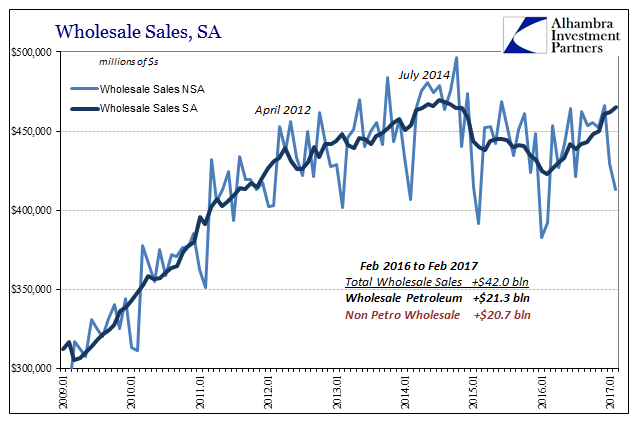

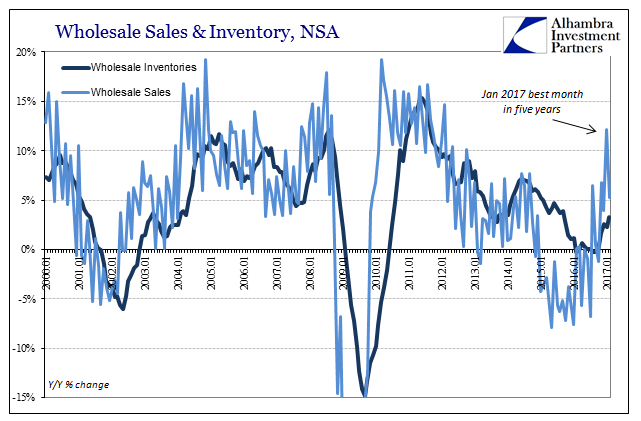

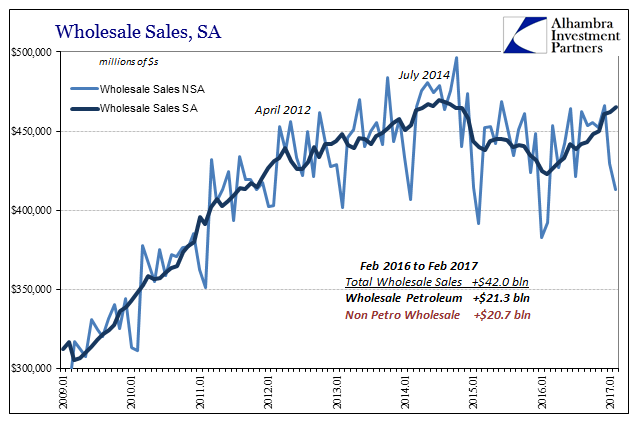

Wholesale sales rose 5.3% in February 2017 year-over-year after jumping by more than 12% in January on oil effects. Like calculated inflation rates, wholesale sales are for now marginally determined by energy price comparisons as well as calendar effects. February 2017 had one fewer day than February 2016, which according to the Census Bureau’s seasonal adjustments played some significant role in February’s number. I think that is overstated, especially as the adjusted series has for several months, more than just February, been toward the high side.

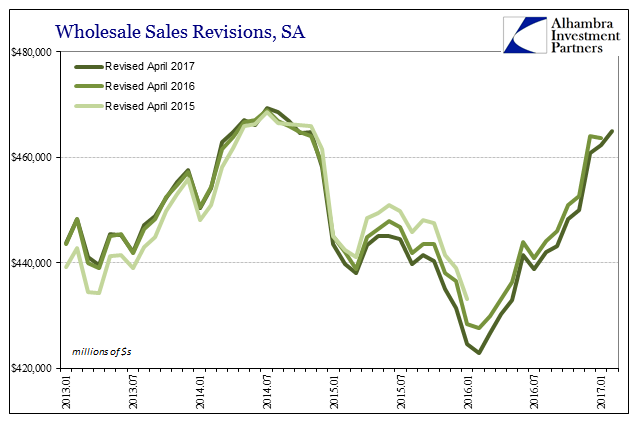

The wholesale segment of the supply chain has clearly improved from 2016’s near recession at its start. As always, what is at issue is not the improvement but whether it is meaningful beyond just the return of positive numbers. One factor to be considered in that judgment is that benchmark revisions released today show that the condition for wholesalers was appreciably worse than estimated over the past two benchmarks.

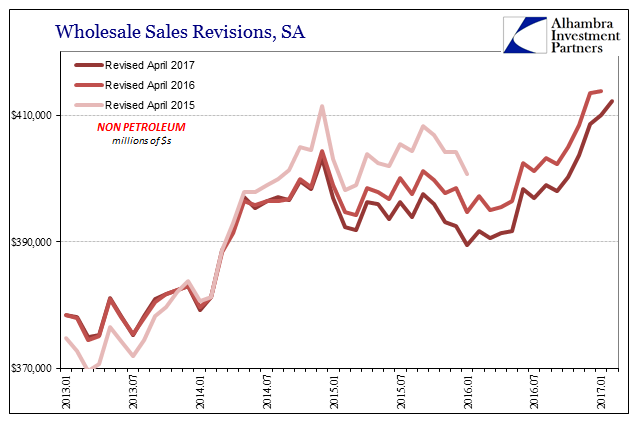

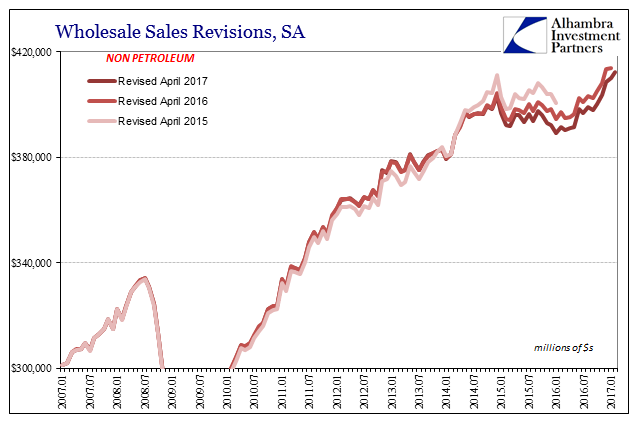

The downward revision for sales was due entirely to sectors outside of petroleum. In fact, crude oil sales across the wholesale space were revised higher in this latest update. Wholesale sales ex petroleum were instead written down by about $6 billion at the bottom in February 2016. January 2016 sales ex petroleum were as of now $11 billion below April 2015’s benchmark.

With a greater overall drag in terms of economic performance in the wholesale segment throughout the “rising dollar” period, the total of lost opportunity is that much greater – meaning the growth rate required to get back closer to even the 2012 slowdown trajectory is that much higher. Without the benefit of petroleum effects, there does not seem to be that much momentum by which actual growth might be accomplished.

Leave A Comment