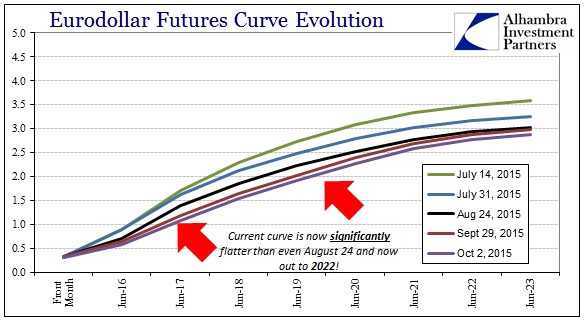

For one, eurodollar futures are “obliged” to take account of any threats from the FOMC even though, in the end, they might only be self-fulfilling. Because the Fed has very little actual ability to condition money markets, none of that is truly “real” but there remains the unknown and money dealing agents still seem reticent about any kind of (further) showdown. Where the eurodollar curve was shriveled toward nothing up to the September payroll report released on October 2, the October payroll report has advanced the recent run of Yellen’s apparently restored resolve.

At pivotal points on the curve, such as the June 2018 maturity, that has obliterated the “dollar” run trend that began back around July 6. However, as the fuller curve displays, that seems to be only a change in policy perceptions and not especially much more than that.

Again, the entire curve had been flattening up to October 2 before meandering throughout October while trying to survey that FOMC resolution. The October FOMC seems to have reversed further doubts and pushed expectations back toward a rate hike. However, as the eurodollar curve today demonstrates, that amounts only to a shift in that policy view rather than a complete outlook.

Even in the shorter maturities, the curve is still inside where it was at the eurodollar outbreak of the last “dollar” wave/run. Further out, though, the curve remains much, much flatter. Again, that suggests eurodollar “obligations” about policy decisions and not wanting to contest that fate directly. In terms of economic progression, that flatter curve continues the trend.

That much we can observe directly via commodities. Copper as of yesterday’s close revisited the lowest closing price since August 26; matching that day’s multi-year low. So far this morning, copper is trading down to $2.241 at the December maturity, which is in the same range as it was on the morning of the global liquidations of August 24.

Leave A Comment