The ultimate dream of the cryptocurrency enthusiasts is for money to become decentralized and essentially removed from the hands of banks and Central Banks who can “manipulate” it for their own benefit. This is a nice thought, but most of it is based on misunderstandings about what “money” is. Let me explain.

I was browsing Twitter this weekend when I ran across this post that was being retweeted by a bunch of the top crypto enthusiasts:

When banks stored all our money, the bankers became the most powerful people in the world.

When the protocols store all our money, the programmers will become the most powerful people in the world.

Fun times ahead if you’re a nerd.

— Richard Burton (@ricburton) April 8, 2018

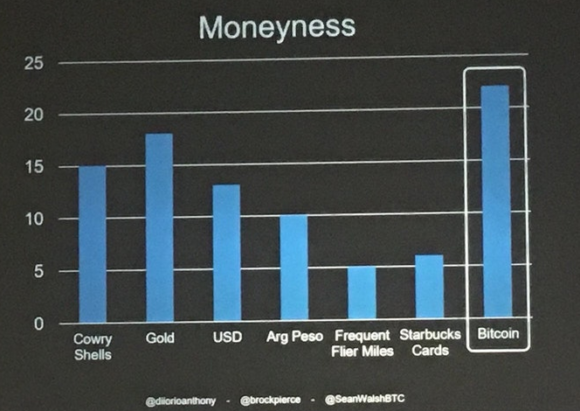

And then there was this presentation going around showing that the “moneyness” of cryptocurrencies is off the charts when compared to other forms of money:

I’d argue that technologists are already the most powerful people in the world (see any recent news about Facebook, Google, Amazon, etc), but that’s a different point.The idea that money can become entirely decentralized is fundamentally at odds with the way our economy works because consumers require purchasing power optionality.

Most of the money in today’s world is comprised of bank deposits. Bank deposits are just bank liabilities (customer assets) that exist because a bank made a loan. Importantly, the Central Bank doesn’t control the issuance of these deposits. The money multiplier is a myth and the quantity of reserves in the banking system has little to no bearing on the quantity of loans that can be made by private banks. This is important to understand because our money supply is largely market based and driven by the creditworthiness of those who seek the optionality of purchasing power by taking out credit. Libertarians and free market advocates should love this arrangement as the money supply is based almost entirely on people with credit being able to get approved for loans by private profit seeking entities.¹

Leave A Comment