For longer term euro dollar traders and watchers, the daily chart on the MT5 platform for the EUR/USD is now at a key point, with several strong signals flashing warnings as we approach the Italian elections this weekend, and with still no resolution to the government of Germany. Of course it is normally Italy and the Italians who deliver indecision and hung parliaments – what an irony then if, on this occasion, the Italian electorate does indeed deliver a clear mandate, which would both surprise and shock the market. We will see, and as an Italian myself I have already cast my postal vote, so await the outcome with interest.

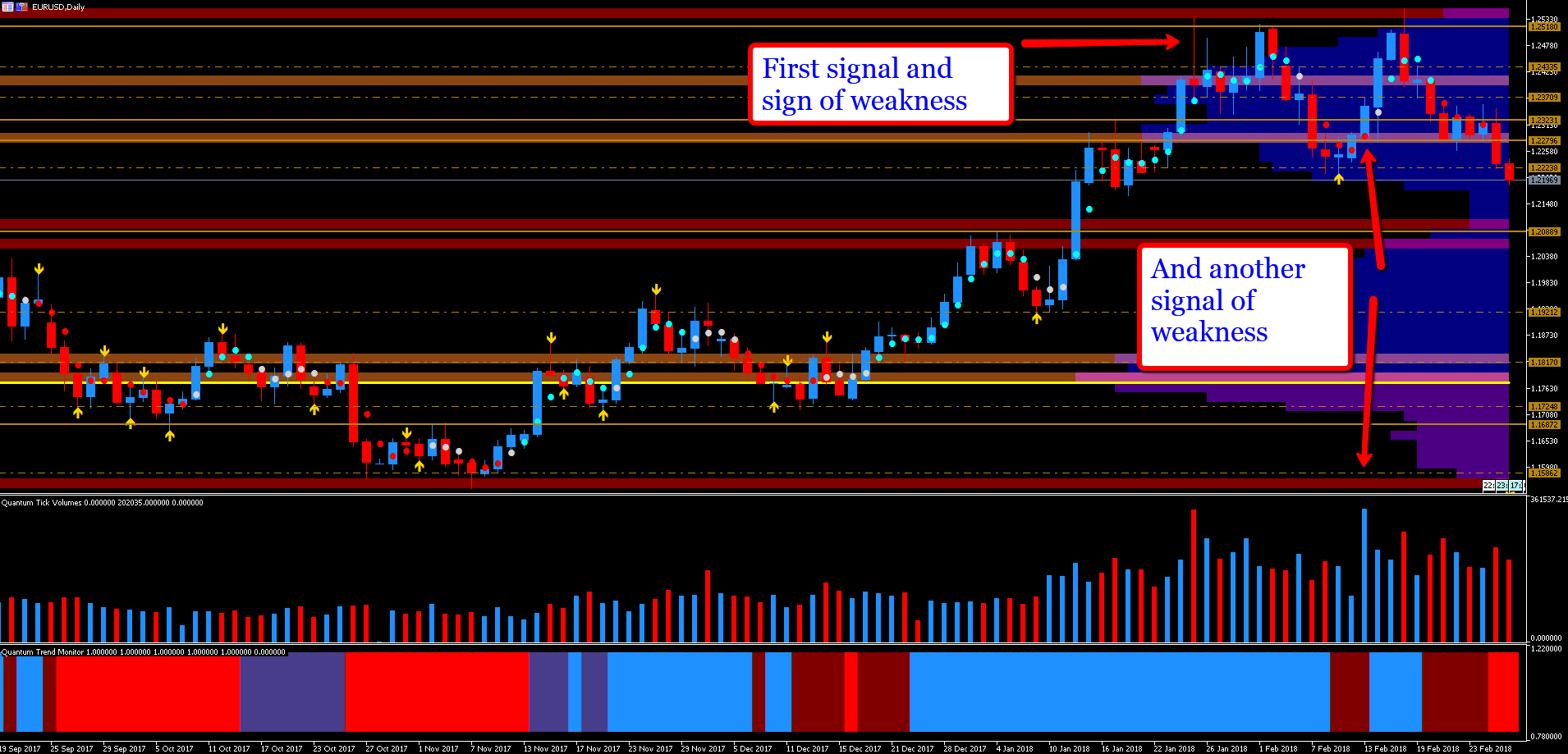

So moving to the chart itself, we have several key signals here, and the first of these was the strong signal of weakness of a classic shooting star candle coupled with extreme volume on the 25th January – a clear warning of weakness ahead. This also set the first test of the ceiling of resistance in the 1.2550 area.

The second signal then arrived on the 13th February, again with extreme volume but with the price action failing to reflect the effort, a classic example of effort not matching result and Wyckoff’s third law. This candle was then followed by two further up days, but on falling volume and once again signalling weakness in the move higher.This clear example of rising prices and falling volume confirming the weakness in the rally, which was then validated by the bearish engulfingh candle and consequent move lower over the last two weeks.

And today’s price action has been pivotal as eurodollar has moved through the potential support region at 1.2223, and with this now breached the pair looks set to continue lower on strong selling volumes. Note also the double, or in fact triple top now in place, and with the shoulders of the pattern now forming we have a classic top in place with a move to test the 1.2088 support line now appearing increasingly likely in the short term. In addition, with a low volume node also below the current price action any move lower is likely to be rapid, as there is little in the way of volume in the 1.2148 area to hold up progress. And the catalyst for such a move may indeed be this weekend’s Italian elections.

Leave A Comment