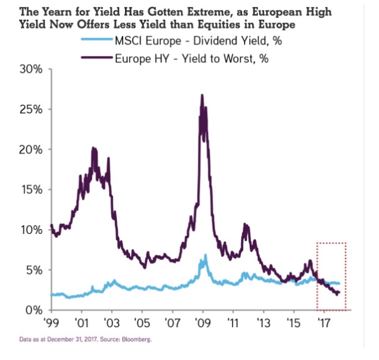

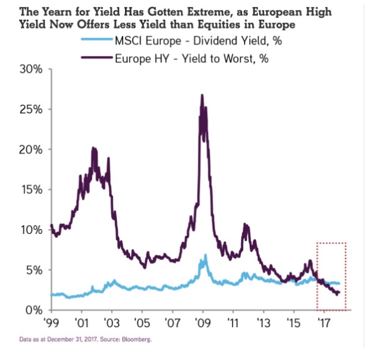

Tiho Brkan (@tihobrkan) tweeted out the following chart noting that yields on European junk bonds are now less than the yields on European equities. Tiho believes this has never happened before.

In a related note, my brother and I were having a conversation over the weekend about how much equities have gone up and the extent to which that has helped anyone participating in markets. He asked if I thought the tax cut was a driver, it was telegraphed as an objective and then, of course, it was passed. The markets though have been moving higher for nine years.

As low volatility and ever higher equity prices persist along with anomalies like the one that Tiho found, it leads me to think that all of the various flavors of QE around the world have grossly distorted markets as a flood of money has not been allocated efficiently, it has all gone into asset markets pushing equities up and contributing to how low yields are. You’ve no doubt seen data about there being trillions in negative debt outstanding, globally, as one example of a gross distortion.

Companies seem more intent on stock buybacks (a source of upward pressure on prices) than on research and development and other forms of capex. Central banks, of course, have been buying assets including Japan and Switzerland buying equities (a source of upward pressure on prices). Many countries have been trying to weaken their currencies, like Japan and Switzerland. Wealthy people have benefited from all this, having more to put into markets (a source of upward pressure on prices). Another form of distortion is that as of last Friday the US Ten Year Treasury Note yields 68 basis points more than Italian Ten Year sovereign debt.

The idea that the crisis and then QE have grossly distorted asset prices and inter-market dynamics is of course not new. There have been countless articles that have attempted to quantify how much or how little of the last nine years of gains should be attributed to QE. Right or wrong, I don’t think QE’s influence can be quantified in any precise manner, but sentiment seemed to move away from the idea that it was as big of a factor as was originally feared ten years ago. GDP has been positive and there have been a lot of jobs created which people take as being organic and healthy. My pushback would be that GDP has been weak versus past recoveries/expansions and we have a serious problem with underemployment as more and more jobs require STEM backgrounds and collectively, we lack that training. Another huge growth area for jobs-needed is low paying healthcare jobs. Great that people are able to find work at all, but a problem is created when too many of us don’t have the discretionary spending power needed to lift the economy in a truly organic fashion.

Leave A Comment