Concentration: the fastest way to build wealth and the fastest way to destroy it. To have any chance at “getting rich quick,” you need to hold a concentrated portfolio. But chance is the key word in that sentence, for you may instead get poor quick.

Concentration risk isn’t limited to holding a single security. It can also come from holding a single currency, geography, industry group, sector, or asset class.

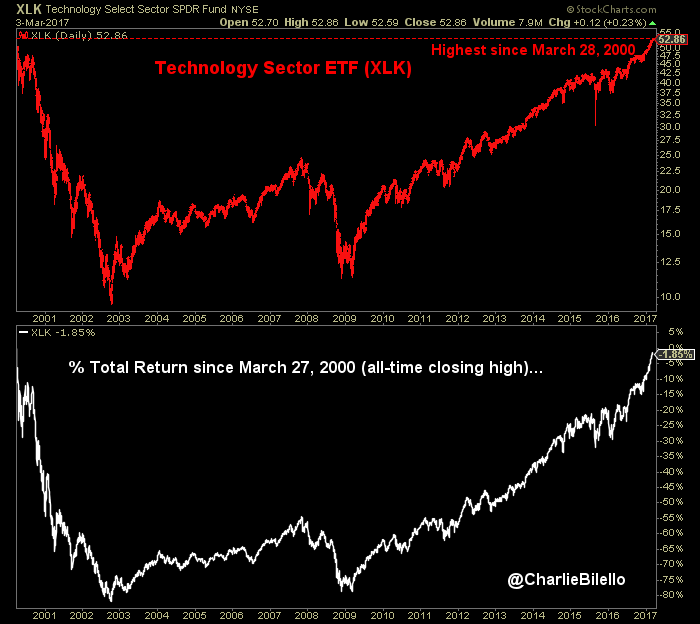

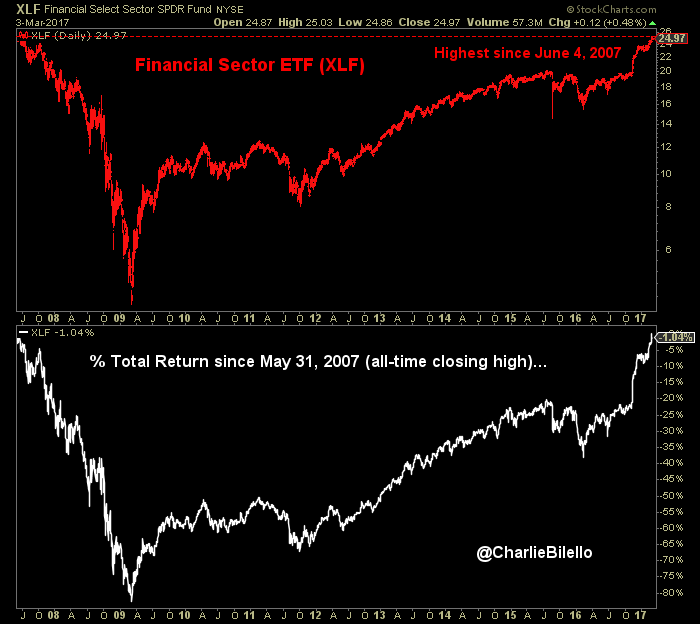

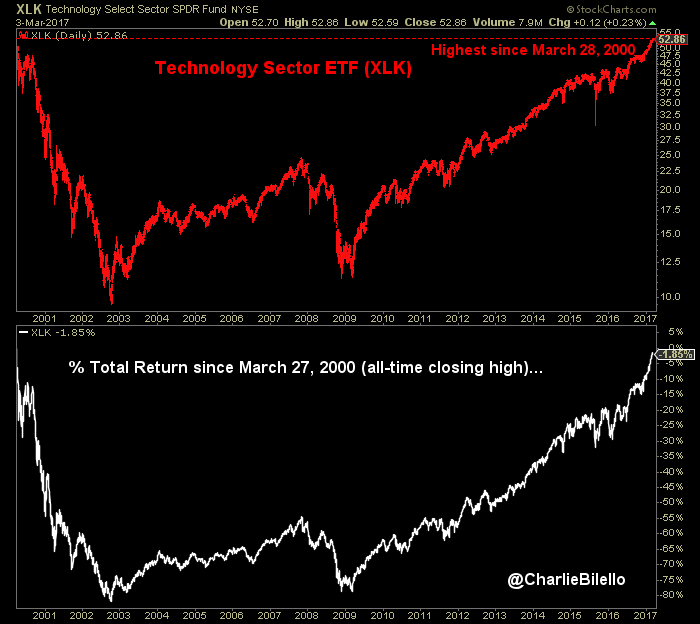

At the sector level, concentration can given and it can taken away. We have seen two prominent examples of this in recent history…

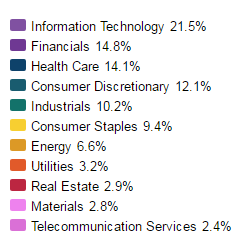

Both Tech and Financials are now less than 2% away from hitting new all-time. Their recent strength has been great news for the overall stock market as these are the two largest sectors in the S&P 500.

If one knew nothing about markets, they might assume that the S&P 500 is also approaching long-awaited new highs. But that is not the case. Following the 2007 through 2009 bear market, the S&P 500 (total return) has hit 200 new all-time highs, with the first occurring back in April 2012. In 2017 alone the S&P 500 has already hit 15 new all-time highs.

How is that possible with its two largest sectors still below their all-time highs from 2000 and 2007? The other sectors have taken up the slack. While the weightings of Technology and Financials have declined from their 2000/2007 peaks, the combined weightings of the other sectors have moved higher.

Why You Diversify

The lesson here: concentration cuts both ways. It can build wealth and it can destroy it. Investors who held concentrated portfolios in Tech and Financials back in 2000 and 2007 assumed that risk with the goal of “getting rich” quick. After 80+% drawdowns, they learned that there is no guarantee of success. Today these same investors are simply hoping to “get even” and at long last are close to getting there.

Leave A Comment