The oil price crash of 2015-2016 was a huge blow to the oil and gas industry. It created ripple effects that were felt across the entire energy sector.

Master Limited Partnerships, or MLPs, were among the hardest hit when commodity prices tumbled.

Several oil and gas MLPs cut their dividends. Some went bankrupt altogether.

However, it wasn’t all bad news.

A select few MLPs not only maintained their distributions through the crash, they actually kept on increasing their payouts.

For example, Sunoco Logistics Partners (SXL) and Magellan Midstream Partners (MMP) are both Dividend Achievers, a group of 271 stocks with 10+ years of consecutive dividend increases.

Now that the energy sector is slowly recovering, both Sunoco and Magellan should continue to increase their dividends going forward.

This article will compare-and-contrast these two midstream MLP Dividend Achievers.

Business Overview

Winner: Magellan

Both Sunoco and Magellan operate in the midstream space, which means they own and operate oil and gas transportation and storage assets. These assets include pipelines and terminals.

Sunoco and Magellan collect fees to store and transport oil and gas through their asset networks. Their cash flow is based on volumes, rather than the underlying commodity price.

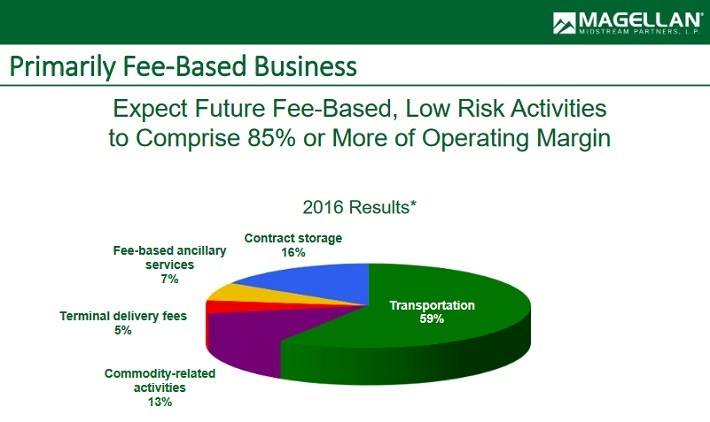

For example, approximately 85% of Magellan’s cash flow comes from fee-based activities.

Source: Evercore ISI Energy Summit Presentation, page 7

This helps them generate steady cash flow, which in turn allows them to continue raising dividends.

Even when oil and gas prices crashed, they maintained their Dividend Achiever status.

Sunoco’s crude oil business involves approximately 5,900 miles of crude oil pipelines, with an aggregate storage capacity of approximately 28 million barrels.

Source: March 2017 Investor Presentation, page 7

Meanwhile, the NGL segment contains approximately 900 miles of pipelines, and terminals that hold approximately 5 million barrels of storage capacity.

Leave A Comment