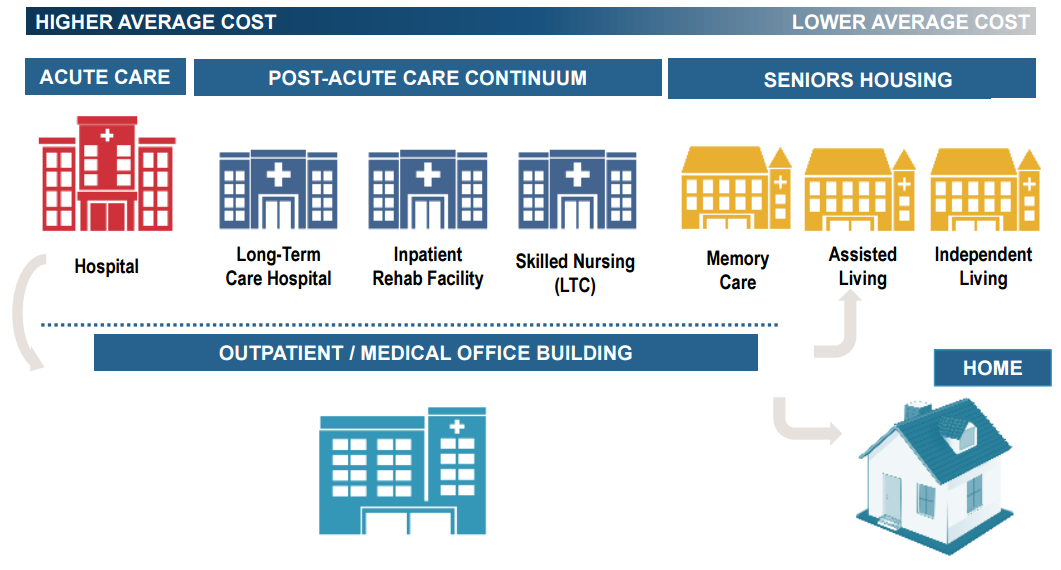

The company is essentially involved in every aspect of patient care, from hospitals and long-term skilled nursing facilities to senior assisted living communities and medical office buildings, or MOBs.

Welltower organizes its business into three kinds of medical properties:

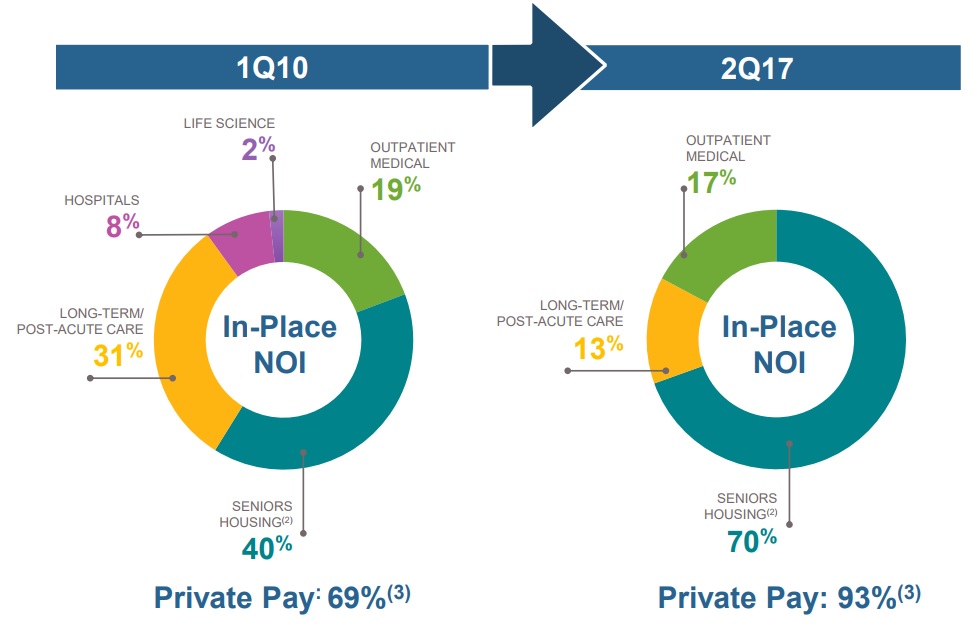

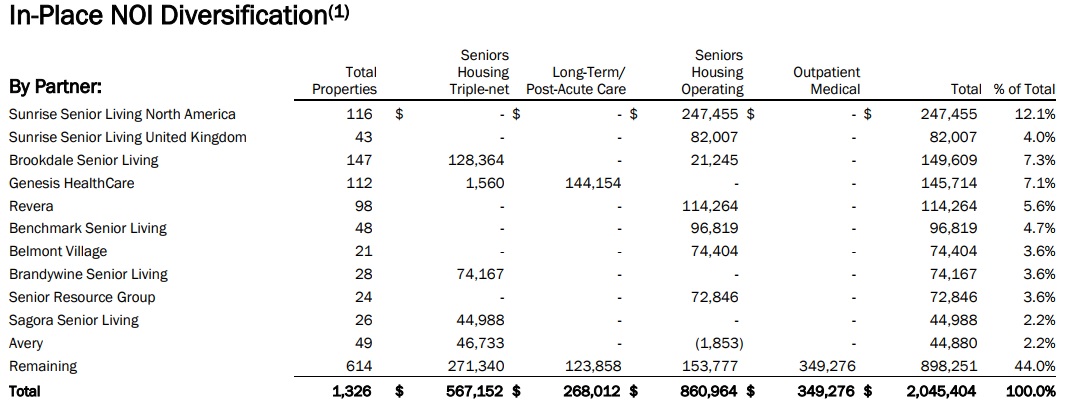

Senior assisted living (i.e. retirement homes): 69.8% of operating income

Post-Acute Long-Term Care (i.e. skilled nursing facilities): 13.1% of operating income

Outpatient Medical Office Buildings: 17.1% of operating income

Over the past seven years, management has been steadily reducing the company’s reliance on government funding (i.e. Medicare/Medicaid), and today 93% of the company’s revenue comes from private payer insurance sources.

