The last week and a half has certainly been a roller coaster ride of emotions in the stock market. After a 3-day sell off that culminated in extreme levels of fear, broad-based equity benchmarks managed to stage a sharp rally that has alleviated (some) feelings of panic.

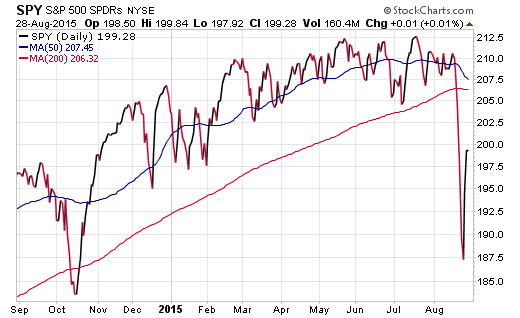

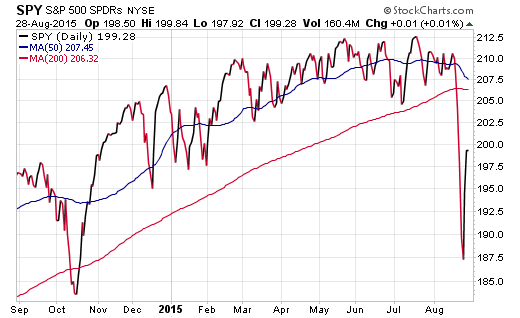

By the numbers, the SPDR S&P 500 ETF (SPY) fell 12% from all-time July high to the depths of the August lows. It has subsequently rebounded half of that decline as we head into the first days of September.

While there is still a great deal of work to be done in order to recoup the full extent of those losses, examining how your portfolio performed in the midst of the chaos can be a helpful exercise. Many investors may be surprised at how deeply their accounts fell despite the intention of having a relatively balanced or even conservative asset allocation.

The Shock Absorber Is Missing In Action

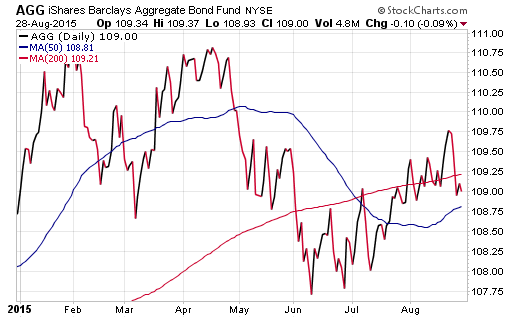

One of the most underwhelming asset classes during this sell off in stocks has been the lack of performance in high quality bonds. Since SPY peaked on July 20, theiShares U.S. Aggregate Bond ETF (AGG) has gained just 0.39%. This weak follow through was mirrored in the iShares Investment Grade Corporate Bond ETF (LQD) and iShares 7-10 Year Treasury Bond ETF (IEF), which gained a timid 0.19% and 1.57% respectively.

Typically, during periods of extreme stock market volatility, we see a flight to quality in bonds that helps cushion the draw down in our portfolios. This is one of the primary benefits of multi-asset diversification and helps alleviate overwhelming conviction in a single high risk outcome. Those who have come to rely on the strength of bonds during a sell off have been let down over the last several weeks.

Put simply, if your bonds aren’t marginally offsetting the losses in stocks, you are going to feel the pain of those losses more acutely.

In my opinion, most of this indecision in the bond market is due to three factors:

Leave A Comment