“That [half a dollar of buying] frenzy was not stackers lining up to buy phyz. It was speculators buying paper.

Why does that matter? Speculators, who typically use leverage, can’t hold the market price against the tide of the hoarders. They can push for a while, but they have to close their positions sooner or later, either to take profits (as they reckon them, in dollars) or to stop losses.”

This is what we wrote last week. It turned out to be prescient. This week, the price of silver gave up all of that and more, ending at $13.91. That’s down 63 cents.

We don’t believe that labor reports drive the prices of the monetary metals. Labor reports may be a driver of the Fed’s interest rate decisions. Maybe (we think the Fed cares most about three things: its own solvency, bank solvency, and the government’s endless need to borrow more).

In any case, speculators certainly do not drive the price of metal. Just not durably. Sometimes they can distort it for longer (as we recall happened in the summer of 2013) and sometimes they are a flash in the pan. This is one reason why we watch the basis. It is a measure of speculators vs. hoarders. Only the latter, only monetary reservation demand, can permanently drive the prices of the metals up to whatever level.

It’s the flip side of the collapse of the dollar. The value of the dollar is not 1/P (price level) nor 1 / N (quantity of dollars). It’s whatever people will pay for it. That is ounces of gold. Or more like milligrams at this point.

Gold is not going anywhere (though silver can go up and down, in gold terms). It’s the dollar that mostly goes down, though not this week in silver terms! The dollar is now up to 2¼ grams of silver.

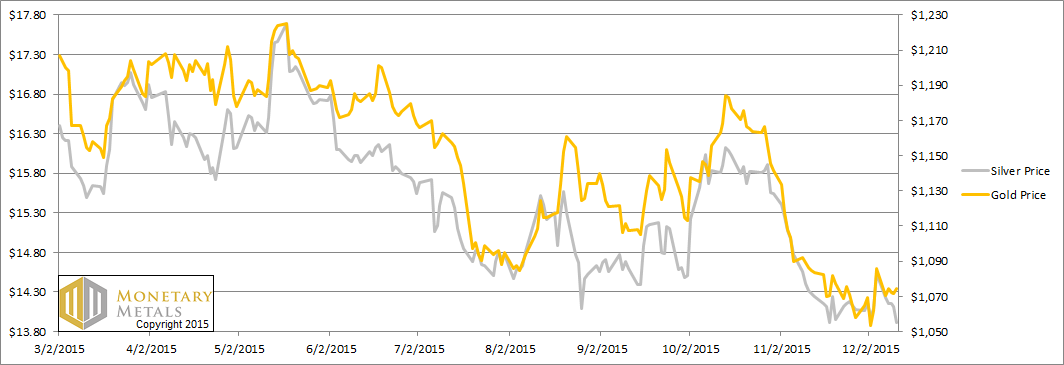

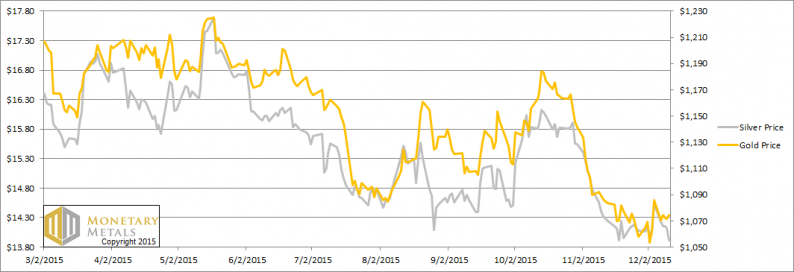

Read on for the only true look at the fundamentals of gold and silver. But first, here’s the graph of the metals’ prices.

The Prices of Gold and Silver

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

Leave A Comment