One of the advantages of investing in European oil majors is that their dividend yields tend to be higher than that of their U.S.-based counterparts.

For example, BP (BP) and Royal Dutch Shell (RDS-B) both currently offer dividend yields of approximately 6.6%.

By comparison, the U.S. oil majors like Exxon Mobil (XOM) typically yield in the 3%-4% range.

The trade-off for investors is that Exxon Mobil has a lower yield, but a longer and more consistent track record of dividend growth.

In fact, is a Dividend Aristocrat, a group of companies in the S&P 500 with 25+ consecutive years of dividend increases.

You can see the full list of Dividend Aristocrats here.

You won’t get that kind of dividend growth history from the European oil majors. BP and Shell pay out a significantly higher percentage of their earnings, so that they can offer their tantalizingly-high yields.

As a result, BP and Shell are probably more attractive for investors looking for current income, rather than dividend growth.

This article will discuss which of the two high-yield European oil stocks is the better option for income investors.

Business Overview

Business conditions remain challenged for BP and Shell, on a number of fronts. First, oil prices declined significantly from their highs of over $100 per barrel.

And, as both companies are based in Europe, they are both exposed to the weak economic growth and elevated political uncertainty in Europe.

However, while Shell has returned to more consistent profitability, BP has not.

In the past 12 months, Shell’s earnings-per-share totaled $1.06; BP lost $1.19 per share in the same period.

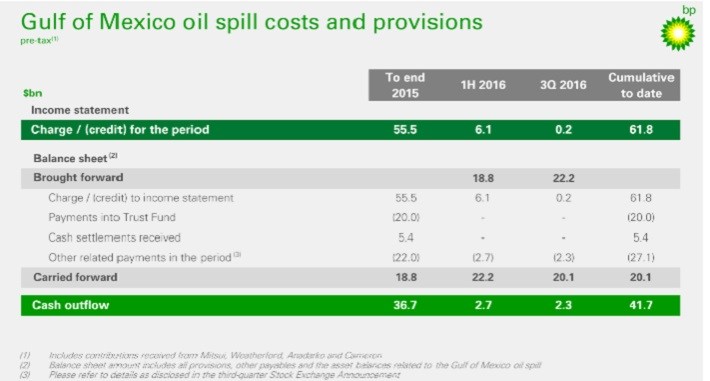

One reason for this is because BP continues to be dragged down by huge costs related to the Gulf of Mexico spill.

Over the first nine months of 2016, BP absorbed $7 billion in costs in its other businesses segment, which includes spill-related items.

Source: BP Third Quarter Earnings presentation, page 16

Leave A Comment