It was a rough week for investors in stocks and stocks of all kinds. The S&P 500 lost 5%. Emerging Markets also lost 5%. Gold Stocks, which had weakened before the broader equity market have been hit hard. The GDX and GDXJ also lost 5% last week. The HUI Gold Bugs Index (which excludes royalty companies unlike GDX) lost 7%. After a strong start to the year, gold stocks have essentially given back all their gains. Nevertheless, we remain extremely optimistic on gold stocks over the next 12-18 months as trends in the economy and stock market should begin to support gold after the second quarter.

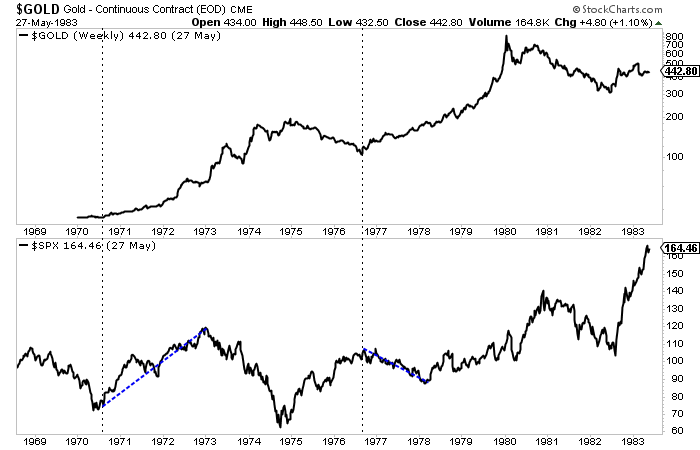

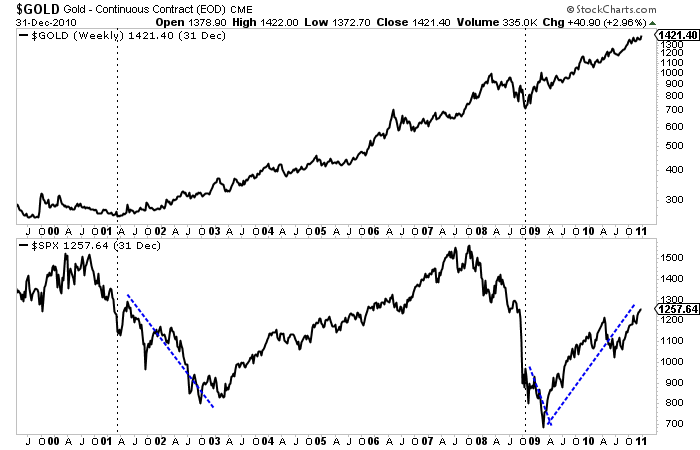

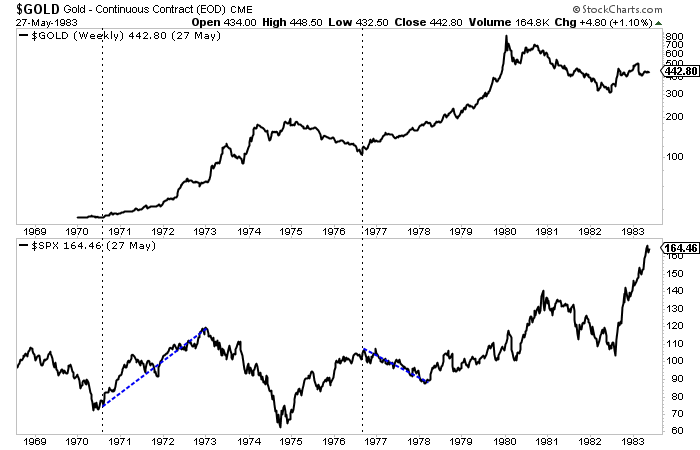

Historically speaking some of the best performance in gold and gold stocks occurred during or after a bear market in stocks. The best examples can be found in the 1970’s and 2000’s as the charts show. Gold surged after the bottom in stocks in 1970 and continued to perform very well during the 1973-1974 bear market. After a brief but sharp bear in 1975-1976 gold rebounded strongly as the S&P 500 began a mild bear market in 1977. Years later gold emerged from a significant bottom in 2001 while the stock market endured its worst bear market in a quarter century. Gold continued to perform even after the market bottom in late 2002. Gold emerged from the global financial crisis before the stock market but continued to make new highs after the stock market bottomed in March 2009.

This performance is not just random. It makes quite a bit of fundamental sense. As we know, gold is driven by falling or negative real rates. Typically policy makers in response to a recession or bear market will pursue policies that lead to falling or negative real rates. These policies are not reversed until the economy gains strength. Gold can also benefit from inflationary recessions, which we saw in the 1970’s. Perhaps we are headed for that outcome at some point but I digress.

The best comparison to today may be the mid-‘1960’s. Although the gold price was fixed until 1971, we can use gold stocks to study the macro picture of the 1960’s and how it may relate to today.

Leave A Comment