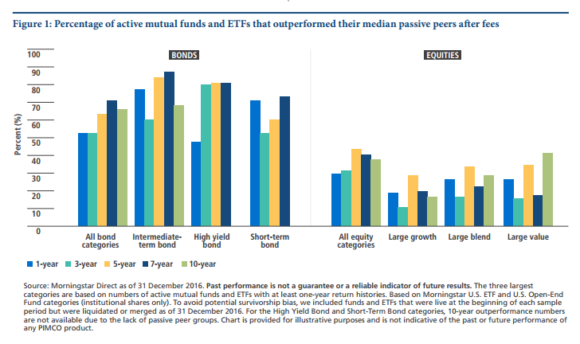

When it comes to equity indexing I am a huge fan of trying to replicate something pretty close to global cap weighting. There are mountains of evidence showing that anything other than this is a recipe for poor performance. But when it comes to bonds the story is very different. In fact, more active bond managers do significantly better than their equity counterparts when compared to their benchmarks. PIMCO went into some detail on this in a recent report (read the full report here), but here’s the basic gist of the story:

This might seem strange until you understand that bond aggregates aren’t really that much of an aggregate. Unlike a total stock market index, bond aggregates deviate pretty significantly from the actual composition of the bond market. As Rick Ferri wrote many years ago, the actual bond market doesn’t look very much like the bond aggregates that we use to mimic these funds. In fact, they can be dramatically different as the aggregate holds no high yield bonds, no municipal bonds, no preferred securities, little US Dollar denominated foreign debt and has several other important differences. This would be a lot like the Total Stock Market Index omitting something like small cap stocks. That’s no minor deviation from total cap weighting. In fact, you might even call it active asset allocation!¹

This explains why so many active bond managers beat their benchmarks – it’s much easier to take more risk in the bond market and beat the market. Of course, this doesn’t mean they beat the market after adjusting for risk, but still, you don’t eat risk adjusted returns. So, the arithmetic of active management still holds here, but there’s a reasonable argument that the aggregate index is being too active.²

I am a huge advocate of low fee indexing, but I suspect that a lot of people investing in the “passive” indexing revolution have done worse than they should have in the last 10 years because their bond portfolios don’t actually reflect the bond market.³ In other words, the Total Bond Market Index Funds chose to actively deviate from the total bond market and left out some of the highest yielding components over the last 5-10 years. So even while it was low fee it was actively constructed in a manner that hurt its returns. This is just one example of how the myth of passive investing can get you in hot water.

Leave A Comment