The Wendy’s Company (WEN – Free Report) just released its fourth-quarter and full year 2017 financial results, posting adjusted earnings of $0.11 per share and revenues of $309.2 million. Currently, Wendy’s is a Zacks Rank #3 (Hold) and is down over 1% to $16 per share in after-hours trading shortly after its earnings report was released.

WEN:

Missed earnings estimates. The company posted adjusted earnings of $0.11 per share, missing the Zacks Consensus Estimate of $0.12 per share.

Missed revenue estimates. The company saw revenue figures of $309.2 million, falling short of our consensus estimate of $315.31 million.

Wendy’s same-restaurant North America sales jumped by 1.3% in Q4, and 2% in fiscal 2017. Overall fourth-quarter revenues dipped marginally year-over-year. Wendy’s pointed to the fact that it held 90 fewer “company-operated restaurants” as the reason for this decline.

For the full-year, sales fell 14.8% to $1.22 billion due to the reduced number of company-operated restaurants, closing the year with 295 fewer locations.

Wendy’s expects North America same-restaurant sales will grow between 2% and 2.5% in fiscal 2018.

“We are very proud of the fact that we have now recorded 20 consecutive quarters of positive same-restaurant sales in North America, two consecutive years of positive global net new restaurant growth and that North America AUVs have reached an all-time high of $1.61 million,” CEO Todd Penegor said in a statement.

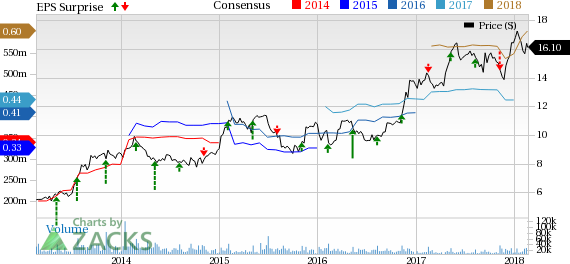

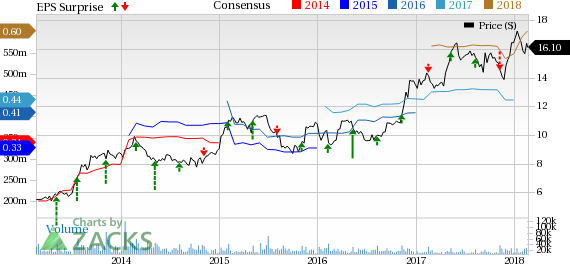

Here’s a graph that looks at WEN’s Price, Consensus and EPS Surprise history:

Wendy’s Company (The) Price, Consensus and EPS Surprise

Wendy’s Company (The) Price, Consensus and EPS Surprise | Wendy’s Company (The) Quote

The Wendy’s Company is the world’s third-largest quick-service hamburger company. The Wendy’s system includes more than 6,500 franchise and Company-operated restaurants in the United States and 27 countries and U.S. territories worldwide.

Leave A Comment