Markets seem to think the Federal Reserve’s recent policy statement and Chair Yellen’s subsequent press conference comments were dovish. This is a misread that I believe will have a meaningful impact on fixed income markets. The big question is whether a Fed that is more hawkish than expected is bearish for bonds or simply presents a relative value play as the yield curve slope changes. Some thoughts below

I already teed this one up last week, after the Yellen presser. Evertyhing pointed to a more hawkish Fed in my view. I wrote that the biggest takeaway was Yellen’s view that there are “good reasons to think the relationship between the slope of the yield curve and the business cycle may have changed.” Moreover, the data were moving in the wrong direction – with Fed projections showing higher growth and lower unemployment than after the September FOMC meeting. Taken together with Chair Yellen’s insistence at the press conference that the things holding down inflation were “transitory”, it was clear that she was telegraphing the Fed’s intention to stay the course irrespective of the slope of the yield curve.

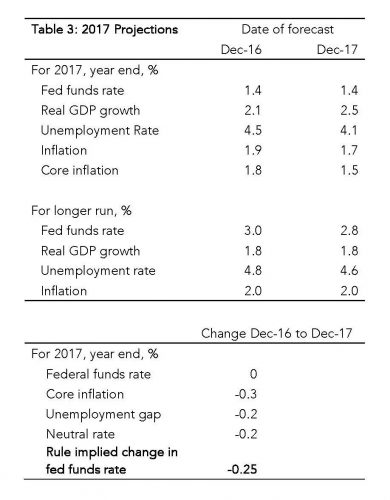

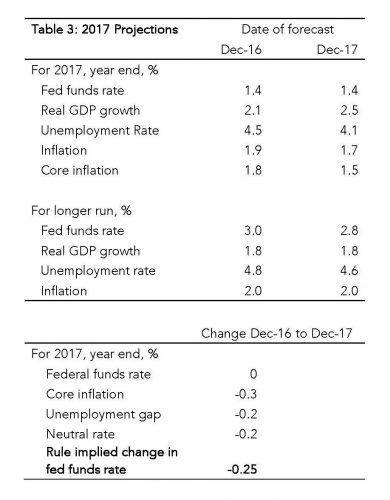

In fact, we saw the exact same policy options at the end of last year — and have ended 2017 with the Fed raising rates just as they said they would. University of Oregon Professor Tim Duy has a post up now pointing this out. And his chart below makes clear that, “the Fed ran a hawkish policy in 2017 relative to changes in the economic forecast”.

If I am reading Tim’s chart correctly, the data say the Fed should have raised its policy rate 50 basis points. Instead they have increased the policy rate by 75 basis points.

Why did this happen? In a nutshell, NAIRU. The Fed is caught up in Phillips Curve thinking because – according to that kind of thinking – the trade-off between inflation and unemployment is supposed to be most acute at this stage in the business cycle. From the Fed’s perspective, the undershoot in inflation has become less worrisome because the unemployment rate has fallen below the level where inflation is supposed to accelerate – the non-accelerating inflation rate of unemployment or NAIRU.

Leave A Comment