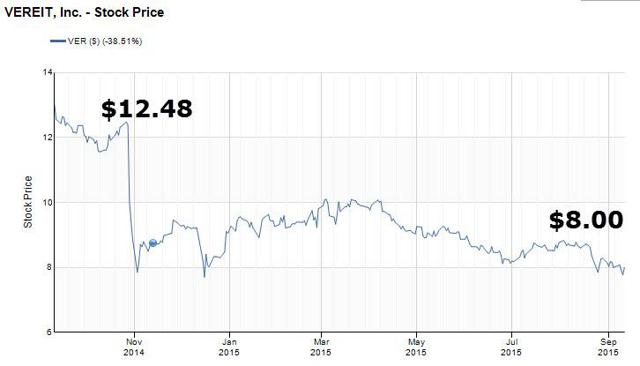

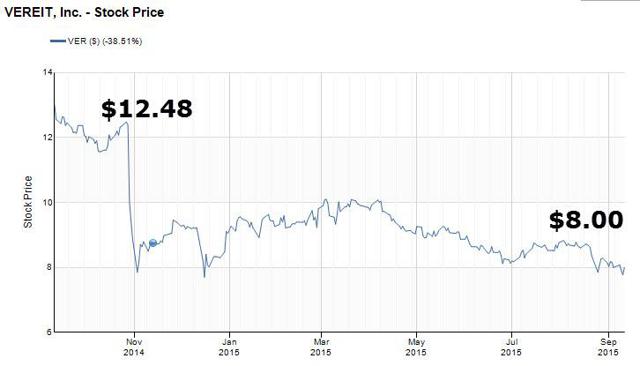

I’ll admit, VEREIT’s (NYSE:VER) share price and dividend yield are looking awfully cheap – shares in the $7.24 billion (market cap) REIT closed on Friday at $8.00 with a dividend yield of 6.9%.

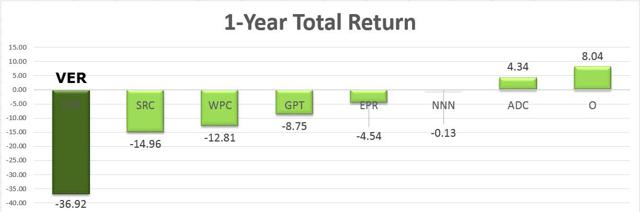

There is little doubt that VER has been the ugly duckling of the Net Lease sector, the Total Return for VER has been -36.9% during the last 12 months.

Even over the last 90 days, VER has underperformed the leading Net Lease players (Realty Income Corporation (NYSE:O), National Retail Properties, Inc. (NYSE:NNN), and W.P. Carey, Inc. (NYSE:WPC)):

The last 30 days offers the same conclusive evidence: VER has not responded to any catalysts to drive the company’s share price. Mr. Market is still waiting for a “tipping point” that could promise a boost in the share price and more importantly, begin to reward the exasperated Long investors.

But what is the “tipping point” for VER? Here’s how Malcomb Gladwell defined the “tipping point”:

…the moment of critical mass, the threshold, the boiling point/

Investor Day

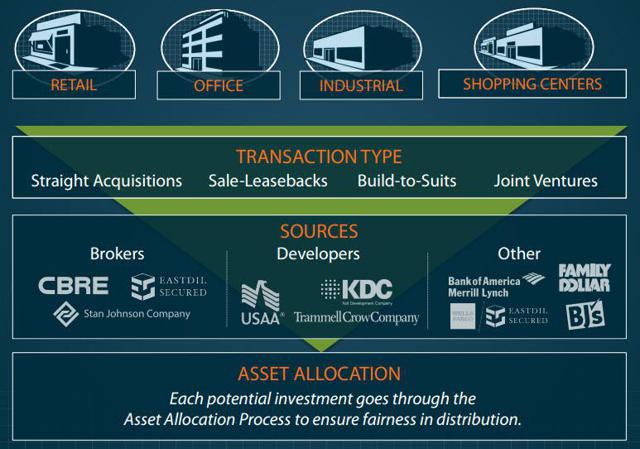

Last week, VER sponsored an Investor Day conference in New York City and the company provided an 80+ page Presentation. Glenn Rufrano, VER’s new CEO hosted the conference along with several key execs on the management team. In the slide below, Rufrano illustrates the benefits of a full service real estate company:

As a multi-disciplined Net Lease landlord, Rufrano provides the broad-based transactional platform in which VER sources retail, office, industrial, and shopping center assets.

Perhaps one of the better known catalysts for VER is its “culling process” or simply the pruning strategies in which VER has begun to sell off non-controlled JVs, flat lease properties (i.e. CVS), non-core properties (i.e. shopping centers), and casual dining restaurants.

Rufrano went on to cite the disposition strategy in detail, using a variety of options to unload properties including 1031 exchange, foreign investors, REITs, private investors, institutional investors, and private equity.

Leave A Comment