Richard Werner – an economics professor and the creator of quantitative easing – says that it’s a myth that interest rates drive the level of economic activity. The data shows that the opposite is true: rates lag the economy.

Economics prof Steve Keen – who called the Great Recession before it happened – points out today in Forbes that the Fed’s rate dashboard is missing crucial instrumentation:

The Fed will probably hike rates 2 to 4 more times—maybe even get the rate back to 1 per cent—and then suddenly find that the economy “unexpectedly” takes a turn for the worse, and be forced to start cutting rates again.

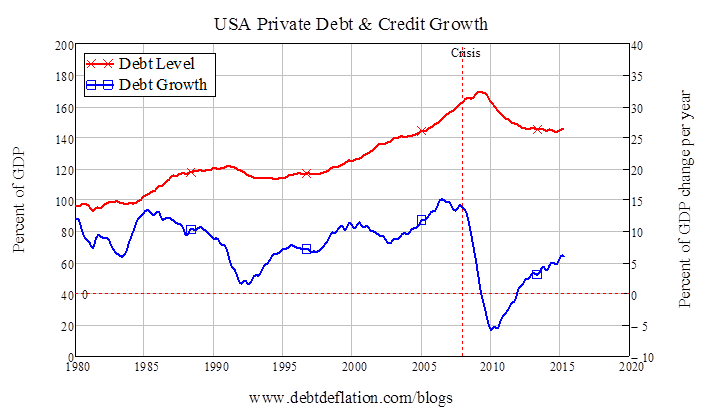

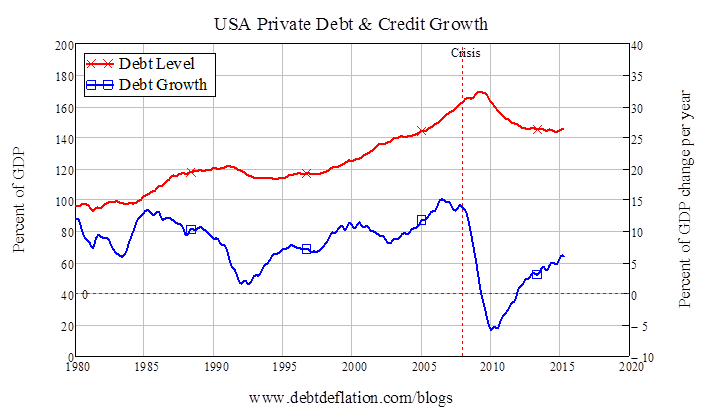

This is because there are at least two more numbers that need to be factored in to get an adequate handle on the economy: 142 and 6—the level and the rate of change of private debt. Several other numbers matter too—the current account and the government deficit for starters—but private debt is the most significant omitted variable in The Fed’s toy model of the economy. These two numbers (shown in Figure 2) explain why the US economy is growing now, and also why it won’t keep growing for long—especially if The Fed embarks on a period of rate hiking.

Figure 2: The two key numbers The Fed is ignoring

Leave A Comment