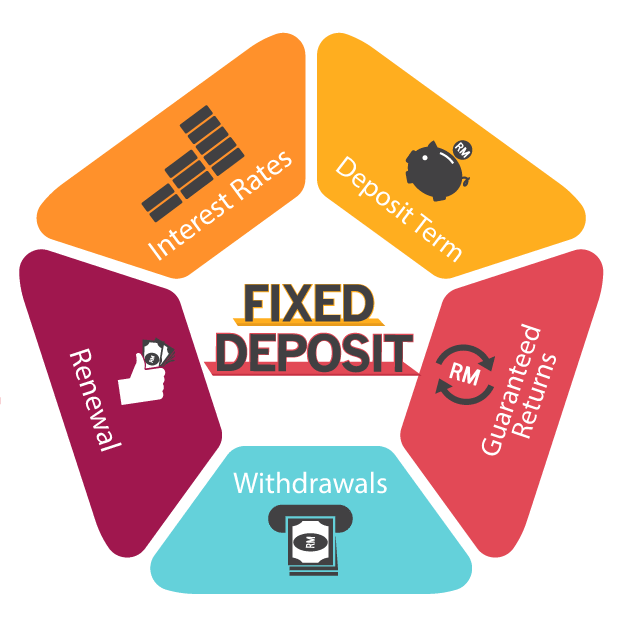

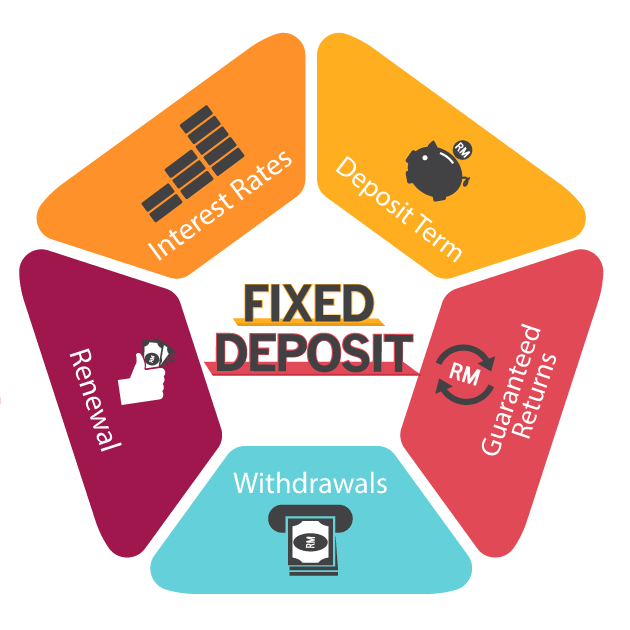

An investment in an equity might be beneficial in generating high returns in the long run. However, they are not risk-free. Fixed Deposit, on the contrary, offers sizeable returns but is risk-free. FDs are the best investment options when it comes to parking your surplus income. This debt asset instrument is one of the most popular choices among investors. Yes, the current fixed deposit rates being offered by the banks are not as good as they once were. However, there are Non-Banking Financial Companies (NBFCs) who are still offering a higher rate of interest.

There are various banks throughout the country which offer the rate of interest between 6-7%. However, NBFCs offer a better rate of interest on your investment. Furthermore, for senior citizens, the fixed deposits are more beneficial. Thus, this is one of the most favourable times to invest in fixed deposits.

Senior citizen fixed deposit is similar to normal fixed deposit accounts. The major difference here is that the interest rate offered is higher as compared to normal fixed deposit. Thus, this helps the investor earn a little more than the normal investors. As far as the eligibility is concerned, the account can be opened by both: Indian citizens as well as NRI’s who are 60 and above.

NBFCs offer 100-250 bps more returns than banks. Regardless of the tenure that you choose, the FD interest rate will be higher than the bank. One thing you should avoid doing is waiting for the right time to come to invest in a fixed deposit. Many people doubt the liquidity that the fixed deposit offers. However, it is important to know that there are various alternatives that you can opt for. You can invest in a linked-fixed deposit account, or you can even opt for an overdraft facility.

These services are being provided by the NBFCs and other lenders. It is important to know that the services they provide are better than banks. When considering a company to invest in, make sure that you opt for companies with highest credit rating. There are companies which have had high credit ratings for years and are quite well known. Make sure you choose them. They offer various benefits which include:

Leave A Comment