Business Analysis

The key to any reliable high-yield investment, especially REITs, is a highly secure and consistent source of normalized funds from operations, or FFO (Welltower’s equivalent to free cash flow and what funds the dividend).

In the case of Welltower, this cash flow security comes from very well staggered and diversified rental lease agreements, with an average remaining length of 9.7 years.

In addition to only having to renegotiate 1.5% to 2.5% of leases in any given year, Welltower’s tenant base is similarly diversified across some of the industry’s strongest names, which helps ensure that the company’s portfolio of tenants can collectively continue making their rent payments in full and on time.

Though Welltower is America’s largest medical REIT, it owns just 3% of the $1 trillion U.S. healthcare real estate market according to Morningstar, meaning there is still plenty of room to grow in this highly fragmented industry.

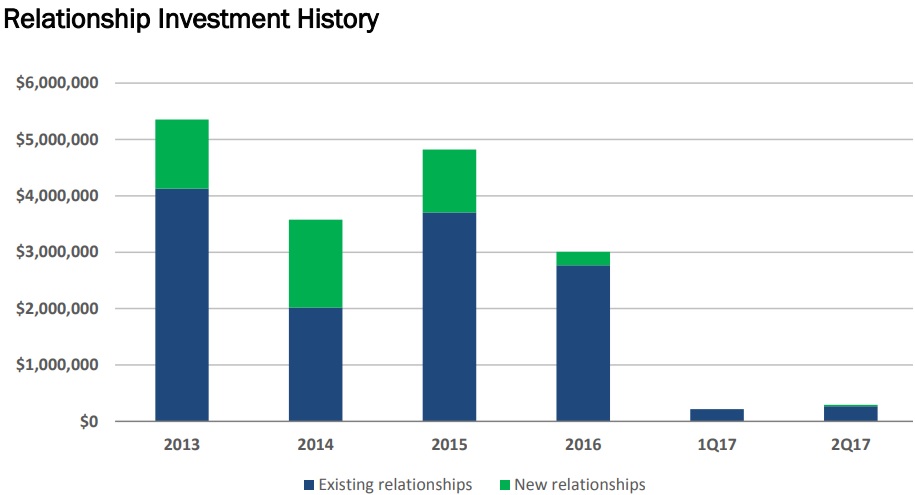

Welltower has historically been a large-scale property acquirer, buying about $13.5 billion in new properties between 2013 and 2015. And since 2010, Welltower has bought $28 billion in new properties, increasing its portfolio by about 300%.

However, management recently made a wise long-term decision to temporarily slow the pace of new property purchases in order to adapt to challenging market conditions and focus on strengthening the quality of the portfolio.

This has been done in two ways to further lower the company’s fundamental risk.

First, Welltower is selling off much of its struggling skilled nursing facility properties, especially those owned by distressed SNF operator Genesis Healthcare (GEN).

In 2016 and 2017, Welltower plans to sell about $4.1 billion worth of SNF facilities, which will result in much slower growth (2017 FFO per share growth expected to be 2.9% vs 6% in 2016); however, in the long-term this is a smart move for a highly conservative blue chip REIT.

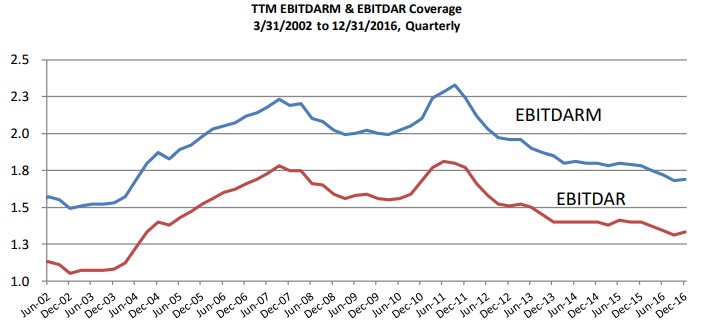

That’s because the skilled nursing facility industry is currently experiencing major challenges due to a number of factors.

First, the Center for Medicare & Medicaid Services (CMS) has been instituting a number of reforms to how Medicare and Medicaid reimburse healthcare providers, including shorter-stays and 20% lower reimbursement rates.

Combined with higher regulatory compliance costs and rising labor costs in the medical industry as a whole, many SNF operators are struggling with razor thin margins and having difficulty covering their full rental costs.

For example, the EBTIDAR coverage ratio (i.e. cash flow/rent) is a good measure of the health of the SNF industry, and in recent years it’s been falling to riskier levels.

Source: Omega Healthcare Investors

Senior housing that’s operated under a triple net lease model, meaning the tenant pays all maintenance, insurance, and taxes, is similarly struggling, with a total of four of Welltower’s leases currently underwater.

Leave A Comment