The Volatility Index (VIX) is giving me pause today. I came into today thinking I would buy the dip if we were to sell off some, but seeing the VIX index up today nearly 12% on the day is definitely not fitting the mold of what we should be seeing with the S&P 500 down only 5 points and the Nasdaq flat on the day.

Instead I want to see where we are heading going into June. If the bears can drop this market tomorrow, we may have to be much more concerned with this market, especially in lieu of the brexit vote coming up and possible rate increase this month or next.

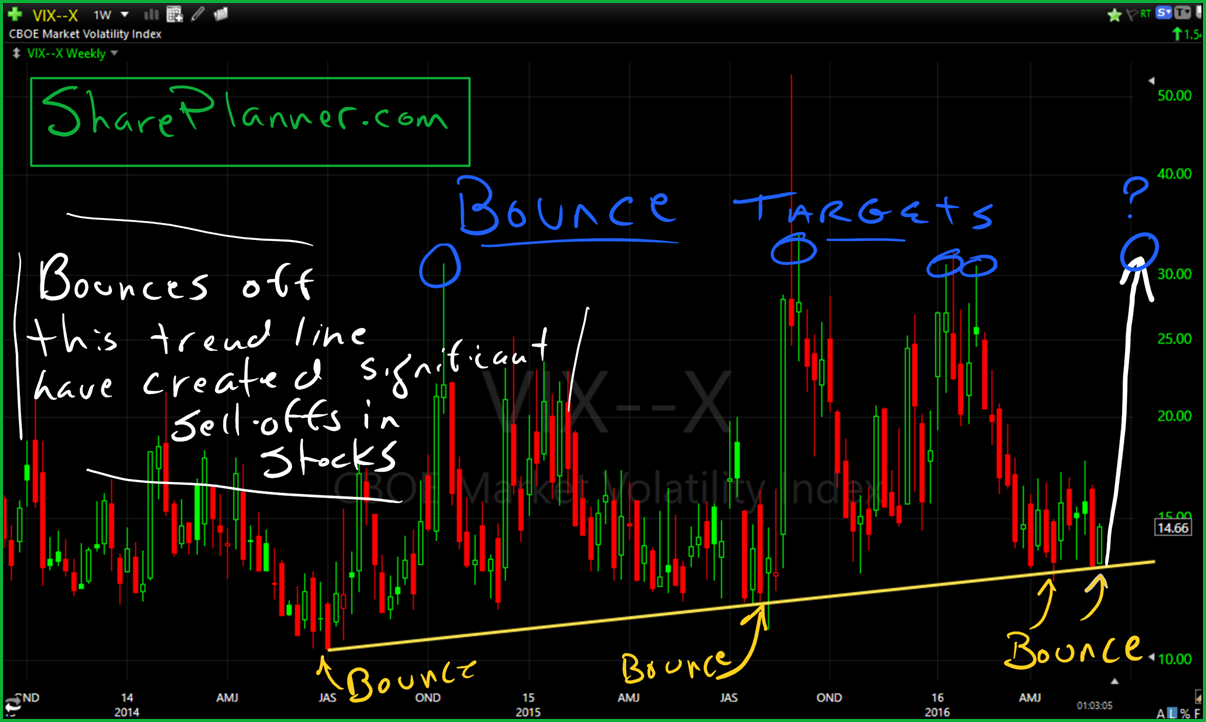

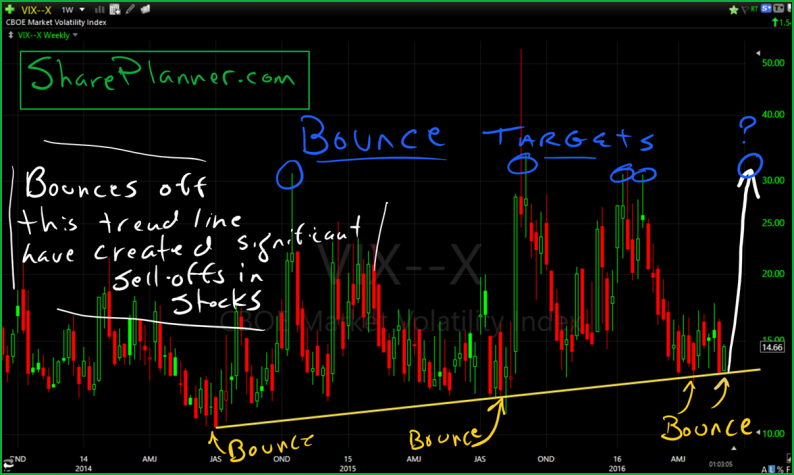

Check out the VIX chart below and you’ll see the bounce off of the rising trend-line that started back in July of 2014. These bounces tend to be hard and take the market down with them. Considering past precedent, it is the reason I am showing some concern here. Now, plenty of recent first days of the trading months have been bullish. Look no further than May to see what I am talking about. Should we rally hard tomorrow, it should reel in the VIX some as well and make today’s concern a mute point, but I’d rather wait and see first.

Leave A Comment